Pizza Hut 2013 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K36

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

The combined Operating Profits of China, YRI and India constitute

approximately 70% of our segment Operating Profit in 2013. In addition,

the Company’s foreign currency net asset exposure (defined as foreign

currency assets less foreign currency liabilities) totaled approximately

$4.2billion as of December 28, 2013. Operating in international markets

exposes the Company to movements in foreign currency exchange rates.

The Company’s primary exposures result from our operations in Asia-Pacific,

Europe and the Americas. For the fiscal year ended December 28, 2013

Operating Profit would have decreased approximately $155 million if all

foreign currencies had uniformly weakened 10% relative to the U.S. dollar.

This estimated reduction assumes no changes in sales volumes or local

currency sales or input prices.

Commodity Price Risk

We are subject to volatility in food costs as a result of market risk associated with commodity prices. Our ability to recover increased costs through

higher pricing is, at times, limited by the competitive environment in which we operate. We manage our exposure to this risk primarily through pricing

agreements with our vendors.

ITEM 8 Financial Statements

andSupplementaryData

Index to Financial Information

Page

Reference

Consolidated Financial Statements

Report of Independent Registered Public Accounting Firm 37

Consolidated Statements of Income for the fiscal years ended December 28, 2013, December 29, 2012 and December 31, 2011 38

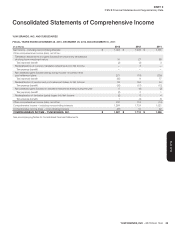

Consolidated Statements of Comprehensive Income for the fiscal years ended December 28, 2013, December 29, 2012 and

December 31, 2011 39

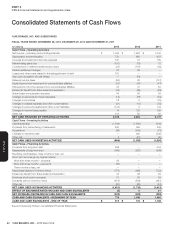

Consolidated Statements of Cash Flows for the fiscal years ended December 28, 2013, December 29, 2012 and December 31, 2011 40

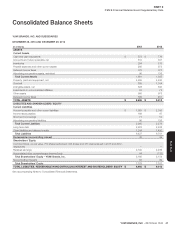

Consolidated Balance Sheets as of December 28, 2013 and December 29, 2012 41

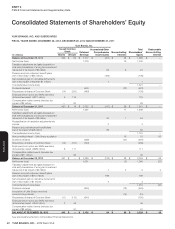

Consolidated Statements of Shareholders’ Equity for the fiscal years ended December 28, 2013, December 29, 2012 and

December31, 2011 42

Notes to Consolidated Financial Statements 43

Management’s Responsibility for Financial Statements 71

Financial Statement Schedules

No schedules are required because either the required information is not present or not present in amounts sufficient to require submission of the

schedule, or because the information required is included in the above-listed financial statements or notes thereto.