Pizza Hut 2013 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K 49

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

NOTE4 Items Affecting Comparability of Net Income and Cash Flows

Little Sheep Acquisition and Subsequent

Impairment

On February 1, 2012 we acquired an additional 66% interest in Little Sheep

Group Limited (“Little Sheep”) for $540 million, net of cash acquired of $44

million, increasing our ownership to 93%. The acquisition was driven by our

strategy to build leading brands across China in every significant category.

Prior to our acquisition of this additional interest, our 27% interest in Little

Sheep was accounted for under the equity method of accounting. As a

result of the acquisition we obtained voting control of Little Sheep, and

thus we began consolidating Little Sheep upon acquisition. As required by

GAAP, we remeasured our previously held 27% ownership in Little Sheep,

which had a recorded value of $107 million at the date of acquisition, at

fair value based on Little Sheep’s traded share price immediately prior to

our offer to purchase the business and recognized a non-cash gain of

$74 million. This gain, which resulted in no related income tax expense,

was recorded in Other (income) expense on our Consolidated Statement

of Income in 2012 and was not allocated to any segment for performance

reporting purposes.

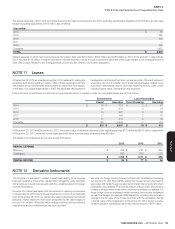

We recorded the following assets acquired and liabilities assumed upon

acquisition of Little Sheep as a result of our purchase price allocation:

Current assets, including cash of $44 $ 109

Property, plant and equipment 64

Goodwill 376

Intangible assets, including indefinite-lived

trademark of $404 421

Other assets 35

Total assets acquired 1,005

Deferred taxes 105

Other liabilities 60

Total liabilities assumed 165

Redeemable noncontrolling interest 59

Other noncontrolling interests 16

NET ASSETS ACQUIRED $ 765

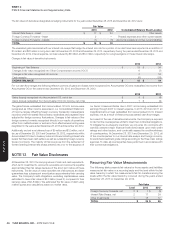

The fair values of intangible assets were determined using an income

approach based on expected cash flows� The goodwill recorded resulted

from the value expected to be generated from applying YUM’s processes

and knowledge in China, including YUM’s development capabilities, to

the Little Sheep business� The goodwill is not expected to be deductible

for income tax purposes and has been allocated to the China operating

segment�

As part of the acquisition, YUM granted an option to the shareholder that

holds the remaining 7% ownership interest in Little Sheep that would require

us to purchase their remaining shares owned upon exercise, which may occur

any time after the third anniversary of the acquisition� This noncontrolling

interest has been recorded as a Redeemable noncontrolling interest in the

Consolidated Balance Sheet� The Redeemable noncontrolling interest was

reported at its fair value of $59 million at the date of acquisition, which was

based on the Little Sheep traded share price immediately subsequent to

our offer to purchase the additional interest�

Under the equity method of accounting, we previously reported our 27%

share of the net income of Little Sheep as Other (income) expense in

the Consolidated Statements of Income� Since the acquisition, we have

reported Little Sheep’s results of operations in the appropriate line items

of our Consolidated Statement of Income� We no longer report Other

(income) expense as we did under the equity method of accounting� Net

income attributable to our partner’s ownership percentage is recorded

in Net Income (loss) – noncontrolling interests� Little Sheep reports on a

one month lag, and as a result, their consolidated results were included

in the China Division starting the second quarter of 2012� In 2012, the

consolidation of Little Sheep increased China Division Revenues by 4%

and did not have a significant impact on China Division Operating Profit

versus 2011.

The purchase price paid for the additional 66% interest and the resulting

purchase price allocation assumed same-store sales growth and new

unit development for the brand. Little Sheep’s sales were negatively

impacted by a longer than expected purchase approval and ownership

transition phase. Our efforts to regain sales momentum were significantly

compromised in May 2013 due to negative publicity regarding quality

issues with unrelated hot pot concepts in China, even though there was

not an issue with the quality of Little Sheep products.

The sustained declines in sales and profits that began in May 2013 and

continued through the third quarter, coupled with the anticipated time it will

now take for the business to recover, resulted in a determination during the

quarter ended September 7, 2013 that it is not more likely than not that

the Little Sheep trademark and reporting unit fair values are in excess of

their carrying values. Therefore, our Little Sheep trademark and goodwill

were tested for impairment in the quarter ended September 7, 2013, prior

to the annual impairment reviews performed at the beginning of the fourth

quarter of each year in accordance with our accounting policy.

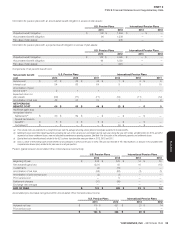

As a result of comparing the trademark’s fair value of $345 million to its

carrying value of $414 million, an impairment charge of $69 million was

recorded in the quarter ended September 7, 2013. Additionally, after

determining the fair value of the Little Sheep reporting unit was less than

its carrying value, goodwill was written down to $162 million, resulting in

an impairment charge of $222 million. The Company also evaluated other

Little Sheep long-lived assets for impairment and recorded a $4 million

impairment charge related to restaurant-level PP&E.

These non-cash impairment charges totalling $295 million were recorded in

Closures and impairment (income) expense on our Consolidated Statement

of Income and were not allocated to any segment for performance

reporting purposes, consistent with the classification of the $74 million

gain that was recorded upon acquisition. We recorded an $18 million tax

benefit associated with these impairments and allocated $19 million of

the net impairment charges to Net Income (loss) - noncontrolling interests,

which resulted in a net impairment charge of $258 million allocated to Net

Income – YUM! Brands, Inc.

The fair values of the Little Sheep trademark and reporting unit were based

on the estimated prices a willing buyer would pay. The fair value of the

trademark was determined using a relief from royalty valuation approach

that included future estimated sales as a significant input. The reporting

unit fair value was determined using an income approach with future cash

flow estimates generated by the business as a significant input. Future

cash flow estimates are impacted by new unit development, sales growth

and margin improvement. Both fair values incorporated a discount rate of

13% as our estimate of the required rate of return that a third-party buyer

would expect to receive when purchasing the Little Sheep trademark or

reporting unit.

The inputs used in determining the fair values of the Little Sheep trademark

and reporting unit assumed that the business will recover to pre-acquisition

average-unit sales volumes and profit levels over the next three years. At

such pre-acquisition sales and profit levels, we believe that the Little Sheep

restaurant-level unit economics will support the new unit development we

assumed in the fair value estimations of the trademark and reporting unit.

Long-term average growth assumptions subsequent to this assumed

recovery include same-store-sales growth of 4% and average annual net

unit growth of approximately 75 units.