Nokia 2004 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

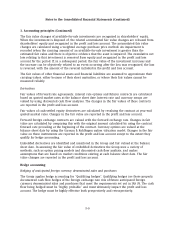

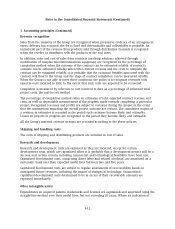

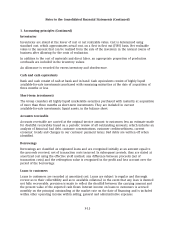

1. Accounting principles (Continued)

impairment exists, the carrying amount of any intangible asset is assessed and written down to

its recoverable amount. Costs of software licenses associated with internal-use software are

capitalized. These costs are included within other intangible assets and are amortized over a

period not to exceed three years.

Pensions

The Group companies have various pension schemes in accordance with the local conditions and

practices in the countries in which they operate. The schemes are generally funded through

payments to insurance companies or to trustee-administered funds as determined by periodic

actuarial calculations.

The Group’s contributions to defined contribution plans and to multi-employer and insured plans

are charged to the profit and loss account in the period to which the contributions relate.

For defined benefit plans, principally the reserved portion of the Finnish TEL system, pension costs

are assessed using the projected unit credit method: the cost of providing pensions is charged to

the profit and loss account so as to spread the service cost over the service lives of employees. The

pension obligation is measured as the present value of the estimated future cash outflows using

interest rates on government securities that have terms to maturity approximating the terms of

the related liabilities. Actuarial gains and losses outside the corridor are recognized over the

average remaining service lives of employees.

Property, plant and equipment

Property, plant and equipment are stated at cost less accumulated depreciation. Depreciation is

recorded on a straight-line basis over the expected useful lives of the assets as follows:

Buildings and constructions ................................ 20–33 years

Production machinery, measuring and test equipment ........... 3 years

Other machinery and equipment ............................ 3–10 years

Land and water areas are not depreciated.

Maintenance, repairs and renewals are generally charged to expense during the financial period in

which they are incurred. However, major renovations are capitalized and included in the carrying

amount of the asset when it is probable that future economic benefits in excess of the originally

assessed standard of performance of the existing asset will flow to the Group. Major renovations

are depreciated over the remaining useful life of the related asset.

Gains and losses on the disposal of fixed assets are included in operating profit/loss.

Leases

The Group has entered into various operating leases, the payments under which are treated as

rentals and charged to the profit and loss account on a straight-line basis over the lease terms.

F-12