Pizza Hut 2013 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2014Proxy Statement26

Proxy Statement

STOCK OWNERSHIP INFORMATION

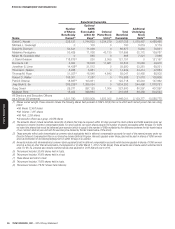

Name

Beneficial Ownership

Additional

Underlying

Stock

Units(4) Total

Number

of Shares

Beneficially

Owned(1)

Options/

SARS

Exercisable

within 60

Days(2)

Deferral

Plans Stock

Units(3)

Total

Beneficial

Ownership

David C� Novak 328,127 1,744,632 1,334,279 3,407,038 1,079,457 4,486,495

Michael J� Cavanagh 0 100 0 100 5,019 5,119

David W� Dorman 54,541 11,036 0 65,577 5,254 70,831

Massimo Ferragamo 53,429 11,036 43,130 107,595 32,172 139,767

Mirian M� Graddick-Weir 0 565 0 565 7,321 7,886

J� David Grissom 118,872(5) 230 2,055 121,157 0 121,157

Bonnie G� Hill 3,024 18,848 11,961 33,833 16,083 49,916

Jonathan S� Linen 14,438(6) 21,512 0 35,950 33,281 69,231

Thomas C� Nelson 8,288 5,961 0 14,249 33,414 47,663

Thomas M� Ryan 31,357(7) 18,848 4,842 55,047 30,455 85,502

Robert D� Walter 108,301 7,287 0 115,588 21,018 136,606

Patrick Grismer 18,887(8) 103,831 0 122,718 25,244 147,962

Jing-Shyh S� Su 369,229(9) 1,265,024 0 1,634,253 244,498 1,878,751

Greg Creed 29,371 297,125 1,004 327,500 80,397 407,897

Muktesh Pant 15,402 399,663 0 415,065 89,458 504,523

All Directors and Executive Officers

as a Group (22 persons) 1,301,790 5,620,909 1,523,302 8,446,001 2,139,777 10,585,778

(1) Shares owned outright. These amounts include the following shares held pursuant to YUM’s 401(k) Plan as to which each named person has sole voting

power:

• Mr. Novak, 32,463 shares

• Mr. Grismer, 7,287 shares

• Mr. Pant, 2,259 shares

• all executive officers as a group, 44,636 shares

(2) The amounts shown include beneficial ownership of shares that may be acquired within 60 days pursuant to stock options and SARs awarded under our

employee or director incentive compensation plans. For stock options, we report shares equal to the number of options exercisable within 60 days. For SARs

we report the shares that would be delivered upon exercise (which is equal to the number of SARs multiplied by the difference between the fair market value

of our common stock at year-end and the exercise price divided by the fair market value of the stock).

(3) These amounts reflect units denominated as common stock equivalents held in deferred compensation accounts for each of the named persons under our

Director Deferred Compensation Plan or our Executive Income Deferral Program. Amounts payable under these plans will be paid in shares of YUM common

stock at termination of directorship/employment or within 60 days if so elected.

(4) Amounts include units denominated as common stock equivalents held in deferred compensation accounts which become payable in shares of YUM common

stock at a time (a) other than at termination of employment or (b) after March 1, 2014. For Mr. Novak, those amounts also include vested restricted stock

units. For Mr. Su, amounts also include restricted stock units awarded in 2010 that will vest in 2015.

(5) This amount includes 26,000 shares held in trusts.

(6) This amount includes 10,000 shares held in a trust.

(7) These shares are held in a trust.

(8) This amount includes 11,600 shares held in trusts.

(9) This amount includes 278,361 shares held indirectly.