Nokia 2004 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

37. Differences between International Financial Reporting Standards and U.S. Generally

Accepted Accounting Principles (Continued)

Compensation expense

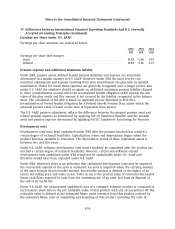

As allowed by FAS 123, Accounting for Stock-Based Compensation (FAS 123), under U.S. GAAP the

Group has elected to continue to apply APB 25 and related interpretations in accounting for its

stock-based compensation plans. No stock-based employee compensation cost is reflected in net

income for options granted with an exercise price equal to the market value of the underlying

stock at the date of grant. Generally, options vest on the date they become exercisable. Restricted

shares vest upon the fulfilment on the employees’ service period. In addition to meeting the

criteria for the period of employment, performance shares do not vest until certain performance

criteria are also met.

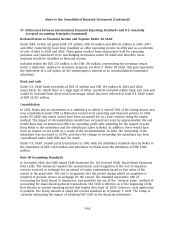

Had compensation cost for stock-based management incentive plans been determined based on

the fair value at the grant dates for options under that plan consistent with the method prescribed

in FAS 123, the Group’s net income and earnings per share would have been reduced to the pro

forma amounts indicated below:

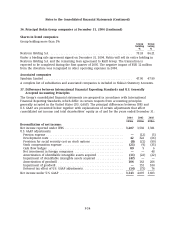

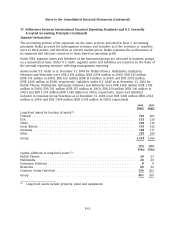

2004 2003 2002

Net income under U.S. GAAP (EURm) .................... As reported 3,343 4,097 3,603

Add: Stock-based employee compensation expense included

in reported net income under U.S. GAAP, net of tax ....... 1320

Deduct: Total stock-based employee compensation expense

determined under fair value method for all awards, net of

tax ............................................. (116) (325) (467)

Net income under U.S. GAAP (EURm) .................... Pro forma 3,228 3,775 3,156

Basic earnings per share (EUR) ......................... As reported 0.73 0.86 0.76

Pro forma 0.70 0.79 0.67

Diluted earnings per share (EUR) ....................... As reported 0.73 0.86 0.75

Pro forma 0.70 0.79 0.66

Under FAS 123, pro forma disclosures are only required in relation to awards granted after

January 1, 1995. Nokia calculates the fair value of options using the Black Scholes model. The fair

value of the options is estimated on the date of grant with the following assumptions:

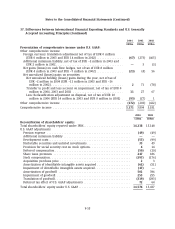

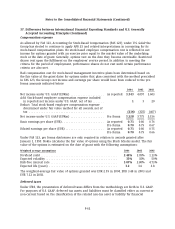

Weighted average assumptions 2004 2003 2002

Dividend yield .............................................. 2.44% 2.05% 1.13%

Expected volatility ........................................... 33% 35% 50%

Risk-free interest rate ........................................ 3.07% 2.80% 4.73%

Expected life (years) ......................................... 3.2 3.6 3.8

The weighted-average fair value of options granted was EUR 2.59 in 2004, EUR 3.48 in 2003 and

EUR 7.12 in 2002.

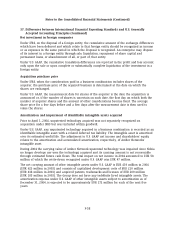

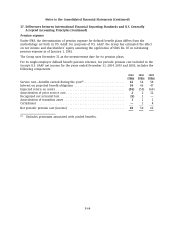

Deferred taxes

Under IFRS, the presentation of deferred taxes differs from the methodology set forth in U.S. GAAP.

For purposes of U.S. GAAP, deferred tax assets and liabilities must be classified either as current or

non-current based on the classification of the related non-tax asset or liability for financial

F-62