Pizza Hut 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

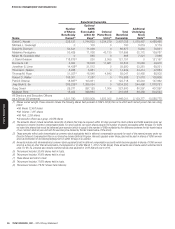

YUM! BRANDS, INC.-2014Proxy Statement 21

Proxy Statement

ITEM3ADVISORY VOTE ON EXECUTIVE COMPENSATION

We Made Changes to Our Executive Compensation Program for 2013

After Considering Your Feedback

As described in the Compensation Discussion and Analysis,

our Management Planning and Development Committee

(the“Committee”) considered the feedback of many of our

major institutional shareholders, and during 2013 implemented

several significant changes, described below, in our executive

compensation program. Specifically, changes made by the

Committee included the following:

•

Updated the Company’s Executive Peer Group to

better align the size of the peer group companies

with YUM.

•

Re-designed 2013-2015 Performance Share Plan -

Re-designed 2013-2015 Performance Share Plan to

measure relative total shareholder return vs. the S&P 500.

•

Increased Use of Performance Share Units in CEO’s

Long Term Incentive (“LTI”) Program - Changed the

CEO’s LTI compensation mix from 90% SARs and 10%

PSUs to 75% SARs and 25% PSUs.

•

Eliminated CEO’s Accruals under Company’s Pension

Equalization Plan - Replaced our CEO’s nonqualified

pension benefits under the Pension Equalization Plan

(“PEP”) with a benefit in the Leadership Retirement Plan.

As a result of this change, Mr. Novak will receive a long-

term benefit that is similar to what he would have received

under PEP, assuming historically normal interest rates,

without the fluctuation from interest rate volatility that is

inherent in the PEP.

•

Eliminated Excise Tax Gross-Ups - Eliminated excise

tax gross-ups upon a change in control for current and

future Change in Control Severance Agreements with

executives, including the NEOs.

•

Implemented “Double Trigger” Vesting upon a Change

in Control - Implemented double trigger vesting upon

a change in control of the Company for equity awards

made in 2013 and beyond.

We believe these changes further align our executive

compensation program with best practices, enhance

shareholder value, and enable us to better achieve our business

goals.

Accordingly, we ask our shareholders to vote in favor of the

following resolution at the Annual Meeting:

RESOLVED, that the shareholders approve, on an advisory

basis, the compensation awarded to our NEOs, as disclosed

pursuant to SEC rules, including the Compensation

Discussion and Analysis, the compensation tables and

related materials included in this proxy statement.

What vote is required to approve this proposal?

Approval of this proposal requires the affirmative vote of

a majority of shares present in person or represented by

proxy and entitled to vote at the Annual Meeting. While

this vote is advisory and non-binding on the Company,

the Board of Directors and the Committee will review the

voting results and consider shareholder concerns in their

continuing evaluation of the Company’s compensation

program. Unless the Board of Directors modifies its policy

on the frequency of this advisory vote, the next advisory

vote on executive compensation will be held at the 2015

Annual Meeting of Shareholders.

What is the recommendation of the Board of Directors?

The Board of Directors recommends that you vote FOR approval of this proposal.