Nokia 2004 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

37. Differences between International Financial Reporting Standards and U.S. Generally

Accepted Accounting Principles (Continued)

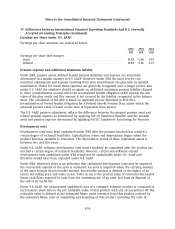

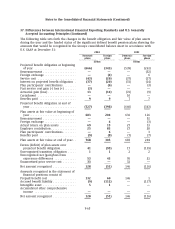

For plans where the benefit obligation is in excess of the plan assets, the aggregate benefit

obligation is EUR 224 million (EUR 353 million in 2003) and the aggregate fair values of plan

assets is EUR 100 million (EUR 207 million in 2003). For plans where the accumulated benefit

obligation is in excess of the plan assets, the aggregate pension accumulated benefit obligation is

EUR 208 million (EUR 192 million in 2003) and the aggregate fair value of plan assets is EUR 95

million (EUR 93 million in 2003).

The Accumulated Benefit Obligation at December 31, 2004 for the domestic plans was EUR 642

million (2003 EUR 554 million) and for the foreign plans EUR 371 million (2003 EUR 281 million).

Weighted average assumption used in calculation of pension obligations are as follows:

2004 2003

Domestic Foreign Domestic Foreign

%%%%

Discount rate for determining present values ............. 4.75 5.00 5.25 5.30

Expected long-term rate of return on plan assets .......... 5.00 5.31 6.00 6.87

Annual rate of increase in future compensation levels ...... 3.50 3.82 3.50 3.49

Pension increases ................................... 2.00 2.38 2.30 2.27

The Group also contributes to multiemployer plans, insured plans and defined contribution plans.

Such contributions were approximately EUR 192 million, EUR 146 million and EUR 167 million in

2004, 2003 and 2002, respectively, including premiums associated with pooled benefits.

At December 31, 2004, approximately 0.5% (3% in 2003) or EUR 4 million (EUR 19 million in 2003)

of domestic plan assets consisted of Nokia equity securities. The foreign pension plan assets

include a self investment through a loan provided to Nokia by the plan of EUR 62 million (EUR 64

million in 2003).

The Group expects to make contributions of EUR 25 million and EUR 25 million to its domestic and

foreign pension plans in 2005, respectively.

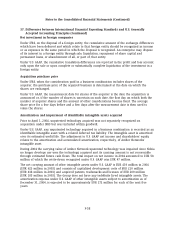

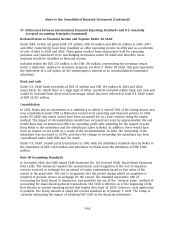

The Groups’s pension plan weighted average asset allocation as a percentage of Plan Assets at

December 31, 2004, and 2003, by asset category is as follows:

2004 2003

Domestic Foreign Domestic Foreign

%%%%

Asset Category:

Equity securities .................................... 36 23 39 56

Debt securities ...................................... 61 52 33 31

Insurance contracts .................................. —11—13

Real estate ......................................... 2— 2—

Short-term investments .............................. 11426 —

Total ............................................. 100 100 100 100

F-66