Nokia 2004 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

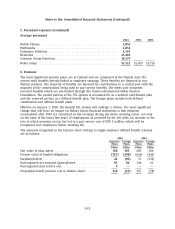

1. Accounting principles (Continued)

standard will have a material impact on the Group’s financial position, results of operations or

cash flows.

In February 2004, the IASB issued IFRS 2, Share-based Payment. The standard requires the

recognition of share-based payment transactions in financial statements, including transactions

with employees or other parties to be settled in cash, other assets, or equity instruments of the

Company. Currently the Group has only share-based payment transactions with employees to be

settled in equity instruments of the Company. The services received, and the corresponding

increase in equity, are measured by reference to the fair value of the equity instruments granted.

The compensation is recognized as an expense in the profit and loss account over the service

period. IFRS 2 is effective for fiscal years beginning on or after January 1, 2005 and applies to

grants of shares, share options or other equity instruments that were granted after November 7,

2002 and had not yet vested at the effective date of the standard. The Group is currently

estimating the impact of adopting IFRS 2 on the financial statements.

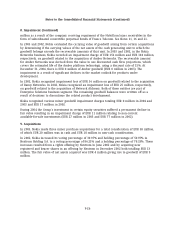

In March 2004, the IASB issued IFRS 3, Business Combinations, and the revised standards IAS 36,

Impairment of Assets, and IAS 38, Intangible Assets. IFRS 3 is required to be applied to all business

combinations for which the agreement date is on or after March 31, 2004. The standard requires

that all business combinations be accounted for by the purchase method, provides specific criteria

for recognizing intangible assets acquired in a business combination and also prohibits the

amortization of goodwill and instead requires it to be tested for impairment annually, in

accordance with the revised IAS 36. Any excess of acquirer’s interest in the net fair value of

acquiree’s identifiable assets, liabilities and contingent liabilities over cost is recognized

immediately as a gain.

Goodwill related to acquisitions prior to March 31, 2004 continued to be amortized through

December 31, 2004 as required in the transition guidance. Goodwill related to acquisitions

subsequent to March 31, 2004 is not amortized. Intangible assets with definite useful lives will

continue to be amortized over their respective estimated useful lives. Intangible assets with

indefinite useful lives are not amortized. Currently the Group does not have indefinitely lived

intangible assets. The revised standards IAS 36 and IAS 38 are effective for fiscal years beginning

on or after January 1, 2005. The Group does not expect the adoption of these standards to have a

material impact on the Group’s financial position, results of operations or cash flows.

In March 2004, the IASB issued IFRS 5, Non-current Assets Held for Sale and Discontinued

Operations, which addresses financial accounting and reporting for the disposal of non-current

assets. The standard supersedes IAS 35, Discontinuing Operations. IFRS 5 introduces the concept of

a disposal group and adopts the classification ‘‘held for sale’’. IFRS 5 retains the requirement to

report separately discontinued operations. An asset classified as held for sale, or included within a

disposal group that is classified as held for sale, is not depreciated. IFRS 5 is effective for fiscal

years beginning on or after January 1, 2005. The Group does not expect the adoption of this

standard will have a material impact on the Group’s financial position, results of operations or

cash flows.

F-16