Pizza Hut 2013 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

So to sum things up, we’re uniquely positioned for a strong bounce-back year in

2014, primarily driven by our expected same-store sales recovery at KFC in China. This sales

recovery, our new unit development and the actions we’ve taken to strengthen our global

business give us confidence in our ability to deliver at least 20% EPS growth in 2014.

Importantly, we believe we’re stronger and better positioned than ever

to deliver on the three things that drive shareholder value in retail:

DRIVING NEW UNIT DEVELOPMENT

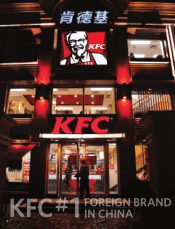

Our new unit opportunity in China and other emerging markets remains the best in

retail and our opportunity to expand is huge. We have three iconic brands consumers

love and more than 40,000 restaurants in 128 countries and territories. We’re

especially strong in high-growth emerging markets with more than 14,000 units and

more than 50% of our operating profit in 2013 coming from the emerging world.

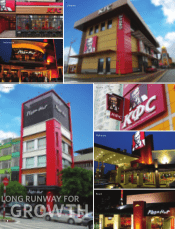

While we have 58 restaurants per million people in the U.S. today, we have only 2

restaurants per million in the emerging markets. That is a long runway for growth and

gives us tremendous confidence in our ability to continue our aggressive expansion for

years to come.

GROWING SAME-STORE SALES

Our more than 40,000 restaurants have significant capacity to drive even higher

same-store sales growth and profitability around the world. We’re growing our brands

with a powerful combination of innovative new sales layers, expanded day parts, menu

variety, strong value offers and by opening new channels with digital. Harnessing the

power of digital technology, we’re expanding the use of online and mobile ordering

platforms across our Pizza Hut and KFC delivery businesses worldwide. We’re also on

track to launch a new mobile ordering app for our Taco Bell U.S. business in 2014.

GENERATING HIGH RETURNS

Finally, our returns on invested capital have consistently been among the best in

the retail industry. Our growth is franchise-led, with franchisees investing virtually

all the capital to own and operate what is now 78% of our restaurants. In 2013, this

model generated nearly $2 billion in franchise fees, which combined with the profit

from our company-operated restaurants, enabled us to invest over $1 billion in capital

expenditures for the future growth of the business. And for the ninth consecutive

year, we increased our dividend payment by at least 10% while returning almost $1.4

billion in cash to shareholders in the form of dividends and share repurchases. It takes

a company with considerable economic strength and growth potential to do that,

particularly in a down year.