Nokia 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Nokia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nokia Form 20-F 2004

Table of contents

-

Page 1

Nokia Form 20-F 2004 -

Page 2

... Box 226, FIN-00045 NOKIA GROUP, Espoo, Finland (Address of principal executive offices) Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered American Depositary Shares Shares, par value EUR 0.06 (1) New York Stock Exchange New... -

Page 3

... and Listing Details ...Plan of Distribution ...Markets ...Selling Shareholders ...Dilution ...Expenses of the Issue ...ADDITIONAL INFORMATION ...Share Capital ...Memorandum and Articles of Association ...Material Contracts ...Exchange Controls ...Taxation ...Dividends and Paying Agents ...Statement... -

Page 4

... TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS ...CONTROLS AND PROCEDURES ...AUDIT COMMITTEE FINANCIAL EXPERT ...CODE OF ETHICS ...PRINCIPAL ACCOUNTANT FEES AND SERVICES ...EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT COMMITTEES ...PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND... -

Page 5

...dollars at the rates indicated or at any other rates. In this Form 20-F, unless otherwise stated, references to ''shares'' are to Nokia Corporation shares, par value EUR 0.06. Our principal executive office is currently located at Keilalahdentie 4, P.O. Box 226, FIN-00045 Nokia Group, Espoo, Finland... -

Page 6

... products and solutions; • inventory management risks resulting from shifts in market demand; • our ability to source quality components without interruption and at acceptable prices; • our success in collaboration arrangements relating to technologies, software or new products and solutions... -

Page 7

...employees; • developments under large, multi-year contracts or in relation to major customers; • exchange rate fluctuations, including, in particular, fluctuations between the euro, which is our reporting currency, and the US dollar, the UK pound sterling and the Japanese yen; • the management... -

Page 8

.... ITEM 3. KEY INFORMATION 3.A Selected Financial Data The financial data set forth below at December 31, 2003 and 2004 and for each of the years in the three-year period ended December 31, 2004 have been derived from our audited consolidated financial statements included in Item 18 of this Form 20... -

Page 9

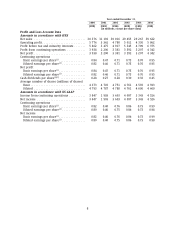

2000 (EUR) Year ended December 31, 2001 2002 2003 2004 (EUR) (EUR) (EUR) (EUR) (in millions, except per share data) 2004 (USD) Profit and Loss Account Data Amounts in accordance with IFRS Net sales ...Operating profit ...Profit before tax and minority interests ...Profit from continuing ... -

Page 10

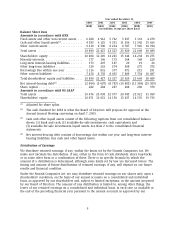

... per share data) 2004 (USD) Balance Sheet Data Amounts in accordance with IFRS Fixed assets and other non-current assets ...Cash and other liquid assets(3) ...Other current assets ...Shareholders' equity ...Minority interests ...Long-term interest-bearing liabilities Other long-term liabilities... -

Page 11

...the Annual General Meeting convening on April 7, 2005 a dividend of EUR 0.33 per share in respect of 2004. The table below sets forth the amounts of total cash dividends per share and per ADS paid in respect of each fiscal year indicated. For the purposes of showing the US dollar amounts per ADS 10 -

Page 12

... as certain other currencies.'' Exchange Rate Data The following table sets forth information concerning the noon buying rate in New York City for cable transfers as certified for customs purposes by the Federal Reserve Bank of New York for euro for the years 2000 through 2004 and for each of the... -

Page 13

... Risk Factors Set forth below is a description of factors that may affect our business, results of operations and share price from time to time. Our sales and profitability depend on the continued growth of the mobile communications industry as well as the growth of the new market segments within... -

Page 14

...layers for products and solutions. As a result of these changes, new market segments within our industry have begun to emerge and we have made significant investments in new business opportunities in certain of these market segments, such as smartphones, imaging, games, music and enterprise mobility... -

Page 15

... operator customer satisfaction and we are working together with operators on product planning as well as accelerating product hardware and software customization programs. These developments may result in new challenges as we provide customized products, such as the need for us to produce mobile... -

Page 16

..., technical performance, product features, quality, customer support and brand recognition. We are facing increased competition from both our traditional competitors in the mobile communications industry as well as a number of new competitors, particularly from countries where production costs tend... -

Page 17

.... Our sales and operating results are also impacted by fluctuations in exchange rates and at the quarterly level by seasonality. In developing markets, the availability and cost, through affordable tariffs, of mobile phone service compared with the availability and cost of fixed line networks may... -

