Nokia 2004 Annual Report Download - page 176

Download and view the complete annual report

Please find page 176 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

35. Risk management (Continued)

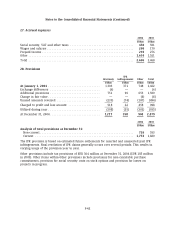

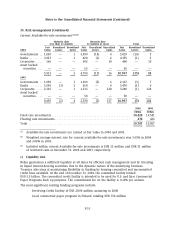

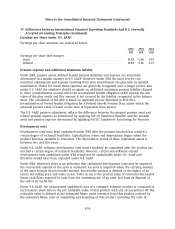

Current Available-for-sale investments(1)(2)(3)

Maturity date Maturity date

less than 12 months 12 months or more Total

Fair Unrealized Unrealized Fair Unrealized Unrealized Fair Unrealized Unrealized

2004 Value Losses Gains Value Losses Gains Value Losses Gains

Governments . . 1,820 — 1 3,999 (14) 4 5,819 (14) 5

Banks ........ 3,927 — 1 428 (1) 2 4,355 (1) 3

Corporates .... 166 — — 302 — 10 468 — 10

Asset backed

securities .... — — — 65 — — 65 — —

5,913 — 2 4,794 (15) 16 10,707 (15) 18

2003

Governments . . 1,058 — 1 1,109 (3) 6 2,167 (3) 7

Banks ........ 5,206 (1) 2 264 — 4 5,470 (1) 6

Corporates .... 2,165 — 1 1,115 — 128 3,280 (1) 128

Asset backed

securities .... — — — 50 — — 50 — —

8,430 (2) 4 2,538 (3) 137 10,967 (5) 141

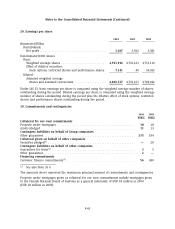

2004 2003

EURm EURm

Fixed rate investments ............................................... 10,429 10,541

Floating rate investments ............................................. 278 426

Total ............................................................. 10,707 10,967

(1) Available-for-sale investments are carried at fair value in 2004 and 2003.

(2) Weighted average interest rate for current available-for-sale investments was 3.63% in 2004

and 3.08% in 2003.

(3) Included within current Available-for-sale investments is EUR 11 million and EUR 31 million

of restricted cash at December 31, 2004 and 2003, respectively.

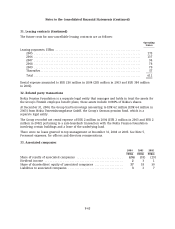

c) Liquidity risk

Nokia guarantees a sufficient liquidity at all times by efficient cash management and by investing

in liquid interest-bearing securities. Due to the dynamic nature of the underlying business

Treasury also aims at maintaining flexibility in funding by keeping committed and uncommitted

credit lines available. At the end of December 31, 2004, the committed facility totaled

USD 2.0 billion. The committed credit facility is intended to be used for U.S. and Euro Commercial

Paper Programs back up purposes. The commitment fee on the facility is 0.10% per annum.

The most significant existing funding programs include:

Revolving Credit Facility of USD 2,000 million, maturing in 2008

Local commercial paper program in Finland, totaling EUR 750 million

F-51