Nokia 2004 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

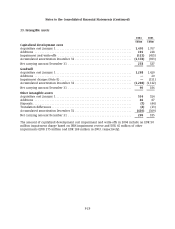

Notes to the Consolidated Financial Statements (Continued)

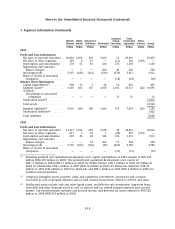

10. Depreciation and amortization

2004 2003 2002

EURm EURm EURm

Depreciation and amortization by asset category

Intangible assets

Capitalized development costs ................................... 244 327 233

Intangible rights .............................................. 38 51 65

Goodwill .................................................... 96 159 206

Other intangible assets ......................................... 30 21 28

Property, plant and equipment

Buildings and constructions ..................................... 32 34 37

Machinery and equipment ...................................... 426 545 737

Other tangible assets .......................................... 215

Total ......................................................... 868 1,138 1,311

Depreciation and amortization by function

Cost of sales ................................................... 196 214 314

R&D.......................................................... 431 537 473

Selling, marketing and administration .............................. 137 185 211

Other operating expenses ......................................... 843 107

Goodwill ...................................................... 96 159 206

Total ......................................................... 868 1,138 1,311

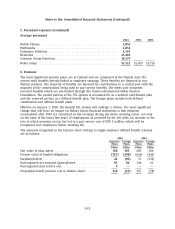

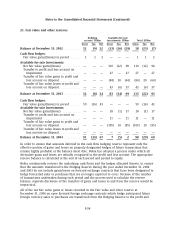

11. Financial income and expenses

2004 2003 2002

EURm EURm EURm

Income from available-for-sale investments

Dividend income .............................................. 22 24 25

Interest income ............................................... 299 323 230

Other financial income ........................................... 178 38 27

Exchange gains and losses ........................................ 832 (29)

Interest expense ................................................ (22) (25) (43)

Other financial expenses ......................................... (80) (40) (54)

Total ......................................................... 405 352 156

During 2004, Nokia sold approximately 69% of its original holdings in the subordinated convertible

perpetual bonds issued by France Telecom. As a result, the Group booked a total net gain of

EUR 106 million in other financial income, of which EUR 104 million was recycled from Fair Value

and Other Reserves. See Notes 16 and 21.

F-27