Page 18

..., products or solutions supplied by the companies that work with us do not meet the required quality, safety and other standards or customer needs, our own quality controls fail, or the financial standing of the companies that work with us deteriorates. Our operations rely on complex and highly... -

Page 19

... by suppliers of components and various layers in our products and solutions or by companies with which we work in cooperative research and development activities. Similarly, we and our customers may face claims of infringement in connection with our customers' use of our products and solutions... -

Page 20

... to implement our strategies and harm our results of operations. The global networks business relies on a limited number of customers and large multi-year contracts. Unfavorable developments under such a contract or in relation to a major customer may affect our sales, our results of operations and... -

Page 21

...ability to manage our total customer finance and trade credit exposure depends on a number of factors, including our capital structure, market conditions affecting our customers, the level of credit available to us and our ability to mitigate exposure on acceptable terms. We cannot guarantee that we... -

Page 22

...to direct and indirect regulation in each of the countries in which we, the companies with which we work or our customers do business. As a result, changes in various types of regulations applicable to current or new technologies, products or services could affect our business adversely. For example... -

Page 23

...customers and suppliers, potential litigation involving ourselves or our industry, and announcements concerning the success of new products and services, as well as general market volatility. See ''Item 9.A Offer and Listing Details'' for information regarding the trading price history of our shares... -

Page 24

...mobile networks. Nokia connects people to each other and the information that matters to them with mobile devices and solutions for voice, data, imaging, games, multimedia and business applications. We also provide equipment, solutions and services for our operator and enterprise customers. For 2004... -

Page 25

... Depositary Shares, and the Helsinki Exchanges, in the form of shares. In addition, the shares are listed on the Frankfurt and Stockholm stock exchanges. Our principal executive office is located at Keilalahdentie 4, P.O. Box 226, FIN-00045 Nokia Group, Espoo, Finland and our telephone number is... -

Page 26

...Mobile device market growth during 2004 was also driven by attractively priced color-screen and camera phones in Western Europe and North America. In Nokia's five geographical sales areas, mobile device market volume growth was 100% in Latin America, 33% in Europe, Middle-East & Africa, 32% in China... -

Page 27

...of the total global mobile device market volume in 2008. In 2004, Nokia increased its shareholding in Symbian from 32.2% to 47.9%. The market-leading Series 60 software platform, which is licensed by Nokia to several other handset manufacturers and designed to run on top of the Symbian OS, continued... -

Page 28

... Packet Access, which provides high speed data delivery to 3G terminals to support multimedia services. Business Strategy Nokia is and will primarily continue to be a market and customer driven product company. We intend to continue to capitalize on our role as a market leader in mobile devices... -

Page 29

... products and services. We work together with customers, suppliers and industry participants in the Open Mobile Alliance and other industry forums, and focus on end-to-end solutions in all our development activities. In line with our strategy, we have identified five medium-term priorities... -

Page 30

... Nokia Mobile Phones: Imaging, Entertainment and Media, Mobile Enhancements and Mobile Services. Enterprise Solutions aims to help businesses and institutions extend their use of mobility from mobile devices for voice and basic data to secure mobile access, content and applications. Our solutions... -

Page 31

... of activity and geographical location, please see Note 3 to the financial statements included in Item 18 of this annual report. Nokia in Mobile Devices-2004 For 2004, the total mobile device sales volume achieved by the Mobile Phones, Multimedia and Enterprise Solutions business groups reached... -

Page 32

... of customization options. Mobile Phones The Mobile Phones business group aims to make user-friendly mobile devices with many features for different segments of the global market. We seek to put consumers first in our product creation process and primarily target high-volume category sales. Mobile... -

Page 33

... are a new category of mobile devices that can run computer-like applications such as email, web browsing and enterprise software, and can also have built-in music players, video recorders and other multimedia features. In 2004, we announced the Nokia 7610, Nokia's first mega pixel camera phone, and... -

Page 34

... high end of Nokia's business mobile device portfolio. The Security and Mobile Connectivity unit has a broad range of application and secure connectivity offerings designed to help enterprise customers ensure that their employees are granted the appropriate level of access to corporate information... -

Page 35

... group has five units: Radio Networks, Core Networks, Services, Customer and Market Operations, and Delivery Operations. Radio Networks develops GSM, EDGE and WCDMA radio access networks and cellular transmission for operators and network providers. The main products are base stations, base station... -

Page 36

...of these channels is specific to, and managed by, an individual business group. For example, Enterprise Solutions manages sales of our secure mobile connectivity products to certain resellers who contribute value, such as consulting services or additional software, before distribution. Multimedia is... -

