Nokia 2004 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

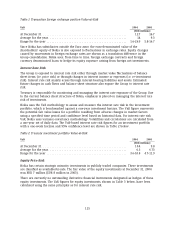

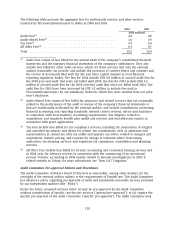

The following table presents the aggregate fees for professional services and other services

rendered by PricewaterhouseCoopers to Nokia in 2004 and 2003.

2004 2003

(EUR millions)

Audit Fees(1) ............................................... 4.2 4.8

Audit-related Fees(2) ......................................... 1.0 0.9

Tax Fees(3) ................................................ 5.0 6.0

All Other Fees(4) ............................................ 0.3 0.7

Total ..................................................... 10.5 12.4

(1) Audit Fees consist of fees billed for the annual audit of the company’s consolidated financial

statements and the statutory financial statements of the company’s subsidiaries. They also

include fees billed for other audit services, which are those services that only the external

auditor reasonably can provide, and include the provision of comfort letters and consents and

the review of documents filed with the SEC and other capital markets or local financial

reporting regulatory bodies. The fees for 2004 include EUR 0.8 million of accrued audit fees for

the 2004 year-end audit that were not billed until 2005; the fees for 2003 include EUR 0.2

million of accrued audit fees for the 2003 year-end audit that were not billed until 2004. The

audit fees for 2003 have been increased by EUR 0.2 million to include fees paid to

PricewaterhouseCoopers by our subsidiary, Nextrom, which fees were omitted from our prior

year’s disclosure.

(2) Audit-related Fees consist of fees billed for assurance and related services that are reasonably

related to the performance of the audit or review of the company’s financial statements or

that are traditionally performed by the external auditor, and include consultations concerning

financial accounting and reporting standards; internal control reviews; advice and assistance

in connection with local statutory accounting requirements; due diligence related to

acquisitions; and employee benefit plan audits and reviews; and miscellaneous reports in

connection with grant applications.

(3) Tax Fees include fees billed for tax compliance services, including the preparation of original

and amended tax returns and claims for refund; tax consultations, such as assistance and

representation in connection with tax audits and appeals, tax advice related to mergers and

acquisitions, transfer pricing, and requests for rulings or technical advice from taxing

authorities; tax planning services; and expatriate tax compliance, consultation and planning

services.

(4) All Other Fees include fees billed for forensic accounting and occasional training services and,

in 2004 only, for advisory services in connection with the outsourcing of an operational

process. Forensic accounting in 2004 mainly related to internal investigations; in 2003 it

related entirely to Telsim; for more information, see ‘‘Item 8.A.7 Litigation.’’

Audit Committee Pre-approval Policies and Procedures

The Audit Committee of Nokia’s Board of Directors is responsible, among other matters, for the

oversight of the external auditor subject to the requirements of Finnish law. The Audit Committee

has adopted a policy regarding pre-approval of audit and permissible non-audit services provided

by our independent auditors (the ‘‘Policy’’).

Under the Policy, proposed services either (i) may be pre-approved by the Audit Committee

without consideration of specific case-by-case services (‘‘general pre-approval’’); or (ii) require the

specific pre-approval of the Audit Committee (‘‘specific pre-approval’’). The Audit Committee may

118