Nokia 2004 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

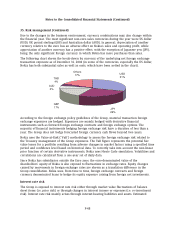

35. Risk management (Continued)

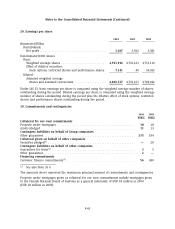

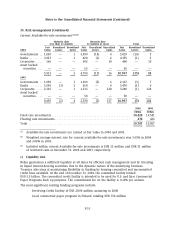

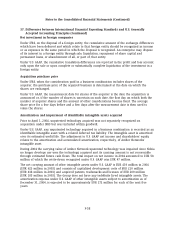

Fair values of derivatives

The net fair values of derivative financial instruments at the balance sheet date were:

2004 2003

EURm EURm

Derivatives with positive fair value(1):

Forward foreign exchange contracts(2) .................................... 278 358

Currency options bought .............................................. 14 59

Cash settled equity options ............................................. 513

Interest rate swaps ................................................... —1

Embedded derivatives(3) ............................................... —25

Derivatives with negative fair value(1):

Forward foreign exchange contracts(2) .................................... (89) (108)

Currency options written .............................................. (11) (35)

Credit default swaps .................................................. (2) —

Embedded derivatives(3) ............................................... —(8)

(1) Out of the forward foreign exchange contracts and currency options, fair value EUR 43 million

was designated for hedges of net investment in foreign subsidiaries as at December 31, 2004

(EUR 90 million at December 31, 2003) and reported within translation differences.

(2) Out of the foreign exchange forward contracts, fair value EUR 91 million was designated for

cash flow hedges as at December 31, 2004 (EUR 33 million at December 31, 2003) and

reported in fair value and other reserves.

(3) Embedded derivatives are components of contracts having the characteristics of derivatives,

and thus requiring fair valuing of such components. The change in the fair value is reported

in other financial income and expenses.

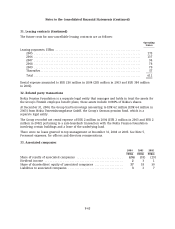

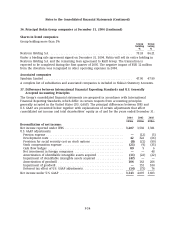

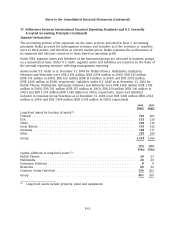

36. Principal Nokia Group companies at December 31, 2004

Parent Group

holding majority

%%

US Nokia Inc. ..................................................... — 100.00

DE Nokia GmbH ................................................... 100.00 100.00

GB Nokia UK Limited .............................................. — 100.00

KR Nokia TMC Limited ............................................. 100.00 100.00

CN Nokia Capitel Telecommunications Ltd .............................. — 52.90

NL Nokia Finance International B.V. ................................... 100.00 100.00

HU Nokia Kom ´

arom Kft ............................................. 100.00 100.00

BR Nokia do Brazil Technologia Ltda .................................. 99.99 100.00

IT Nokia Italia Spa ................................................ 100.00 100.00

IN Nokia India Ltd ................................................ 100.00 100.00

CN Dongguan Nokia Mobile Phones Company Ltd ........................ — 70.00

CN Beijing Nokia Hang Xing Telecommunications Systems Co. Ltd ........... — 69.00

F-53