Page 37

... The production and logistics for the device businesses of Mobile Phones, Multimedia and Enterprise Solutions is managed by Customer and Market Operations, including control of the mobile device factories. The organization is also responsible for the process development in the demand-supply network... -

Page 38

... in 2004, while Nokia continues to manufacture network elements for core and radio networks products in Beijing. Consolidation of our base station manufacturing in China enables increased economies of scale, bringing improved operational efficiency and cost benefits. In line with our strategy to... -

Page 39

... the Series 40 platform, which is used in feature phones and which supports Java௣ to enable external creation of new applications. Technology Platforms also develops software on top of the Symbian operating system, or OS. Nokia's global mobile device software developer support program, Forum Nokia... -

Page 40

... new innovative solutions to support future end user services. Further, we focus on creating open hardware and software architectures, which results in the research and development costs being spread among the industry players. Nokia Research Center Looking beyond current product development, Nokia... -

Page 41

Competition Mobile Devices For 2004, the total mobile device sales volume achieved by the Mobile Phones, Multimedia and Enterprise Solutions business groups reached a record of 207.7 million units, representing growth of 16% compared with 2003. Based on an estimated global market volume for mobile ... -

Page 42

... by suppliers of components and various layers in our products and solutions or by companies with which we work in cooperative research and development activities. Similarly, we and our customers may face claims of infringement in connection with our customers' use of our products and solutions... -

Page 43

... framework for all types of electronic communication networks and services. Also other regulatory measures have been taken in the recent years in order to open telecommunications competition in the internal markets and to address consumer protection and environmental policy issues relating to... -

Page 44

...safe communications, our barring solution is based on subscriber and mobile service recognition and allows mobile users to control access to mobile content services. For example, parents can prevent children from accessing undesirable content or unwanted services. • In the supply chain, to further... -

Page 45

..., job rotation, training and performance management. • Work life balance: health & safety, flexible working hours, telecommuting opportunities, leave and benefits. 4.C Organizational Structure The following is a list of Nokia's significant subsidiaries as of December 31, 2004: Country of... -

Page 46

...The following is a list of their location, use and capacity: Productive Capacity, Net (m2)(1) Country Location and Product BRAZIL CHINA Manaus (mobile devices) ...Beijing (mobile devices) ...Dongguan (mobile devices) ...Suzhou (base stations and cellular network transmission products) ...Beijing... -

Page 47

...: Mobile Phones, Multimedia, Enterprise Solutions and Networks. There are also two horizontal groups that support the mobile device business groups: Customer and Market Operations and Technology Platforms. In addition, the structure includes common group functions that consist of common research and... -

Page 48

... years. Net Sales and Operating Profit by Business Group 2004 Operating Profit/(Loss) Year ended December 31, 2003 Net Operating Sales Profit/(Loss) (EUR millions) 2002 Operating Profit/(Loss) Net Sales Net Sales Mobile Phones ...Multimedia ...Enterprise Solutions ...Networks ...Common Group... -

Page 49

... America, Russia, India and China and robust replacement sales of color screen and camera phones in Western Europe and North America. The following chart sets forth the global mobile device market volume and year over year growth rate by geographic area for the three years ended December 31, 2004... -

Page 50

...us, to GSM and CDMA technology, where operators did not view certain segments of our product portfolio as sufficiently competitive. The following chart sets forth Nokia's mobile device volume and year over year growth rate by geographic area for the three years ended December 31, 2004. Nokia Mobile... -

Page 51

... productivity gains, cost savings and competitive advantages enabled by secure mobile voice, data and business applications. With our Enterprise Solutions business group we intend to capture profitable segments of the enterprise market by offering products and services designed to help enterprises... -

Page 52

... markets in 2004 were driven by upgrades to camera functionality and/or to a larger and brighter color screen. In some cases the consumer benefits of the new product introductions could be perceived so high, that the new feature introduction warrants a price premium. • Price erosion: Price... -

Page 53

... in the longer term, sales and marketing costs will increase. In the Mobile Phones business group we spent more in sales and marketing than in R&D in 2004. However, in 2004 the Multimedia and Enterprise Solutions business groups continued to spend more on R&D than sales and marketing. The relative... -

Page 54

...as a proportion of total sales throughout 2004, closing the year at approximately 25%. In 2004, Networks entered several new geographical areas, with the effect that initial roll-out profitability was negatively impacted by market entry related costs as well as the highly competitive nature of these... -

Page 55

Networks Net Sales by Geographic Area Year ended December 31, 2004 Year ended Change (%) December 31, Change (%) 2003 to 2004 2003 2002 to 2003 (EUR millions, except percentage data) Year ended December 31, 2002 Europe, Middle-East & Africa . China ...Asia-Pacific ...North America ...Latin America ... -

