Nokia 2004 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

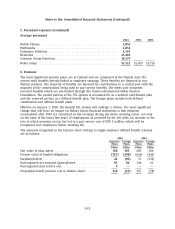

1. Accounting principles (Continued)

The Group recognizes the estimated liability for non-cancellable purchase commitments for

inventory in excess of forecasted requirements at each balance sheet date.

The Group recognizes a provision for the estimated future settlements related to asserted and

unasserted Intellectual Property Rights (IPR) infringements, based on the probable outcome of each

case as of each balance sheet date.

The Group recognizes a provision for social security costs on unexercised stock options granted to

employees at the date options are granted. The provision is measured based on the fair value of

the options, and the amount of the provision is adjusted to reflect the changes in the Nokia share

price.

The Group recognizes a provision for prior year tax contingencies based upon the estimated future

settlement amount at each balance sheet date.

Dividends

Dividends proposed by the Board of Directors are not recorded in the financial statements until

they have been approved by the shareholders at the Annual General Meeting.

Earnings per share

The Group calculates both basic and diluted earnings per share in accordance with IAS 33,

Earnings per share, (IAS 33). Under IAS 33, basic earnings per share is computed using the

weighted average number of shares outstanding during the period. Diluted earnings per share is

computed using the weighted average number of shares outstanding during the period plus the

dilutive effect of stock options, restricted shares and performance shares outstanding during the

period.

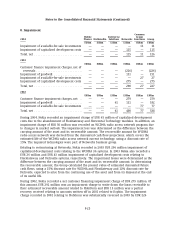

New IFRS standards and revised IAS standards

In December 2003, International Financial Reporting Standards (IFRS) were amended as the IASB

released revised IAS 32, Financial Instruments: Disclosure and Presentation and IAS 39, Financial

Instruments: Recognition and Measurement. These standards replace IAS 32 (revised 2000), and

supersedes IAS 39 (revised 2000), and must be applied for annual periods beginning on or after

January 1, 2005. Under IAS 39 (revised) no cash flow hedge accounting is available on forecast

intragroup transactions. Any deferral of hedging gains or losses that were included in the 2004

and 2003 consolidated financial statements needs to be reversed. The final form of the standards

is still open and given the uncertainty the Group is currently not able to estimate the impact of

adopting the revised standards on the financial statements.

The revised IAS 21, The Effects of Changes in Foreign Exchange Rates, issued by the IASB in

December 2003, requires the goodwill arising on the acquisition of a foreign operation to be

expressed in the functional currency of the foreign operation and translated at the closing rate.

Currently the Group records goodwill arising on the acquisition of a foreign entity using the

exchange rate at the date of the transaction. The revised standard is effective for fiscal years

beginning on or after January 1, 2005. The Group does not expect the adoption of the revised

F-15