Nokia 2004 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

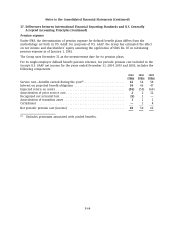

37. Differences between International Financial Reporting Standards and U.S. Generally

Accepted Accounting Principles (Continued)

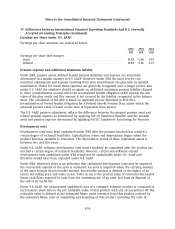

performing maintenance and customer support required to satisfy the enterprise’s responsibility

set forth at the time of sale.

The amount of unamortized capitalized computer software costs, under U.S. GAAP, is EUR 210

million in 2004 (EUR 438 million in 2003).

Marketable securities and unlisted investments

All available-for-sale investments, which includes all publicly listed and non-listed marketable

securities, are measured at fair value and gains and losses are recognized within shareholders’

equity until realized in the profit and loss account upon sale or disposal.

Under U.S. GAAP, the Group’s listed marketable securities would be classified as available-for-sale

and carried at aggregate fair value with gross unrealized holding gains and losses reported as a

separate component of shareholders’ equity. Investments in equity securities that are not traded

on a public market are carried at historical cost, giving rise to an adjustment between IFRS and

U.S. GAAP.

Provision for social security cost on stock options

Under IFRS, the Group provides for social security costs on stock options on the date of grant,

based on the market value of the underlying stock at the date of grant. The provision is adjusted

for movements in the market value of the underlying stock.

Under U.S. GAAP, no expense is recorded until the options are exercised.

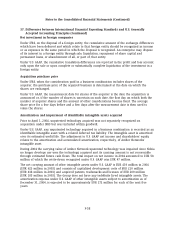

Stock compensation

Under IFRS, no compensation expense is recorded on stock options, restricted shares or

performance shares granted. Under U.S. GAAP, the Group follows the methodology in APB Opinion

25, Accounting for Stock Issued to Employees (APB 25), and related interpretations to measure

employee stock compensation. Under APB 25 intrinsic value from Nokia’s option programs arises

when the exercise price is less than the quoted market value of the underlying stock on the date

of grant.

Restricted shares and performance shares are accounted for as variable award plans under

U.S. GAAP where compensation is measured each period end as the difference between the

exercise price and the quoted market value of the underlying stock. For performance shares, the

Group assesses the probability of whether the performance criteria will be met in calculating the

compensation expense. Compensation arising from stock option programs, restricted shares and

performance shares is recorded as deferred compensation within shareholders’ equity and

recognized in the profit and loss account over the vesting period of the stock.

Cash flow hedges

As a result of a specific difference in the rules under IAS 39 and FAS 133, Accounting for Derivative

Instruments and Hedging Activities, relating to hedge accounting, certain foreign exchange gains

and losses classified within equity under IFRS are included in the income statement under

U.S. GAAP.

F-57