Pizza Hut 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

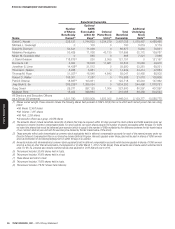

YUM! BRANDS, INC.-2014Proxy Statement 29

Proxy Statement

EXECUTIVE COMPENSATION

YUM’s Compensation Philosophy

Our compensation program is designed to support our long-

term growth model, while holding our executives accountable

to achieve key annual results year over year�

YUM’s compensation philosophy for the NEOs is reviewed

annually by the Committee, and has the following key objectives:

•

Reward performance – The majority of NEO pay is

performance based and therefore at-risk� We design pay

programs that incorporate team and individual performance,

customer satisfaction and shareholder return�

•Emphasize long-term incentive compensation – Our

belief is simple, if we create value for shareholders, then

we share a portion of that value with those responsible

for the results� We believe that all of our long-term incentive

compensation is performance based� Stock Appreciation

Rights (“SARs”) reward for value creation which over time

is a function of our results and the favorable expectations

of our shareholders� Performance Share Unit (“PSU”)

awards reward for superior relative performance as

compared to the S&P 500� Both vehicles encourage

executives to grow the value of the Company with a

long-term perspective in mind�

•

Drive ownership mentality – We require executives to

personally invest in the Company’s success by owning

Company stock�

•

Retain and reward the best talent to achieve superior

shareholder results – To be consistently better than our

competitors, we need to recruit and retain superior talent

who are able to drive superior results� We have structured

our compensation programs to motivate and reward these

results�

Relationship Between Company Pay and Performance

To focus on both the short and long-term success of the

Company, our NEOs’ compensation includes a significant portion,

approximately 80%, that is “at-risk”, where the compensation

paid is determined based on the achievement of specified

results. If short-term and long-term financial and operational

goals are not achieved, then performance-related compensation

will decrease. If goals are exceeded, then performance-related

compensation will increase. As demonstrated below, our target

pay mix for NEOs emphasizes our commitment to “at-risk” pay

in order to tie pay to performance.

11%

19%

CEO TARGET PAY MIX—2013

At-Risk At-Risk

70%

50%

25%

25%

ALL OTHER NEO TARGET PAY MIX—2013

Base Salary Annual Bonus

Long-Term Equity Incentive

Base Salary Annual Bonus Long-Term Equity Incentive

Based on the Company’s 2013 performance, compensation

fell considerably versus the prior year, specifically:

•

Cash compensation (base salary and annual bonus)

decreased by 60% for the Chief Executive Officer (“CEO”)

and 33% for the other NEOs.

•

Direct compensation (base salary, annual bonus and

long-term equity incentive) decreased by 26% for the

CEO and 19% for the other NEOs.

•

A reduction in annual bonus contributed significantly to

the year over year decline in direct compensation, as

bonus payouts reflected our failure to achieve key

performance metrics in 2013. Annual bonus decreased

by 80% for the CEO and 51% for the other NEOs combined

year over year.