Nokia 2004 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

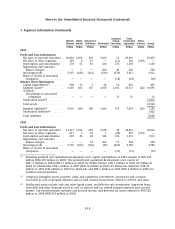

3. Segment information (Continued)

Enterprise Solutions offers businesses solutions ranging from business-optimized mobile devices

for end users to a broad portfolio of IP network perimeter security gateways and mobile

connectivity offerings.

Networks is a leading provider of network infrastructure, communications and networks service

platforms and professional services to operators and service providers.

In addition to the four business groups, the Group’s organization has two horizontal units to

support the mobile device business groups, increase operational efficiency and competitiveness,

and to take advantage of economies of scale: Customer and Market Operations and Technology

Platforms. The horizontal groups are not separate reporting entities, but their costs are carried

mainly by the mobile device business groups, which comprises of Mobile Phones, Multimedia and

Enterprise Solutions, with the balance included in Common Group Expenses. The costs and

revenues as well as assets and liabilities of the horizontal groups are allocated to the mobile

device business groups on a symmetrical basis; with any amounts not so allocated included in

Common Group Functions. Common Group Functions consists of common research and general

Group functions.

The accounting policies of the segments are the same as those described in Note 1. Nokia accounts

for intersegment revenues and transfers as if the revenues or transfers were to third parties, that

is, at current market prices. Nokia evaluates the performance of its segments and allocates

resources to them based on operating profit.

No single customer represents 10% or more of Group revenues.

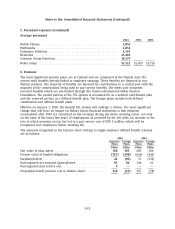

Common Total

Mobile Multi- Enterprise Group reportable Elimi-

Phones media Solutions Networks Functions segments nations Group

EURm EURm EURm EURm EURm EURm EURm EURm

2004

Profit and Loss Information

Net sales to external customers . . 18,429 3,636 806 6,367 29 29,267 29,267

Net sales to other segments ..... 78 23 24 — (29) 96 (96) —

Depreciation and amortization . . 306 77 23 314 148 868 868

Impairment and customer

finance charges ............ — — — 115 11 126 126

Operating profit ............. 3,768 179 (199) 878 (296) 4,330 4,330

Share of results of associated

companies ................ — — — — (26) (26) (26)

Balance Sheet Information

Capital expenditures(1) ......... 279 67 18 91 93 548 548

Segment assets(2) ............. 3,758 787 210 3,055 1,142 8,952 (12) 8,940

of which:

Investments in associated

companies .............. — — — — 200 200 200

Unallocated assets(3) .......... 13,729

Total assets ................. 22,669

Segment liabilities(4) .......... 4,114 934 271 1,574 170 7,063 (12) 7,051

Unallocated liabilities(5) ........ 1,212

Total liabilities .............. 8,263

F-18