Nokia 2004 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

company receiving repayment of the MobilCom loans receivables in the form of subordinated

convertible perpetual bonds of France Telecom.

As a strategic market requirement, we plan to continue to arrange and facilitate financing to our

customers, and provide financing and extended payment terms to a small number of selected

customers.

We expect our customer financing commitments to be financed mainly through cash flow from

operations as well as through the capital markets.

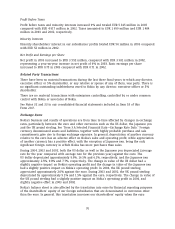

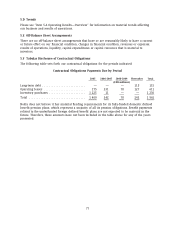

The following table sets forth the amounts of Nokia’s customer financing commitments and the

periods in which these commitments will expire if they are not utilized pursuant to the terms of

the related financing arrangements. Such amounts can also be available to customers in periods

prior to expiration. The amounts represent the maximum amount of commitments.

Customer Financing Commitments Expiration Per Period

2005 2006-2007 2008 Total

(EUR millions)

Customer financing commitments ....................... 56 — — 56

All customer financing commitments are available under loan facilities negotiated with customers

of Networks. Availability of the amounts is dependent upon the borrower’s continuing compliance

with stated financial and operational covenants and compliance with other administrative terms

of the facility. The loans are available to fund capital expenditure relating to purchases of network

infrastructure equipment and services from Networks. Certain loans may be partially secured

through either guarantees by the borrower’s direct or indirect parent or other group companies,

or shares and/or other assets of the borrower, its parent or other entities under common

ownership.

The following table sets forth the amounts of Nokia’s contingent commitments for the periods

indicated. The amounts represent the maximum principal amount of commitments.

Contingent Commitments Expiration Per Period

2005 2006-2007 2008-2009 Thereafter Total

(EUR millions)

Guarantees of Nokia’s performance .......... 123 49 3 — 175

Financial guarantees and securities pledged on

behalf of customers ..................... 3 — — — 3

Total .................................. 126 49 3 — 178

Guarantees of Nokia’s performance include EUR 175 million of guarantees that are provided to

certain Networks customers in the form of bank guarantees, standby letters of credit and other

similar instruments. These instruments entitle the customer to claim payment as compensation for

non-performance by Nokia of its obligations under network infrastructure supply agreements.

Depending on the nature of the instrument, compensation is payable either immediately upon

request, or subject to independent verification of non-performance by Nokia.

Financial guarantees and securities pledged on behalf of customers represent guarantees relating

to payment by certain Networks customers under specified loan facilities between such customers

and their creditors. Nokia’s obligations under such guarantees are released upon the earlier of

expiration of the guarantee or early payment by the customer.

75