Nokia 2004 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

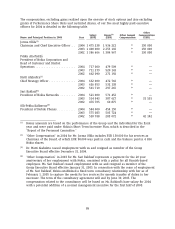

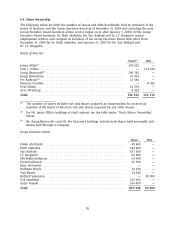

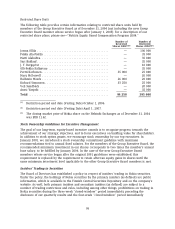

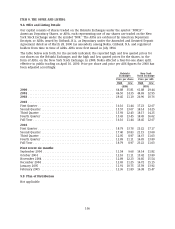

Number of shares represented by unexercisable options as of December 31, 2004

2001 2001

2001 B C 3Q/01 C 4Q/01 2002 B 2003 2Q 2003 4Q 2004 2Q

Exercise price per

share (EUR) ....... EUR 36.75 EUR 20.61 EUR 26.67 EUR 17.89 EUR 14.95 EUR 15.05 EUR 11.79

Jorma Ollila ......... 187 500 — 156 250 437 500 550 000 — 400 000

Pekka Ala-Pietil¨

a..... 46 875 — 39 066 109 375 116 875 — 80 000

Matti Alahuhta ...... 18 750 — 15 625 76 565 82 500 — 60 000

Sari Baldauf ........ 18 750 — 15 625 76 565 82 500 — 60 000

J.T. Bergqvist ........ 7 500 — 6 250 30 625 34 375 — 30 000

Olli-Pekka Kallasvuo . . 18 750 — 15 625 76 565 82 500 — 60 000

Pertti Korhonen ...... 5 625 — 4 691 30 625 34 375 — 50 000

Mary McDowell ...... —————70 00050 000

Hallstein Moerk ...... 5 625 — 4 691 13 125 13 750 — 30 000

Yrj¨

o Neuvo ......... 13 125 — 10 941 30 625 27 500 — 20 000

Richard Simonson .... — 9 000 — 6 565 7 907 — 50 000

Veli Sundb¨

ack....... 7 500 — 6 250 17 500 34 375 — 30 000

Anssi Vanjoki ....... 13 125 — 10 941 43 750 68 750 — 60 000

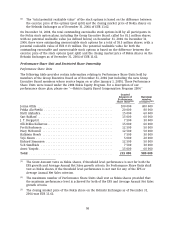

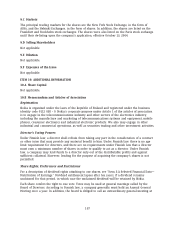

On December 31, 2004, the aggregate holdings of exercisable stock options of members of the

Group Executive Board (not including the new Group Executive Board members whose service

began on or after January 1, 2005) called for approximately 3.9 million shares, representing less

than 1% of the issued share capital and voting rights in Nokia Corporation.

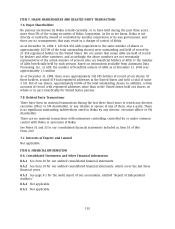

Total potential realizable

Number of shares value of ‘‘In the Money’’

represented by shares represented by

Options sold or outstanding options as of outstanding options as of

exercised in 2004 December 31, 2004 December 31, 2004(2)

Number of Value

Underlying Realized(1)

Shares (EUR thousands) Exercisable Unexercisable Exercisable Unexercisable

Jorma Ollila ........ 1 020 000 5 1 968 750 1 731 250 — —

Pekka Ala-Pietil ¨

a .... — — 482 809 392 191 — —

Matti Alahuhta ...... — — 251 560 253 440 — —

Sari Baldauf ........ 420 000 2 251 560 253 440 — —

J. T. Bergqvist ....... 100 000 164 101 250 108 750 — —

Olli-Pekka Kallasvuo . . — — 251 560 253 440 — —

Pertti Korhonen ..... 16 000 28 89 684 125 316 — —

Mary McDowell ...... — — — 120 000 — —

Hallstein Moerk ..... — — 57 809 67 191 — —

Yrj¨

o Neuvo ......... 280 000 206 132 809 102 191 — —

Richard Simonson . . . — — 39 028 73 472 — —

Veli Sundb ¨

ack ...... 400 000 660 84 375 95 625 — —

Anssi Vanjoki ....... 680 000 503 168 434 196 566 — —

Total ............. 2 916 000 1 568 3 879 628 3 772 872 — —

(1) ‘‘Value realized’’ represents either (a) the total gross value received in respect of options sold

over the Helsinki Exchanges or (b) the difference between the aggregate closing market price

(on the Helsinki Exchanges on the exercise day) of the Nokia shares subscribed for, and the

exercise price of the options exercised for share subscriptions.

97