Nokia 2004 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

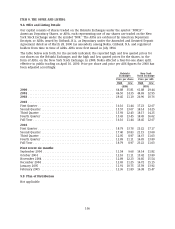

ITEM 9. THE OFFER AND LISTING

9.A Offer and Listing Details

Our capital consists of shares traded on the Helsinki Exchanges under the symbol ‘‘NOK1V.’’

American Depositary Shares, or ADSs, each representing one of our shares are traded on the New

York Stock Exchange under the symbol ‘‘NOK.’’ The ADSs are evidenced by American Depositary

Receipts, or ADRs, issued by Citibank, N.A., as Depositary under the Amended and Restated Deposit

Agreement dated as of March 28, 2000 (as amended), among Nokia, Citibank, N.A. and registered

holders from time to time of ADRs. ADSs were first issued in July 1994.

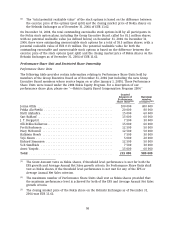

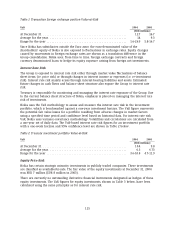

The table below sets forth, for the periods indicated, the reported high and low quoted prices for

our shares on the Helsinki Exchanges and the high and low quoted prices for the shares, in the

form of ADSs, on the New York Stock Exchange. In 2000, Nokia effected a four-for-one share split,

effective in public trading on April 10, 2000. Price per share and price per ADS figures for 2000 has

been adjusted accordingly.

New YorkHelsinki

Stock ExchangeExchanges

Price per share Price per ADS

High Low High Low

(EUR) (USD)

2000 ................................................... 64.88 35.81 61.88 29.44

2001 ................................................... 46.50 14.35 44.69 12.95

2002 ................................................... 29.45 11.10 26.90 10.76

2003 ...................................................

First Quarter ............................................. 16.16 11.44 17.23 12.67

Second Quarter ........................................... 15.57 13.07 18.14 14.25

Third Quarter ............................................ 15.93 12.43 18.17 14.25

Fourth Quarter ........................................... 15.43 13.45 18.45 16.02

Full Year ................................................ 16.16 11.44 18.45 12.67

2004

First Quarter ............................................. 18.79 13.78 23.22 17.17

Second Quarter ........................................... 17.40 10.83 21.15 13.08

Third Quarter ............................................ 12.05 8.97 14.67 11.03

Fourth Quarter ........................................... 12.89 11.11 16.85 13.80

Full Year ................................................ 18.79 8.97 23.22 11.03

Most recent six months

September 2004 .......................................... 11.54 9.68 14.14 11.82

October 2004 ............................................ 12.10 11.11 15.42 13.80

November 2004 .......................................... 12.89 12.23 16.85 15.54

December 2004 ........................................... 12.65 11.25 16.72 15.15

January 2005 ............................................ 11.91 10.75 15.59 13.92

February 2005 ........................................... 12.36 11.89 16.38 15.47

9.B Plan of Distribution

Not applicable.

106