Nokia 2004 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Stock Options

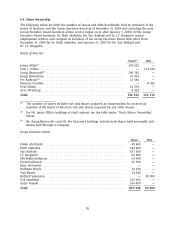

A total number of 6.8 million stock options were issued to selected employees in the organization

under the 2004 program, which was significantly fewer than in 2003. This number includes

1 million stock options granted to the Group Executive Board.

For a summary of the existing Nokia stock option plans, in some of which the Group Executive

Board members participate, please see Note 22 to our consolidated financial statements included

in Item 18 of this Form 20-F. The plans under Note 22 have been approved by the Annual General

Meetings in the year of the launch of the plan.

Restricted Shares

In 2004, we granted a total of 1.9 million restricted shares to recruit, retain, reward and motivate

selected high potential employees, who are critical to the future success of Nokia. The restricted

shares granted during 2004 will vest in October 2007, after which time the shares will be

transferred and delivered to the recipients. Until the shares are transferred and delivered, the

recipients will not have any shareholder rights, such as voting or dividend rights associated with

these restricted shares.

Nokia’s Equity Based Compensation Program 2005

The Board of Directors announced its proposed design for the 2005 Equity Program on January 27,

2005. The Equity Program 2005 follows the design of the 2004 Equity Program. The primary equity

elements in 2005 will be: performance shares for the wide number of employees, stock options to

a more limited population, and a continued, very limited usage of restricted shares for high

potential and critical employees. The key elements of the proposed Equity Program 2005 are:

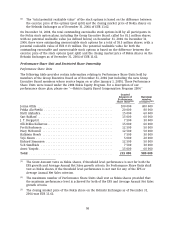

• The performance criteria for the 2005 Performance Share Plan, running for a performance

period of 4 years, are:

(1) Average Annual Net Sales Growth: 3% (threshold) and 12% (maximum), and

2) Annual EPS Growth: EUR 0.82 (threshold) and EUR 1.33 in 2008 (maximum).

EPS growth is calculated based on the compounded annual growth rate over the full

performance period (2005-2008) compared to 2004 EPS of 0.70.

The maximum performance level for both criteria will result in the vesting of the

maximum of 18.8 million Nokia shares. If the threshold levels of performance are not

achieved, none of the Performance Share Units will vest. For performance between

the threshold and maximum performance levels the payout follows a linear scale.

• We intend to grant Performance Share Units in 2005 resulting in a maximum payout of

18.8 million Nokia shares, in the event that the maximum performance levels be met. It is

our intent to grant Performance Share Units to a similar target group and amounting to a

similar number also in 2006. We have also reserved a pool of units, to be used for grants

within the anticipated annual grant cycle in 2006 as well as for recruiting and special

retention needs for 2005 and 2006 combined. This amount may result in a maximum

payout of 31.2 million Nokia shares.

• We intend to grant 8.5 million stock options in 2005, each entitling to a subscription of one

Nokia share. Our intent is to grant a similar amount also in 2006. We have reserved an

additional pool of stock options to be used for grants within the anticipated annual grant

cycle in 2006 as well as for recruiting and special retention needs, for 2005 and 2006

combined. The Equity Program 2005 includes a proposal by the Board of Directors to Nokia’s

101