Nokia 2004 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

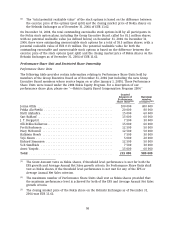

(2) The ‘‘total potential realizable value’’ of the stock options is based on the difference between

the exercise price of the options (post split) and the closing market price of Nokia shares on

the Helsinki Exchanges as of December 31, 2004 of EUR 11.62.

On December 31, 2004, the total outstanding exercisable stock options held by all participants in

the Nokia stock option plans, including the Group Executive Board, called for 81.1 million shares,

with no potential realizable value (as defined below) on December 31, 2004. On December 31,

2004, there were outstanding unexercisable stock options for a total of 59.3 million shares, with a

potential realizable value of EUR 0.13 million. The potential realizable value for both the

outstanding exercisable and unexercisable stock options is based on the difference between the

exercise price of the stock options (post split) and the closing market price of Nokia shares on the

Helsinki Exchanges as of December 31, 2004 of EUR 11.62.

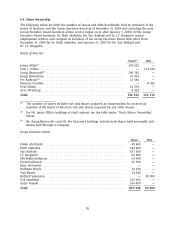

Performance Share Unit and Restricted Share Ownership

Performance Share Units

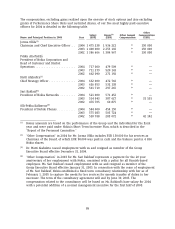

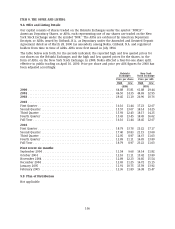

The following table provides certain information relating to Performance Share Units held by

members of the Group Executive Board as of December 31, 2004 (not including the new Group

Executive Board members whose service began on or after January 1, 2005). These Performance

Share Units were issued under the 2004 Nokia Equity Program. For a description of our

performance share plan, please see ‘‘—Nokia’s Equity Based Compensation Program 2004.’’

Granted

Amounts of Maximum

Performance number

Share Units(1)(3) of shares(2)(3)

Jorma Ollila ............................................. 100 000 400 000

Pekka Ala-Pietil ¨

a ......................................... 20 000 80 000

Matti Alahuhta ........................................... 15 000 60 000

Sari Baldauf ............................................. 15 000 60 000

J. T. Bergqvist ............................................ 7 500 30 000

Olli-Pekka Kallasvuo ....................................... 15 000 60 000

Pertti Korhonen .......................................... 12 500 50 000

Mary McDowell .......................................... 12 500 50 000

Hallstein Moerk .......................................... 7 500 30 000

Yrj¨

o Neuvo .............................................. 5 000 20 000

Richard Simonson ........................................ 12 500 50 000

Veli Sundb ¨

ack ........................................... 7 500 30 000

Anssi Vanjoki ............................................ 15 000 60 000

Total .................................................. 245 000 980 000

(1) The Grant Amount vests as Nokia shares, if threshold level performance is met for both the

EPS growth and Average Annual Net Sales growth criteria. No Performance Share Units shall

vest as Nokia shares, if the threshold level performance is not met for any of the EPS or

Average Annual Net Sales criterion.

(2) The maximum number of Performance Share Units shall vest as Nokia shares provided that

the maximun performance level is achieved for both of the EPS and Average Annual Net Sales

growth criteria.

(3) The closing market price of the Nokia share on the Helsinki Exchanges as of December 31,

2004 was EUR 11.62.

98