Nokia 2004 Annual Report Download - page 103

Download and view the complete annual report

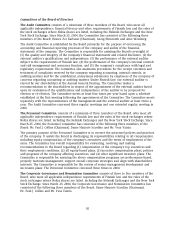

Please find page 103 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Annual General Meeting 2005 for the approval of a new two-year stock option plan

amounting to a maximum of 25 million stock options, permitting these plans.

• The maximum number of restricted shares that we intend to grant during 2005 is

3.5 million. Our intent is to grant a similar amount in 2006. We have also reserved a pool of

restricted shares to be used for special needs in 2005 and 2006. This amount may result in

a maximum payout of 9 million Nokia shares.

Other Employee Stock Option Plans

Unlike our other stock option plans, the plans described below do not result in an increase of our

share capital, as awards under these plans are settled out of treasury shares.

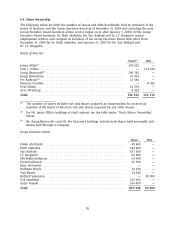

We have a stock option plan available to our employees in the United States and Canada: The

Nokia Holding Inc. 1999 Stock Option Plan. For more information on this plan, see Note 22 to our

consolidated financial statements included in Item 18 of this Form 20-F.

We have an Employee Share Purchase Plan in the United States, which permits all full-time Nokia

employees located in the United States to acquire Nokia ADSs at a 15% discount. The ADSs to be

purchased are funded through monthly payroll deductions from the salary of the participants, and

the ADSs are purchased on a monthly basis. As of December 31, 2004, a total of 1.4 million ADSs

had been purchased under the plan since its inception, and there were a total of approximately

1 000 participants.

In connection with the acquisition of Ipsilon, we assumed Ipsilon’s 1995 stock option plan. The

former employees, officers and directors of Ipsilon are eligible to participate in this plan. We

intend to issue no more options pursuant to this plan. As of December 31, 2004, options to

purchase 0.5 million ADSs were outstanding at an average exercise price of USD 27.24 per ADS.

In connection with the acquisition of certain US corporations, we have replaced stock options held

by the employees, officers or consultants of the acquired corporations immediately prior to the

respective acquisition with stock options that entitle those persons to purchase Nokia ADSs. The

maximum aggregate number of ADSs that may be issued under these arrangements is 7 million.

As of December 31, 2004 options to purchase 1.9 million ADSs were outstanding from all other

acquisitions (excluding Ipsilon) at an average exercise price of USD 19.80 per ADS.

As of December 31, 2004, 2.6 million stock options to purchase ADSs were outstanding from all

plans described in this ‘‘—Other Employee Stock Option Plans’’ section, at an average exercise price

of USD 22.95 per ADS.

102