Nokia 2004 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

reduced and/or delayed infrastructure investments by operators as they focused during those

years on decreasing debt and improving their capital structure primarily due to the combined

effects of the general economic slowdown and high 3G license costs. In order to improve

profitability, Nokia responded to these market developments by restructuring its infrastructure

business and reducing Networks headcount by almost 2000 people in 2003. Towards the end of

2003, the market started to stabilize somewhat. This stabilization continued into 2004, when

following three years of decline, we estimate that the mobile infrastructure market showed

year-on-year growth of approximately 14% in euro terms. This growth was largely the result of

operator investments in the current technologies of GSM, EDGE, and GPRS and their related

services, especially in low penetration markets, and in new-generation technologies, such as

WCDMA 3G.

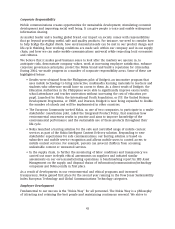

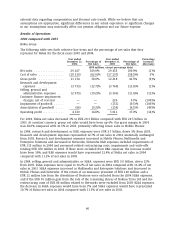

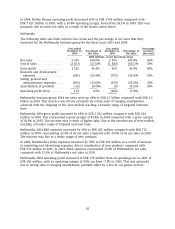

The following chart sets forth the global mobile infrastructure market size by geographic area,

based on Nokia’s estimates, for the three years ended December 31, 2004. Nokia’s estimate of the

value of mobile infrastructure market includes sales of mobile infrastructure equipment and

related services for all cellular standards.

Global Mobile Infrastructure Market Size by Geographic Area

based on Nokia’s Estimates

Year ended Year ended Year ended

December 31, Change (%) December 31, Change (%) December 31,

2004 2003 to 2004 2003 2002 to 2003 2002

(EUR billions, except percentage data)

Europe, Middle-East & Africa . . 17.2 17% 14.7 (15)% 17.2

China .................... 6.2 22% 5.1 (7)% 5.5

Asia-Pacific ............... 7.9 5% 7.5 (20)% 9.4

North America ............. 9.9 9% 9.1 (25)% 12.2

Latin America ............. 3.5 30% 2.7 (10)% 3.0

Total .................... 44.7 14% 39.1 (17)% 47.3

In mobile infrastructure, Nokia expects the overall market in 2005 to be slightly up compared with

2004 in euro terms. We expect operators to continue building coverage and expanding capacity in

low penetration markets as well as optimizing and expanding existing 2G networks in the more

developed markets but to a lesser extent than in 2004. The continued rollout of high-speed,

high-capacity 3G networks is expected to contribute to the market growth.

Networks sales and profitability are also affected by the product mix. Until the second half of

2002, all Nokia Networks infrastructure sales were related to 2G. In the second half of 2002, Nokia

started to recognize revenue from its first 3G contracts. In 2003, the 3G related sales were

approximately 16% of Networks total sales. As 2003 was the first year of 3G volume roll-outs,

profitability of our infrastructure business was lower due to quality issues related to the new

technology. In 2004, 2G accounted for a higher proportion of total net sales than expected, with 3G

ultimately increasing its year-on-year share by 1% to 17%. Service related sales, such as roll-out,

maintenance and professional services, grew as a proportion of total sales throughout 2004,

closing the year at approximately 25%. In 2004, Networks entered several new geographical areas,

with the effect that initial roll-out profitability was negatively impacted by market entry related

costs as well as the highly competitive nature of these markets. However, overall profitability of

3G contracts positively impacted Networks’ profitability in 2004.

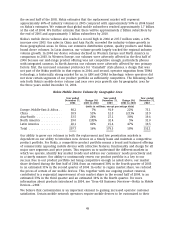

The following chart sets forth Nokia’s Networks net sales by geographic area for the three years

ended December 31, 2004.

53