Nokia 2004 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

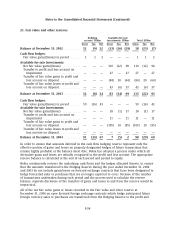

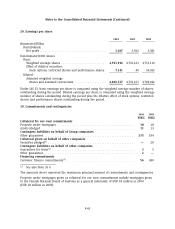

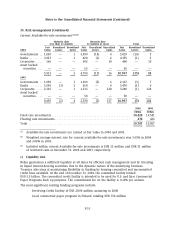

25. Deferred taxes

2004 2003

EURm EURm

Deferred tax assets:

Intercompany profit in inventory ....................................... 41 40

Tax losses carried forward ............................................. 12 36

Warranty provision .................................................. 118 157

Other provisions ..................................................... 174 179

Other temporary differences ........................................... 190 233

Untaxed reserves .................................................... 88 98

Total deferred tax assets ................................................ 623 743

Deferred tax liabilities:

Untaxed reserves .................................................... (30) (33)

Fair value gains/losses ................................................ (28) (22)

Undistributed earnings ................................................ (60) —

Other .............................................................. (61) (186)

Total deferred tax liabilities .............................................. (179) (241)

Net deferred tax asset .................................................. 444 502

The tax charged to shareholders’ equity is as follows:

Fair value and other reserves, fair value gains/losses ......................... (7) (22)

In 2005, the corporate tax rate in Finland will be reduced from 29% to 26%. The impact of the

change on the deferred tax assets in 2004 was a reduction of EUR 28 million and on the deferred

tax liabilities an increase of EUR 2 million. Accordingly, the impact of the change in the tax rate on

the profit and loss account through change in deferred taxes in 2004 was EUR 26 million tax

expense.

During 2004, the Group analyzed the majority of its future foreign investment plans with respect

to foreign investments. As a result of this analysis, the Group concluded that it could no longer

represent that all foreign earnings may be permanently reinvested. Accordingly, the Group

recorded the recognition of a EUR 60 million deferred tax liability during the year.

At December 31, 2004 the Group had loss carry forwards of EUR 67 million (EUR 75 million in

2003) for which no deferred tax asset was recognized due to uncertainty of utilization of these

loss carry forwards. These loss carry forwards will expire in years 2005 through 2010.

26. Short-term borrowings

Short-term borrowings consist primarily of borrowings from banks denominated in different

foreign currencies. The weighted average interest rate at December 31, 2004 and 2003 was 3.07%

and 6.73%, respectively.

F-41