Page 56

... as historically more than half of Nokia's profit before tax has been generated in Finland. See also Note 12 to our consolidated financial statements for a further discussion of our income taxes. Seasonality Our mobile phone and device sales are somewhat affected by seasonality. Historically, the... -

Page 57

... of sale, mainly in the mobile device business. Sales adjustments for volume based discount programs are estimated based largely on historical activity under similar programs. Price protection adjustments are based on estimates of future price reductions and certain agreed customer inventories at... -

Page 58

... product quality programs and processes, including actively monitoring and evaluating the quality of our component suppliers, our warranty obligations are affected by actual product failure rates (field failure rates) and by material usage and service delivery costs incurred in correcting a product... -

Page 59

... the cash inflows and outflows. Management determines discount rates to be used based on the risk inherent in the related activity's current business model and industry comparisons. Terminal values are based on the expected life of products and forecasted life cycle and forecasted cash flows over... -

Page 60

... consolidated financial statements and include, among others, the discount rate, expected long-term rate of return on plan assets and annual rate of increase in future compensation levels. A portion of our plan assets is invested in equity securities. The equity markets have experienced volatility... -

Page 61

... from 2003. Research and development expenses increased in Mobile Phones, Multimedia and Enterprise Solutions and decreased in Networks. Networks R&D expenses included impairments of EUR 115 million in 2004 and personnel-related restructuring costs, impairments and write-offs totaling EUR 470... -

Page 62

... Mobile Phones business group for the fiscal years 2003 and 2004. Year ended December 31, 2004 Year ended Percentage of December 31, Percentage of Net Sales 2003 Net Sales (EUR millions, except percentage data) Percentage Increase/ (decrease) Net sales ...Cost of sales ...Gross profit ...Research... -

Page 63

... the Multimedia business group for the fiscal years 2003 and 2004. Year ended December 31, 2004 Year ended Percentage of December 31, Percentage of Net Sales 2003 Net Sales (EUR millions, except percentage data) Percentage Increase/ (decrease) Net sales ...Cost of sales ...Gross profit ...Research... -

Page 64

... years 2003 and 2004. Year ended December 31, 2004 Year ended Percentage of December 31, Percentage of Net Sales 2003 Net Sales (EUR millions, except percentage data) Percentage Increase/ (decrease) Net sales ...Cost of sales ...Gross profit ...Research and development expenses ...Selling, general... -

Page 65

...the Networks business group for the fiscal years 2003 and 2004. Year ended December 31, 2004 Year ended Percentage of December 31, Percentage of Net Sales 2003 Net Sales (EUR millions, except percentage data) Percentage Increase/ (decrease) Net sales ...Cost of Sales ...Gross profit ...Research and... -

Page 66

.... As a result, the company booked a total net gain of EUR 106 million. The bonds had been classified as available-for-sale investments and fair valued through shareholders' equity. Profit Before Taxes Profit before tax and minority interests decreased 12% to EUR 4 709 million in 2004 compared with... -

Page 67

...are sourced in US dollars and approximately 25% in Japanese yen. All these factors together decreased cost of sales in Nokia Mobile Phones. In Nokia Networks, quality in our network deliveries improved towards the end of the year impacting positively on the gross margin. Also the product mix as well... -

Page 68

... in the Americas and high growth markets such as India, Brazil and Russia where entry level phones predominated. This development together with the weakening US dollar impacted negatively on our average selling price per phone and net sales. For 2003, Nokia's total mobile phone sales volumes grew by... -

Page 69

... dollar and the Japanese yen, were the main contributors to lower product costs. Nokia Networks Nokia Networks Net Sales, Operating Profit and Operating Margin Year ended Year ended Percentage December 31, December 31, Increase/ 2003 2002 (decrease) (EUR millions, except percentage data) Net sales... -

Page 70

... its product portfolio. However, the market for digital set top boxes developed slower than expected leading in decrease in sales compared with 2002. Common Group Expenses-This line item, which comprises Nokia Head Office, Nokia Research Center and other general functions' operating losses, totaled... -

Page 71

..., executive officer or 5% shareholder. There are no material transactions with enterprises controlling, controlled by or under common control with Nokia or associates of Nokia. See Notes 32 and 33 to our consolidated financial statements included in Item 18 of this Form 20-F. Exchange Rates Nokia... -

