Nokia 2004 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

external data regarding compensation and discount rate trends. While we believe that our

assumptions are appropriate, significant differences in our actual experience or significant changes

in our assumptions may materially affect our pension obligation and our future expense.

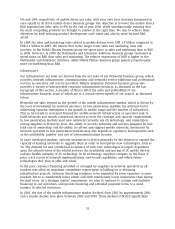

Results of Operations

2004 compared with 2003

Nokia Group

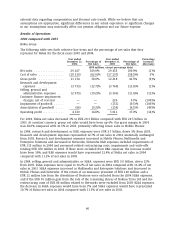

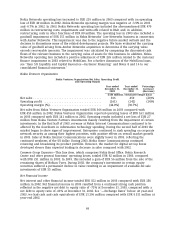

The following table sets forth selective line items and the percentage of net sales that they

represent for Nokia for the fiscal years 2003 and 2004.

Year ended Year ended Percentage

December 31, Percentage of December 31, Percentage of Increase/

2004 Net Sales 2003 Net Sales (decrease)

(EUR millions, except percentage data)

Net sales .................. 29 267 100.0% 29 455 100.0% (1)%

Cost of sales ................ (18 133) (62.0)% (17 237) (58.5)% 5%

Gross profit ................ 11 134 38.0% 12 218 41.5% (9)%

Research and development

expenses ................. (3 733) (12.7)% (3 760) (12.8)% (1)%

Selling, general and

administrative expenses .... (2 975) (10.2)% (3 363) (11.4)% (12)%

Customer finance impairment

charges, net of reversal ..... — — 226 0.7% (100)%

Impairment of goodwill ...... — — (151) (0.5)% (100)%

Amortization of goodwill ..... (96) (0.3)% (159) (0.5)% (40)%

Operating profit ............. 4 330 14.8% 5 011 17.0% (14)%

For 2004, Nokia net sales decreased 1% to EUR 29.3 billion compared with EUR 29.5 billion in

2003. At constant currency, group net sales would have been up 6%. Our gross margin in 2004

was 38.0% compared with 41.5% in 2003, primarily reflecting lower sales in Mobile Phones.

In 2004, research and development, or R&D, expenses were EUR 3.7 billion, down 1% from 2003.

Research and development expenses represented 12.7% of net sales in 2004, materially unchanged

from 2003. Research and development expenses increased in Mobile Phones, Multimedia and

Enterprise Solutions and decreased in Networks. Networks R&D expenses included impairments of

EUR 115 million in 2004 and personnel-related restructuring costs, impairments and write-offs

totaling EUR 470 million in 2003. If these were excluded from R&D expenses, the increase would

have been 10%, and R&D expenses would have represented 12.4% of Nokia net sales in 2004

compared with 11.2% of net sales in 2003.

In 2004, selling, general and administrative, or SG&A, expenses were EUR 3.0 billion, down 12%

from 2003. SG&A expenses were equal to 10.2% of net sales in 2004 compared with 11.4% of net

sales in 2003. SG&A expenses increased in Multimedia and Enterprise Solutions and decreased in

Mobile Phones and Networks. If the return of an insurance premium of EUR 160 million and a

EUR 12 million loss from the divestiture of Nextrom were excluded from the 2004 SG&A expenses,

and if the EUR 56 million gain from the sale of the remaining shares of Nokian Tyres Ltd and the

restructuring costs of EUR 80 million related to Networks were excluded from 2003 SG&A expenses,

the decrease in SG&A expenses would have been 7% and SG&A expenses would have represented

10.7% of Nokia net sales in 2004 compared with 11.3% of net sales in 2003.

60