Nokia 2004 Annual Report Download - page 144

Download and view the complete annual report

Please find page 144 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

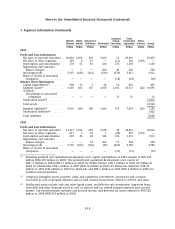

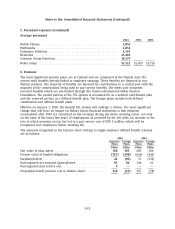

3. Segment information (Continued)

Common Total

Mobile Multi- Enterprise Group reportable Elimi-

Phones media Solutions Networks Functions segments nations Group

EURm EURm EURm EURm EURm EURm EURm EURm

2003

Profit and Loss Information

Net sales to external customers . . 20,826 2,496 502 5,620 11 29,455 29,455

Net sales to other segments ..... 125 8 27 — (11) 149 (149) —

Depreciation and amortization . . 378 55 10 520 175 1,138 1,138

Impairment and customer

finance charges ............ — — — 200 40 240 240

Operating profit ............. 5,927 (186) (141) (219) (370) 5,011 5,011

Share of results of associated

companies ................ — — — — (18) (18) (18)

Balance Sheet Information

Capital expenditures(1) ......... 298 33 3 44 54 432 432

Segment assets(2) ............. 4,169 604 135 4,108 1,101 10,117 (22) 10,095

of which:

Investments in associated

companies .............. — — — — 76 76 76

Unallocated assets(3) .......... 13,825

Total assets ................. 23,920

Segment liabilities(4) .......... 4,532 689 180 1,628 178 7,207 (22) 7,185

Unallocated liabilities(5) ........ 1,423

Total liabilities .............. 8,608

2002

Profit and Loss Information

Net sales to external customers . . 21,417 1,552 469 6,538 40 30,016 30,016

Net sales to other segments ..... 211 3 18 1 (40) 193 (193) —

Depreciation and amortization . . 501 46 28 542 194 1,311 1,311

Impairment and customer

finance charges ............ — — 61 400 77 538 538

Operating profit ............. 5,718 (365) (102) (49) (422) 4,780 4,780

Share of results of associated

companies ................ — — — — (19) (19) (19)

(1) Including goodwill and capitalized development costs, capital expenditures in 2004 amount to EUR 649

million (EUR 670 million in 2003). The goodwill and capitalized development costs consist of

EUR 11 million in 2004 (EUR 17 million in 2003) for Mobile Phones, EUR 3 million in 2004 (12 million in

2003) for Multimedia, EUR 1 million in 2004 (EUR 22 million in 2003) for Enterprise Solutions, EUR 83

million in 2004 (182 million in 2003) for Networks and EUR 3 million in 2004 (EUR 5 million in 2003) for

Common Group Functions.

(2) Comprises intangible assets, property, plant and equipment, investments, inventories and accounts

receivable as well as prepaid expenses and accrued income except those related to interest and taxes.

(3) Unallocated assets include cash and other liquid assets, available-for-sale investments, long-term loans

receivable and other financial assets as well as interest and tax related prepaid expenses and accrued

income. Tax related prepaid expenses and accrued income, and deferred tax assets amount to EUR 826

million in 2004 (EUR 834 million in 2003).

F-19