Nokia 2004 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

On December 31, 2004, the aggregate interest of the members of the Board of Directors and the

Group Executive Board (not including the new Group Executive Board members whose service

began on or after January 1, 2005) in our outstanding share capital was 1 524 824 shares and

ADSs, representing less than 1% of the issued share capital and voting rights in Nokia Corporation.

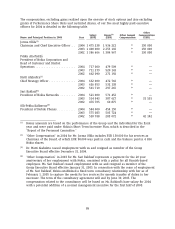

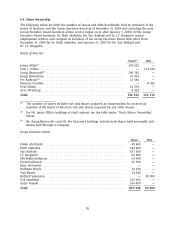

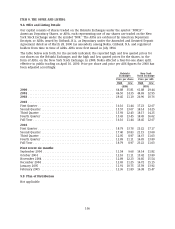

Stock Option Ownership

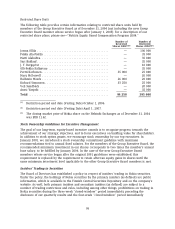

The following tables provide certain information relating to stock options held by members of the

Group Executive Board as of December 31, 2004 (not including the new Group Executive Board

members whose service began on or after January 1, 2005). These stock options were issued

pursuant to our Nokia Stock Option Plans 1999, 2001 and 2003. For a description of our stock

option plans, please see Note 22 to our consolidated financial statements and ‘‘—Nokia’s Equity

Based Compensation Program 2004‘‘ and ‘‘—Other Employee Stock Option Plans.’’

Number of shares represented by exercisable options as of December 31, 2004(1)

1999 A,B 2001 2001 2001 2002 2003

and C(2) A and B C 3Q/01 C 4Q/01 A and B 2Q

Exercise price per share (EUR) .EUR 36.75 EUR 20.61 EUR 26.67 EUR 17.89 EUR 14.95

Jorma Ollila ................ 1 600 000 812 500 — 343 750 562 500 250 000

Pekka Ala-Pietil¨

a............. 720 000 203 125 — 85 934 140 625 53 125

Matti Alahuhta .............. 900 000 81 250 — 34 375 98 435 37 500

Sari Baldauf ................ 560 000 81 250 — 34 375 98 435 37 500

J.T. Bergqvist ............... 140 000 32 500 — 13 750 39 375 15 625

Olli-Pekka Kallasvuo .......... 560 000 81 250 — 34 375 98 435 37 500

Pertti Korhonen ............. 140 000 24 375 — 10 309 39 375 15 625

Mary McDowell .............. ——————

Hallstein Moerk ............. 144 000 24 375 — 10 309 16 875 6 250

Yrj¨

o Neuvo ................. 400 000 56 875 — 24 059 39 375 12 500

Richard Simonson ........... — — 27 000 — 8 435 3 593

Veli Sundb¨

ack .............. 400 000 32 500 — 13 750 22 500 15 625

Anssi Vanjoki ............... — 56 875 — 24 059 56 250 31 250

(1) For information regarding the vesting and expiry of the stock option plans presented in this table, see

Note 22 to our consolidated financial statements.

(2) All of the 1999 stock options expired as of December 31, 2004. The column depicts the total number of

allocated stock options 1999 A, B and C, the exercise prices of which were EUR 16.89 (A), EUR 56.28 (B)

and EUR 29.12 (C) per share, respectively.

96