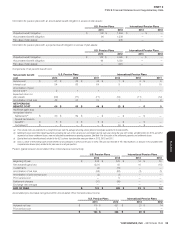

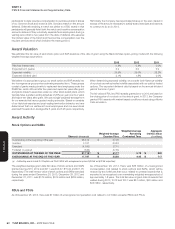

Pizza Hut 2013 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K 55

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

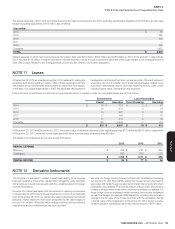

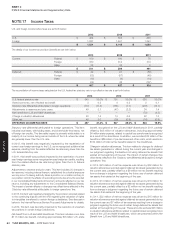

The annual maturities of short-term borrowings and long-term debt as of December 28, 2013, excluding capital lease obligations of $172 million and fair value

hedge accounting adjustments of $14 million, are as follows:

Year ended:

2014 $ 58

2015 250

2016 300

2017 —

2018 325

Thereafter 1,875

TOTAL $ 2,808

Interest expense on short-term borrowings and long-term debt was $270 million, $169 million and $184 million in 2013, 2012 and 2011, respectively.

2013 included $118 million in losses recorded in Interest expense, net as a result of premiums paid and other costs related to the extinguishment of

debt. See Losses Related to the Extinguishment of Debt section of Note 4 for further discussion.

NOTE11 Leases

At December 28, 2013 we operated more than 8,100 restaurants, leasing the

underlying land and/or building in nearly 7,300 of those restaurants with the

vast majority of our commitments expiring within 20 years from the inception

of the lease. Our longest lease expires in 2087. We also lease office space for

headquarters and support functions, as well as certain office and restaurant

equipment. We do not consider any of these individual leases material to our

operations. Most leases require us to pay related executory costs, which

include property taxes, maintenance and insurance.

Future minimum commitments and amounts to be received as lessor or sublessor under non-cancelable leases are set forth below:

Commitments Lease Receivables

Capital Operating Direct Financing Operating

2014 $ 18 $ 721 $ 2 $ 61

2015 19 672 2 56

2016 19 627 3 52

2017 17 569 2 47

2018 17 515 2 43

Thereafter 186 2,593 7 152

$ 276 $ 5,697 $ 18 $ 411

At December 28, 2013 and December 29, 2012, the present value of minimum payments under capital leases was $172 million and $170 million, respectively.

At December 28, 2013, unearned income associated with direct financing lease receivables was $6 million.

The details of rental expense and income are set forth below:

2013 2012 2011

RENTAL EXPENSE

Minimum $ 759 $ 721 $ 625

Contingent 293 290 233

$ 1,052 $ 1,011 $ 858

RENTAL INCOME $ 94 $ 77 $ 66

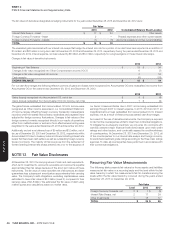

NOTE12 Derivative Instruments

The Company is exposed to certain market risks relating to its ongoing

business operations. The primary market risks managed by using derivative

instruments are interest rate risk and cash flow volatility arising from foreign

currency fluctuations�

We enter into interest rate swaps with the objective of reducing our exposure

to interest rate risk and lowering interest expense for a portion of our fixed-rate

debt. At December 28, 2013, our interest rate swaps outstanding had notional

amounts of $300 million and have been designated as fair value hedges of

a portion of our debt. These fair value hedges meet the shortcut method

requirements and no ineffectiveness has been recorded.

We enter into foreign currency forward contracts with the objective of reducing

our exposure to cash flow volatility arising from foreign currency fluctuations

associated with certain foreign currency denominated intercompany short-term

receivables and payables� The notional amount, maturity date, and currency

of these contracts match those of the underlying receivables or payables� For

those foreign currency exchange forward contracts that we have designated

as cash flow hedges, we measure ineffectiveness by comparing the cumulative

change in the fair value of the forward contract with the cumulative change

in the fair value of the hedged item� At December 28, 2013, foreign currency

forward contracts outstanding had a total notional amount of $141 million