Pizza Hut 2013 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K44

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

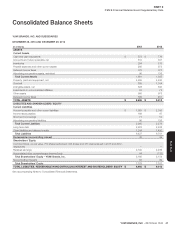

Sheep, separately on the face of our Consolidated Statements of Income.

The portion of equity not attributable to the Company for KFC Beijing and

KFC Shanghai is reported within equity, separately from the Company’s

equity on the Consolidated Balance Sheets. The shareholder that owns

the remaining 7% ownership interest in Little Sheep holds an option that, if

exercised, requires us to redeem their non-controlling interest. Redemption

may occur any time after the third anniversary of the acquisition. This

Redeemable non-controlling interest is classified outside permanent equity

and recorded in the Consolidated Balance Sheet as the greater of the

initial carrying amount adjusted for the non-controlling interest’s share of

net income (loss), or its redemption value.

We participate in various advertising cooperatives with our franchisees

and licensees established to collect and administer funds contributed

for use in advertising and promotional programs designed to increase

sales and enhance the reputation of the Company and its franchise

owners. Contributions to the advertising cooperatives are required for both

Company-owned and franchise restaurants and are generally based on a

percentage of restaurant sales. We maintain certain variable interests in

these cooperatives. As the cooperatives are required to spend all funds

collected on advertising and promotional programs, total equity at risk is

not sufficient to permit the cooperatives to finance their activities without

additional subordinated financial support. Therefore, these cooperatives

are VIEs. As a result of our voting rights, we consolidate certain of these

cooperatives for which we are the primary beneficiary. The Advertising

cooperatives assets, consisting primarily of cash received from the

Company and franchisees and accounts receivable from franchisees,

can only be used to settle obligations of the respective cooperative. The

Advertising cooperative liabilities represent the corresponding obligation

arising from the receipt of the contributions to purchase advertising and

promotional programs for which creditors do not have recourse to the

general credit of the primary beneficiary. Therefore, we report all assets

and liabilities of these advertising cooperatives that we consolidate as

Advertising cooperative assets, restricted and Advertising cooperative

liabilities in the Consolidated Balance Sheet. As the contributions to these

cooperatives are designated and segregated for advertising, we act as an

agent for the franchisees and licensees with regard to these contributions.

Thus, we do not reflect franchisee and licensee contributions to these

cooperatives in our Consolidated Statements of Income or Consolidated

Statements of Cash Flows�

Fiscal Year. Our fiscal year ends on the last Saturday in December and,

as a result, a 53

rd

week is added every five or six years. The first three

quarters of each fiscal year consist of 12 weeks and the fourth quarter

consists of 16 weeks in fiscal years with 52 weeks and 17 weeks in fiscal

years with 53 weeks. Our subsidiaries operate on similar fiscal calendars

except that China, India and certain other international subsidiaries operate

on a monthly calendar, and thus never have a 53

rd

week, with two months

in the first quarter, three months in the second and third quarters and four

months in the fourth quarter. YRI closes one period earlier to facilitate

consolidated reporting.

Fiscal year 2011 included 53 weeks for our U.S. businesses and a portion

of our YRI business. The 53rd week in 2011 added $91 million to total

revenues, $15 million to Restaurant profit and $25 million to Operating

Profit in our 2011 Consolidated Statement of Income. The $25 million

benefit was offset throughout 2011 by investments, including franchise

development incentives, as well as higher-than-normal spending, such

as restaurant closures in the U.S. and YRI.

Foreign Currency. The functional currency of our foreign entities is the

currency of the primary economic environment in which the entity operates.

Functional currency determinations are made based upon a number of

economic factors, including but not limited to cash flows and financing

transactions. The operations, assets and liabilities of our entities outside

the United States are initially measured using the functional currency of that

entity. Income and expense accounts for our operations of these foreign

entities are then translated into U.S. dollars at the average exchange

rates prevailing during the period. Assets and liabilities of these foreign

entities are then translated into U.S. dollars at exchange rates in effect

at the balance sheet date. As of December 28, 2013, net cumulative

translation adjustment gains of $170 million are recorded in Accumulated

other comprehensive income (loss) in the Consolidated Balance Sheet.

