Pizza Hut 2013 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2014Proxy Statement34

Proxy Statement

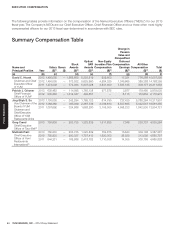

EXECUTIVE COMPENSATION

•

Meridian has no business or personal relationship with

any member of the Committee or management.

•

Meridian’s partners and employees who provide services

to the Committee are prohibited from owning YUM stock

per Meridian’s firm policy.

Comparator Compensation Data

One of the factors our Committee uses in setting executive

compensation is an evaluation of how our target and actual

compensation levels compare to those of similarly situated

executives at companies that comprise our executive peer

group (“Executive Peer Group”). The Executive Peer Group

used for executive benchmarking for all NEOs is made up

of retail, hospitality, food, specialty eatery, and nondurable

consumer goods companies and quick service restaurants,

as these represent the sectors with which the Company is

most likely to compete for executive talent. Companies

from these sectors must also be reflective of the overall

market characteristics of our executive talent market, relative

leadership position in their sector, size as measured by

revenues, complexity of their business, and in some cases

global reach.

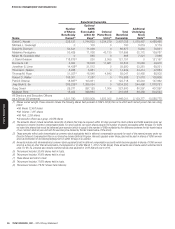

Executive Peer Group

The Committee established the current Executive Peer Group for all NEOs at the end of 2012 for pay actions in 2013,

which includes:

AutoZone Inc. J. C. Penney Company Inc. Nike Inc.

Avon Products Inc. Kellogg Company OfficeMax Inc.

Campbell Soup Company Kimberly-Clark Corporation Staples Inc.

Colgate Palmolive Company Kohl’s Corporation Starbucks Corporation

Darden Restaurants Inc. Macy’s Inc. Unilever USA

Gap Inc. Marriott International

General Mills Inc. McDonald’s Corporation

For 2013, the Committee removed Coca-Cola, PepsiCo

and Kraft from the Executive Peer Group in order to better

align the size of the peer group companies with YUM. At the

time the benchmarking analysis was prepared, the Executive

Peer Group’s median revenues were $15.6 billion and market

capitalization was $12.7 billion, while YUM’s were $18.6 billion

(calculated as described below) and $27.2 billion respectively.

For companies with significant franchise operations, measuring

size can be complex. There are added complexities and

responsibilities for managing the relationships, arrangements,

and overall scope of the franchising enterprise, in particular,

managing product introductions, marketing, driving new unit

development, and driving customer satisfaction and overall

operations improvements across the entire franchise system.

Accordingly, in calibrating size-adjusted market values, our

philosophy is to add 25% ($7.7 billion in 2011) of franchisee

and licensee sales ($30.6 billion in 2011) to the Company’s

sales ($10.9 billion in 2011) to establish an appropriate

revenue benchmark. The reason for this approach is based

on our belief that the correct calibration of complexity and

responsibility lies between corporate-reported revenues and

system widerevenues.

Competitive Positioning

Meridian provided the Executive Peer Group compensation

data to the Committee and it was used as a frame of

reference for establishing compensation targets for base

salary, annual bonus and long-term incentives for all of the

NEOs at the beginning of 2013. However, this data is not

the only factor considered for our NEOs’ compensation,

and it does not supplant the analyses of the individual

performance of all of the NEOs. Because the comparative

compensation information is one of several factors used in

the setting of executive compensation, the Committee

applies discretion in determining the nature and extent of

its use.

For the CEO, the Company generally attempts to target

pay at the 75th percentile of the market, specifically, 75th

percentile total cash and total direct compensation. The

Company has a philosophy for its NEOs (other than for the

CEO) to target the third quartile for base salary, 75th percentile

for target bonus and 50

th

percentile for long-term incentives.

For bonus, we use the average of the last three year’s actual

bonus paid rather than target bonus when benchmarking

for all NEOs. When benchmarking and making decisions

about the CEO’s SARs and options, we use a grant date

fair value based on the full 10-year term rather than the

expected term of all SARs and options granted by the