Pizza Hut 2013 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2013 Pizza Hut annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

YUM! BRANDS, INC.-2014Proxy Statement 61

Proxy Statement

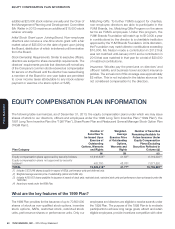

EQUITY COMPENSATION PLAN INFORMATION

similar companies and align the interest of employees and

directors with those of our shareholders. The 1999 Plan is

administered by the Management Planning and Development

Committee of the Board of Directors (the “Committee”). The

exercise price of a stock option grant or SAR under the

1999 Plan may not be less than the average market price

of our stock on the date of grant for years prior to 2008

or the closing price of our stock on the date of the grant

beginning in 2008, and no options or SARs may have a

term of more than ten years. The options and SARs that

are currently outstanding under the 1999 Plan generally

vest over a one to four year period and expire ten years

from the date of the grant. Our shareholders approved the

1999 Plan in May 1999, and the plan as amended in 2003

and again in 2008. The performance measures of the 1999

Plan were re-approved by our shareholders in May 2013.

What are the key features of the 1997 Plan?

The 1997 Plan provides for the issuance of up to 90,000,000

shares of stock. Effective January 1, 2002, only restricted

shares could be issued under this plan. This plan is utilized

with respect to payouts on shares from our deferral plans

and was originally approved by PepsiCo, Inc. as the sole

shareholder of the Company in 1997, prior to the spin-off

of the Company from PepsiCo, Inc. on October 6, 1997.

What are the key features of the SharePower Plan?

The SharePower Plan provides for the issuance of up to

28,000,000 shares of stock. The SharePower Plan allows

us to award non-qualified stock options, SARs, restricted

stock and restricted stock units. Employees, other than

executive officers, are eligible to receive awards under the

SharePower Plan. The SharePower Plan is administered

by the Committee. The exercise price of a stock option

or SAR grant under the SharePower Plan may not be less

than the closing price of our stock on the date of the grant

and no option or SAR may have a term of more than ten

years. The options that are currently outstanding under

the SharePower Plan generally vest over a one to four year

period beginning on the date of grant. The SharePower

Plan was originally approved by PepsiCo, Inc. as the sole

shareholder of the Company in 1997, prior to the spin-off

of the Company from PepsiCo, Inc. on October 6, 1997.

What are the key features of the RGM Plan?

The RGM Plan provides for the issuance of up to 30,000,000

shares of common stock at a price equal to or greater than

the closing price of our stock on the date of grant. The RGM

Plan allows us to award non-qualified stock options, SARs,

restricted stock and RSUs. Employees, other than executive

officers, are eligible to receive awards under the RGM Plan.

The purpose of the RGM Plan is (i) to give restaurant general

managers (“RGMs”) the opportunity to become owners of

stock, (ii) to align the interests of RGMs with those of YUM’s

other shareholders, (iii) to emphasize that the RGM is YUM’s

#1 leader, and (iv) to reward the performance of RGMs. In

addition, the Plan provides incentives to Area Coaches,

Franchise Business Leaders and other supervisory field

operation positions that support RGMs and have profit and

loss responsibilities within a defined region or area. While

all non-executive officer employees are eligible to receive

awards under the RGM plan, all awards granted have been

to RGMs or their direct supervisors in the field. Grants to

RGMs generally have four year vesting and expire after ten

years. The RGM Plan is administered by the Committee,

and the Committee has delegated its responsibilities to the

Chief People Officer of the Company. The Board of Directors

approved the RGM Plan on January 20, 1998.