Nokia 2004 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

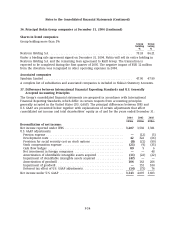

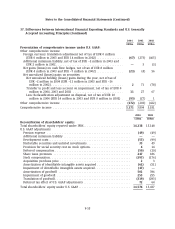

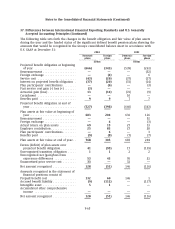

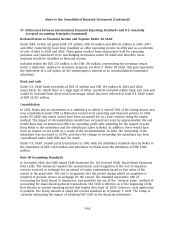

Notes to the Consolidated Financial Statements (Continued)

37. Differences between International Financial Reporting Standards and U.S. Generally

Accepted Accounting Principles (Continued)

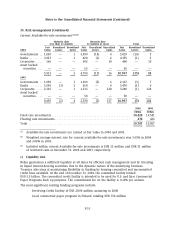

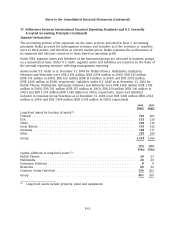

Below is a roll forward of U.S. GAAP goodwill during 2004 and 2003. The comparative figures are

regrouped according to the new organizational structure:

Common

Mobile Enterprise Group

Phones Multimedia Solutions Networks Functions Group

EURm EURm EURm EURm EURm EURm

Balance as of January 1, 2003 .............. 125 21 26 323 9 504

Goodwill acquired ....................... — 20 — — 20

Translation adjustment ................... 4 1 (6) (52) — (53)

Balance as of December 31, 2003 ........... 129 22 40 271 9 471

Goodwill acquired ....................... — — — — — —

Translation adjustment ................... (1) — (3) (22) — (26)

Balance as of December 31, 2004 ........... 128 22 37 249 9 445

Goodwill is not deductible for tax purposes.

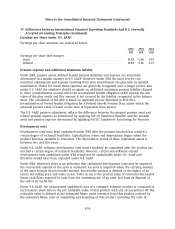

Translation of goodwill

Under IFRS, the Group translates goodwill arising on the acquisition of foreign subsidiaries at

historical rates.

Under U.S. GAAP, goodwill is translated at the closing rate on the balance sheet date with gains

and losses recorded as a component of shareholders’ equity.

Disclosures required by U.S. GAAP

Dependence on limited sources of supply

Nokia’s manufacturing operations depend to a certain extent on obtaining adequate supplies of

fully functional components on a timely basis. Our principal supply requirements are for electronic

components, mechanical components and software, which all have a wide range of applications in

our products. Electronic components include integrated circuits, microprocessors, standard

components, memory devices, cameras, displays, batteries and chargers while mechanical

components include covers, connectors, key mats and antennas. In addition, a particular

component may be available only from a limited number of suppliers. Suppliers may from time to

time extend lead times, limit supplies or increase prices due to capacity constraints or other

factors, which could adversely affect our ability to deliver our products and solutions on a timely

basis. Moreover, even if we attempt to select our suppliers and manage our supplier relationships

with scrutiny, a component supplier may fail to meet our supplier requirements, such as, most

notably, our and our customers’ product quality, safety and other standards, and consequently

some of our products are unacceptable to us and our customers, or we may fail in our own

quality controls. Moreover, a component supplier may experience delays or disruption to its

manufacturing, or financial difficulties. Any of these events could delay our successful delivery of

products and solutions, which meet our and our customers’ quality, safety and other

requirements, or otherwise adversely affect our sales and our results of operations.

F-60