As we manage and share resources at either the country level for all of

our brands in a country or, for some countries in which we have more

significant operations, at the individual brand level within the country,

cumulative translation adjustments are recorded and tracked at the foreign-

entity level that represents either our entire operations within a country

or the operations of our individual brands within that country. Translation

adjustments recorded in Accumulated other comprehensive income (loss)

are subsequently recognized as income or expense generally only upon

sale or upon complete or substantially complete liquidation of the related

investment in a foreign entity. For purposes of determining whether a sale

or complete or substantially complete liquidation of an investment in a

foreign entity has occurred, we consider those same foreign entities for

which we record and track cumulative translation adjustments. Restaurant

closures and refranchising transactions during the periods presented

constituted disposals or sales of assets within our foreign entities and

thus did not result in any translation adjustments being recognized as

income or expense. The adoption of Accounting Standards Update No.

2013-05, Foreign Currency Matters, (Topic 830): Parent’s Accounting

for the Cumulative Translation Adjustment upon Derecognition of Certain

Subsidiaries or Groups of Assets within a Foreign Entity or of an Investment

in a Foreign Entity, in 2014 is not anticipated to have a significant impact

on our accounting for foreign currency matters.

Gains and losses arising from the impact of foreign currency exchange

rate fluctuations on transactions in foreign currency are included in Other

(income) expense in our Consolidated Statement of Income.

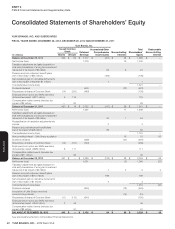

Reclassifications. We have reclassified certain items in the Consolidated

Financial Statements for prior periods to be comparable with the classification

for the fiscal year ended December 28, 2013. These reclassifications had

no effect on previously reported Net Income – YUM! Brands, Inc.

Franchise and License Operations. We execute franchise or license

agreements for each unit operated by third parties which set out the terms

of our arrangement with the franchisee or licensee. Our franchise and

license agreements typically require the franchisee or licensee to pay an

initial, non-refundable fee and continuing fees based upon a percentage

of sales. Subject to our approval and their payment of a renewal fee, a

franchisee may generally renew the franchise agreement upon its expiration.

The internal costs we incur to provide support services to our franchisees

and licensees are charged to General and Administrative (“G&A”) expenses

as incurred. Certain direct costs of our franchise and license operations

are charged to franchise and license expenses. These costs include

provisions for estimated uncollectible fees, rent or depreciation expense

associated with restaurants we lease or sublease to franchisees, franchise

and license marketing funding, amortization expense for franchise-related

intangible assets and certain other direct incremental franchise and license

support costs.

Revenue Recognition. Revenues from Company-owned restaurants are

recognized when payment is tendered at the time of sale. The Company

presents sales net of sales-related taxes. Income from our franchisees

and licensees includes initial fees, continuing fees, renewal fees and rental

income from restaurants we lease or sublease to them. We recognize

initial fees received from a franchisee or licensee as revenue when we

have performed substantially all initial services required by the franchise

or license agreement, which is generally upon the opening of a store. We

recognize continuing fees, which are based upon a percentage of franchisee

and licensee sales and rental income as earned. We recognize renewal

fees when a renewal agreement with a franchisee or licensee becomes

effective. We present initial fees collected upon the sale of a restaurant

to a franchisee in Refranchising (gain) loss.

While the majority of our franchise agreements are entered into with terms

and conditions consistent with those at a prevailing market rate, there are

instances when we enter into franchise agreements with terms that are not

at market rates (for example, below-market continuing fees) for a specified

period of time. We recognize the estimated value of terms in franchise