Pizza Hut 2013 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2013 Form10-K 53

Form 10-K

PART II

ITEM 8Financial Statements andSupplementaryData

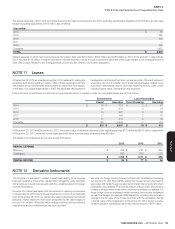

NOTE9 Goodwill and Intangible Assets

The changes in the carrying amount of goodwill are as follows:

China YRI U.S. India Worldwide

Balance as of December 31, 2011

Goodwill, gross $ 88 $ 299 $ 311 $ — $ 698

Accumulated impairment losses — (17) — — (17)

Goodwill, net 88 282 311 — 681

Acquisitions(a) 376 — — — 376

Disposals and other, net(b) 2 (11) (14) — (23)

Balance as of December 29, 2012

Goodwill, gross 466 288 297 — 1,051

Accumulated impairment losses — (17) — — (17)

Goodwill, net 466 271 297 — 1,034

Acquisitions(c) 2 86 — 2 90

Impairment Losses(d) (222) — — — (222)

Disposals and other, net(b) 10 (18) (5) — (13)

Balance as of December 28, 2013

Goodwill, gross 478 356 292 2 1,128

Accumulated impairment losses (222) (17) — — (239)

GOODWILL, NET $ 256 $ 339 $ 292 $ 2 $ 889

(a) We recorded goodwill of $376 million related to our acquisition of Little Sheep. See the Little Sheep Acquisition and Subsequent Impairment section of Note 4.

(b) Disposals and other, net includes the impact of foreign currency translation on existing balances and goodwill write-offs associated with refranchising.

(c) We recorded goodwill of $86 million in our YRI segment related to the acquisition of 65 KFC and 41 Pizza Hut restaurants in Turkey.

(d) We recorded an impairment charge of $222 million to write down Little Sheep’s goodwill in 2013. See the Little Sheep Acquisition and Subsequent Impairment section of Note 4 for details.

Intangible assets, net for the years ended 2013 and 2012 are as follows:

2013 2012

Gross Carrying

Amount

Accumulated

Amortization

Gross Carrying

Amount

Accumulated

Amortization

Definite-lived intangible assets

Reacquired franchise rights $ 188 $ (66) $ 163 $ (47)

Franchise contract rights 130 (90) 131 (84)

Lease tenancy rights 71 (12) 57 (12)

Favorable operating leases 20 (12) 21 (11)

Other 52 (22) 51 (19)

$ 461 $ (202) $ 423 $ (173)

Indefinite-lived intangible assets

KFC trademark $ 31 $ 31

Little Sheep trademark(a) 348 409

$ 379 $ 440

(a) We recorded an impairment charge of $69 million to write down the Little Sheep trademark in 2013. See the Little Sheep Acquisition and Subsequent Impairment section of Note 4 for details.

Amortization expense for all definite-lived intangible assets was $28 million in 2013, $28 million in 2012 and $31 million in 2011. Amortization expense for

definite-lived intangible assets will approximate $27 million in 2014, $26 million in 2015, $25 million in 2016, $23 million in 2017 and $22 million in 2018.