Nokia 2004 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Notes to the Consolidated Financial Statements (Continued)

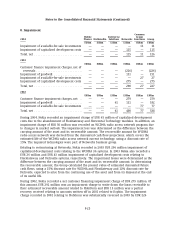

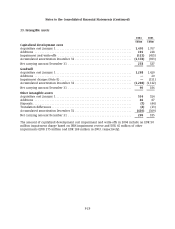

8. Impairment (Continued)

million as a result of the company receiving repayment of the MobilCom loans receivables in the

form of subordinated convertible perpetual bonds of France Telecom. See Notes 11, 16 and 21.

In 2003 and 2002, Nokia evaluated the carrying value of goodwill arising from certain acquisitions

by determining if the carrying values of the net assets of the cash generating unit to which the

goodwill belongs exceeds the recoverable amounts of that unit. In 2003 and 2002, in the Nokia

Networks business, Nokia recorded an impairment charge of EUR 151 million and EUR 104 million,

respectively, on goodwill related to the acquisition of Amber Networks. The recoverable amount

for Amber Networks was derived from the value in use discounted cash flow projections, which

covers the estimated life of the Amber platform technology, using a discount rate of 15%. At

December 31, 2004, there is EUR 0 million of Amber goodwill (EUR 0 million in 2003). The

impairment is a result of significant declines in the market outlook for products under

development.

In 2002, Nokia recognized impairment loss of EUR 36 million on goodwill related to the acquisition

of Ramp Networks. In 2002, Nokia recognized an impairment loss of EUR 25 million, respectively,

on goodwill related to the acquisition of Network Alchemy. Both of these entities are part of

Enterprise Solutions business segment. The remaining goodwill balances were written off as a

result of decisions to discontinue the related product development.

Nokia recognized various minor goodwill impairment charges totaling EUR 0 million in 2004 and

2003 and EUR 17 million in 2002.

During 2004 the Group’s investment in certain equity securities suffered a permanent decline in

fair value resulting in an impairment charge of EUR 11 million relating to non-current

available-for-sale investments (EUR 27 million in 2003 and EUR 77 million in 2002).

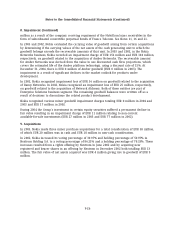

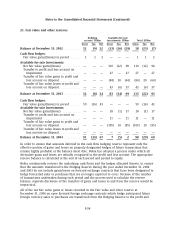

9. Acquisitions

In 2003, Nokia made three minor purchase acquisitions for a total consideration of EUR 38 million,

of which EUR 20 million was in cash and EUR 18 million in non-cash consideration.

In 2002, Nokia increased its voting percentage of 39.97% and holding percentage of 59.97% in

Nextrom Holding S.A. to a voting percentage of 86.21% and a holding percentage of 79.33%. These

increases resulted from a rights offering by Nextrom in June 2002 and by acquiring new

registered and bearer shares in an offering by Nextrom in December 2002 both totalling EUR 13

million. The fair value of net assets acquired was EUR 4 million giving rise to goodwill of EUR 9

million.

F-26