Pizza Hut 2013 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

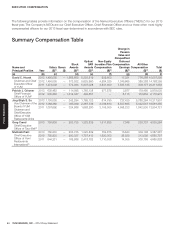

YUM! BRANDS, INC.-2014Proxy Statement46

Proxy Statement

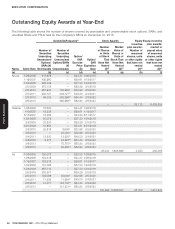

EXECUTIVE COMPENSATION

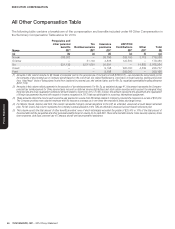

All Other Compensation Table

The following table contains a breakdown of the compensation and benefits included under All Other Compensation in

the Summary Compensation Table above for 2013.

Name

Perquisites and

other personal

benefits

($)(1)

Tax

Reimbursements

($)(2)

Insurance

premiums

($)(3)

LRP/TCN

Contributions

($)(4)

Other

($)(5)

Total

($)

(a) (b) (c) (d) (e) (f) (g)

Novak 388,203 — 26,796 358,150 3,119 776,268

Grismer — 51,144 4,836 123,500 — 179,480

Su 221,139 5,511,651 20,591 — 14,883 5,768,264

Creed — — 9,198 225,000 4,539 238,737

Pant — — 9,198 300,000 — 309,198

(1) Amounts in this column include for Mr. Novak: incremental cost for the personal use of Company aircraft ($388,203)—we calculate the incremental cost to

the Company of any personal use of Company aircraft based on the cost of fuel, trip-related maintenance, crew travel, on board catering, landing and license

fees, “dead head” costs of flying planes to and from locations for personal use, and contract labor; and for Mr. Su: expatriate spendables/housing allowance

($221,139).

(2) Amounts in this column reflect payments to the executive of tax reimbursements. For Mr. Su, as explained at page 41, this amount represents the Company-

provided tax reimbursement for China income taxes incurred on deferred income distributions and stock option exercises which exceed the marginal Hong

Kong tax rate and a tax equalization settlement amount related to income for 2012. For Mr. Grismer, this amount represents the adjustment and equalization

of foreign tax payments incurred with respect to income recognized in 2013 that was attributable to a previous international assignment.

(3) These amounts reflect the income each executive was deemed to receive from IRS tables related to Company-provided life insurance in excess of $50,000.

The Company provides every salaried employee with life insurance coverage up to one times the employee’s salary plus target bonus.

(4) For Messrs. Novak, Grismer and Pant, this column represents Company annual allocations to the LRP, an unfunded, unsecured account based retirement

plan. For Mr. Creed, this column represents the Company’s annual allocation to the TCN, an unfunded, unsecured account based retirement plan.

(5) This column reports the total amount of other benefits provided, none of which individually exceeded the greater of $25,000 or 10% of the total amount of

these benefits and the perquisites and other personal benefits shown in column (b) for each NEO. These other benefits include: home security expense, home

leave expenses, club dues, personal use of Company aircraft and tax preparation assistance.