Nokia 2004 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

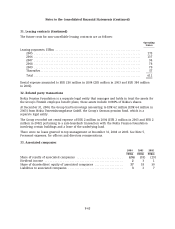

35. Risk management (Continued)

future changes in cash flows and balance sheet structure also expose the Group to interest rate

risk.

Treasury is responsible for monitoring and managing the interest rate exposure of the Group. Due

to the current balance sheet structure of Nokia, emphasis is placed on managing the interest rate

risk of investments.

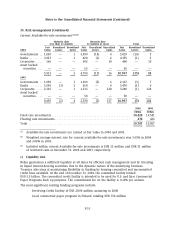

Nokia uses the VaR methodology to assess and measure the interest rate risk in the investment

portfolio, which is benchmarked against a one-year investment horizon. The VaR figure represents

the potential fair value losses for a portfolio resulting from adverse changes in market factors

using a specified time period and confidence level based on historical data. For interest rate risk

VaR, Nokia uses variance-covariance methodology. Volatilities and correlations are calculated from

a one-year set of daily data.

Equity price risk

Nokia has certain strategic minority investments in publicly traded companies. These investments

are classified as available-for-sale. The fair value of the equity investments at December 31, 2004

was EUR 7 million (EUR 8 million in 2003).

There are currently no outstanding derivative financial instruments designated as hedges of these

equity investments.

In addition to the listed equity holdings, Nokia invests in private equity through Nokia Venture

Funds. The fair value of these available-for-sale equity investments at December 31, 2004 was

USD 142 million (USD 85 million in 2003). Nokia is exposed to equity price risk on social security

costs relating to stock compensation plans. Nokia hedges this risk by entering into cash settled

equity swap and option contracts.

b) Credit risk

Customer Finance Credit Risk

Network operators in some markets sometimes require their suppliers to arrange or provide term

financing in relation to infrastructure projects. Nokia has maintained a financing policy aimed at

close cooperation with banks, financial institutions and Export Credit Agencies to support selected

customers in their financing of infrastructure investments. Nokia actively mitigates, market

conditions permitting, this exposure by arrangements with these institutions and investors.

Credit risks related to customer financing are systematically analyzed, monitored and managed by

Nokia’s Customer Finance organization, reporting to the Chief Financial Officer. Credit risks are

approved and monitored by Nokia’s Credit Committee along principles defined in the Company’s

credit policy and according to the credit approval process. The Credit Committee consists of the

CFO, Group Controller, Head of Group Treasury and Head of Nokia Customer Finance.

There were no outstanding loans to customers (EUR 354 million in 2003, net of allowances and

write-offs), while financial guarantees given on behalf of third parties totaled EUR 3 million

(EUR 33 million in 2003). In addition, we had financing commitments totaling EUR 56 million

(EUR 490 million in 2003). Total customer financing (outstanding and committed) stood at EUR 59

million (EUR 877 million in 2003).

F-49