Nokia 2004 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to the Consolidated Financial Statements (Continued)

35. Risk management (Continued)

Euro Commercial Paper (ECP) program, totaling USD 500 million

US Commercial Paper (USCP) program, totaling USD 500 million

None of the above programs have been used to a significant degree in 2004.

Nokia’s international creditworthiness facilitates the efficient use of international capital and loan

markets. The ratings of Nokia from credit rating agencies have not changed during the year. The

ratings as at December 31, 2004 were:

Short-term Standard & Poor’s A-1

Moody’s P-1

Long-term Standard & Poor’s A

Moody’s A1

Hazard risk

Nokia strives to ensure that all financial, reputation and other losses to the Group and our

customers are minimized through preventive risk management measures or purchase of

insurance. Insurance is purchased for risks, which cannot be internally managed. Nokia’s

Insurance & Risk Finance function’s objective is to ensure that Group’s hazard risks, whether

related to physical assets (e.g. buildings) or intellectual assets (e.g. Nokia brand) or potential

liabilities (e.g. product liability) are optimally insured.

Nokia purchases both annual insurance policies for specific risks as well as multi-line and/or

multi-year insurance policies, where available.

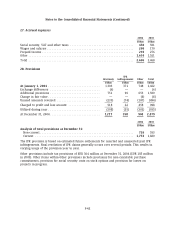

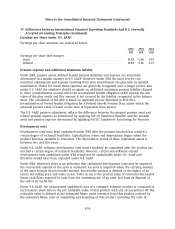

Notional amounts of derivative financial instruments(1)

2004 2003

EURm EURm

Foreign exchange forward contracts(2) ................................... 10,745 10,271

Currency options bought(2) ............................................ 715 2,924

Currency options sold(2) .............................................. 499 2,478

Interest rate swaps .................................................. —1,500

Cash settled equity options(3) .......................................... 237 228

Credit default swaps(4) ............................................... 200 —

(1) Includes the gross amount of all notional values for contracts that have not yet been settled

or cancelled. The amount of notional value outstanding is not necessarily a measure or

indication of market risk, as the exposure of certain contracts may be offset by that of other

contracts.

(2) As at December 31, 2004, notional amounts include contracts amounting to EUR 1.6 billion

used to hedge the shareholders’ equity of foreign subsidiaries (December 31, 2003,

EUR 3.3 billion).

(3) Cash settled equity options can be used to hedge risk relating to incentive programs and

investment activities.

(4) Credit default swaps are used to selectively hedge counterparty risks involved in investment

activities.

F-52