Nokia 2004 Annual Report Download - page 193

Download and view the complete annual report

Please find page 193 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

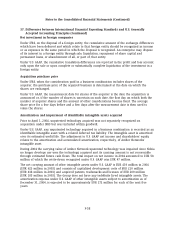

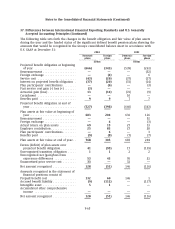

37. Differences between International Financial Reporting Standards and U.S. Generally

Accepted Accounting Principles (Continued)

Reclassification to Financial Income and Expense Under US GAAP

Under IFRS, certain net gains (EUR 137 million, EUR 65 million and EUR 26 million in 2004, 2003

and 2002, respectively) have been classified as other operating income in 2004 and as a reduction

of cost of sales in 2003 and 2002. These gains resulted from instruments held for operating

purposes and considered to be non-hedging derivatives under US GAAP and therefore, these

amounts would be classified as financial income.

Included within the EUR 137 million is the EUR 160 million, representing the premium return

under a multi-line, multi-year insurance program, see Note 7. Under US GAAP, this gain represents

the settlement of a call option on the counterparty’s interest in an unconsolidated reinsurance

subsidiary.

Bank and cash

Under U.S. GAAP bank overdrafts of EUR 21 million and EUR 119 million in 2004 and 2003,

respectively, for which there is a legal right of offset, would be included within bank and cash and

would be excluded from short-term borrowings, which has been reflected in total U.S. GAAP assets

of EUR 22,921 million.

Consolidation

In 2002, Nokia had an investment in a subsidiary in which it owned 50% of the voting shares, and

was consolidated under IFRS as Nokia has control of its operating and financial policies. In 2002,

under US GAAP, this entity would have been accounted for as a joint venture using the equity

method. The impact of deconsolidation would have increased net sales by approximately 4% and

would have had an immaterial effect on operating profit after adjusting for the impact of sales

from Nokia to the subsidiary and the subsidiary’s sales to Nokia. In addition, there would have

been no impact on net profit as a result of the deconsolidation. In 2003, the ownership of the

subsidiary was increased to 52.9%, and since the change in ownership the subsidiary has been

consolidated under both IFRS and U.S. GAAP.

Under U.S. GAAP, related party transactions in 2002 with the subsidiary included sales by Nokia to

the subsidiary of EUR 1,462 million and purchases by Nokia from the subsidiary of EUR 2,090

million.

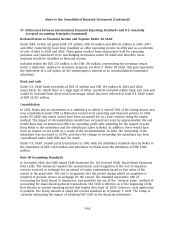

New US Accounting Standards

In December 2004, the FASB issued FASB Statement No. 123 (revised 2004), Share-Based Payments

(FAS 123R). The statement requires the measurement and recognition of the cost of employee

services received in exchange for an award of equity instruments based on fair value of the

award at the grant-date. The cost is recognized over the period during which an employee is

required to provide service in exchange for the award. The standard supersedes APB 25,

Accounting for Stock Issued to Employees, and prohibits the use of the ‘‘intrinsic value’’ method of

accounting for share-based payment transactions. FAS 123R is effective as of the beginning of the

first interim or annual reporting period that begins after June 15, 2005; however, early application

is possible. The Group intends to adopt the revised standard as of January 1, 2005. The Group is

currently estimating the impact of adopting FAS 123R on the financial statements.

F-68