Page 72

... instruments used by Nokia in connection with our hedging activities, see Note 35 to our consolidated financial statements included in Item 18 of this Form 20-F. See also ''Item 11. Quantitative and Qualitative Disclosures About Market Risk ''and ''Item 3.D Risk Factors- Our sales, costs and results... -

Page 73

... capital. In 2003, net cash generated from operating activities decreased primarily due to high year-end sales increasing receivables in working capital offset by a significant payment of 2001 taxes paid in 2002. Net cash used in investing activities in 2004 was EUR 329 million compared with EUR... -

Page 74

... end of June 2004. For further information regarding our long-term liabilities, including interest rate structure and currency mix, see Note 23 to our consolidated financial statements included in Item 18 of this Form 20-F. Our ratio of net interest-bearing debt, defined as short-term and long-term... -

Page 75

...sets forth Nokia's total customer financing, outstanding and committed, for the years indicated. Customer Financing At December 31, 2004 2003 2002 (EUR millions) Financing commitments ...Outstanding long-term loans, net of allowances and write-offs ...Outstanding financial guarantees and securities... -

Page 76

... loans are available to fund capital expenditure relating to purchases of network infrastructure equipment and services from Networks. Certain loans may be partially secured through either guarantees by the borrower's direct or indirect parent or other group companies, or shares and/or other assets... -

Page 77

... in Mobile Phones, Multimedia and Enterprise Solutions and decreased in Networks. R&D expenses in 2004 included impairments of EUR 115 million in Networks due to the discontinuation of certain products and base station horizontalization projects and an impairment related to the WCDMA radio access... -

Page 78

... (EUR millions) Total Long-term debt ...Operating leases ...Inventory purchases ...Total ... - 175 1 225 1 400 - 231 11 242 - 78 - 78 115 127 - 242 115 611 1 236 1 962 Nokia does not believe it has material funding requirements for its fully-funded domestic defined benefit pension plans, which... -

Page 79

... Companies Act and our articles of association, the control and management of Nokia is divided among the shareholders in a general meeting, the Board of Directors and the Group Executive Board. The current members of the Board of Directors were elected at the Annual General Meeting on March 25, 2004... -

Page 80

... 1940 Board member since 2000. Master of Science (Eng.) (Helsinki University of Technology). President and CEO of Metra Corporation 1991-2000, President and CEO of Lohja Corporation 1979-1991. Holder ¨ ¨ Corporation of various executive positions at Wartsil a within production and management 1965... -

Page 81

... as new members of the Board of Directors for the same one-year term. Mr. Hesse is a member of the Board of Directors of Terabeam Wireless, a US based telecommunications technology and services company. Mr. Michelin is the CEO of Michelin Group, the French world-leading tire manufacturing company... -

Page 82

... Strategy ¨ as our Officer, resigned from Nokia effective December 31, 2004. We appointed Dr. Tero Ojanpera new Chief Strategy Officer and Group Executive Board member as of January 1, 2005. Ms. Sari Baldauf, formerly our Executive Vice President and General Manager of Networks, resigned from Nokia... -

Page 83

... and General Manager of Mobile Phones. Group Executive Board member since 1990. With Nokia 1980-81, rejoined 1982. LL.M. (University of Helsinki). Executive Vice President, CFO of Nokia 1999-2003, Executive Vice President of Nokia Americas and President of Nokia Inc. 1997-1998, Executive Vice... -

Page 84

..., Manufacturing Europe of Nokia Mobile Phones 1993-1996, Project Executive of Nokia Mobile Phones UK Ltd 1991-1993, Vice President, R&D of Nokia Mobile Phones, Oulu 1990-1991. Mary T. McDowell, b. 1964 Senior Vice President and General Manager of Enterprise Solutions. Group Executive Board member... -

Page 85

... of Nokia Research Center 2002-2004. Vice President, Research, Standardization and Technology of IP Mobility Networks, Nokia Networks 1999-2001. Vice President, Radio Access Systems Research and General Manager of Nokia Networks in Korea, 1999. Head of Radio Access Systems Research, Nokia Networks... -

Page 86

... General Manager of Multimedia. Group Executive Board member since 1998. Joined Nokia 1991. Master of Science (Econ.) (Helsinki School of Economics and Business Administration). Executive Vice President of Nokia Mobile Phones 1998-2003, Senior Vice President, Europe & Africa of Nokia Mobile Phones... -

Page 87

... to executive officers for 2004: Role and Composition of the Committee The Personnel Committee of the Board of Directors has overall responsibility for evaluating and deciding on compensation for the company's top executives. The Committee approves incentive compensation plans, policies and programs... -

Page 88

... shareholders through long-term incentives in the form of equity-based awards. Compensation Components and Determination The compensation program for executives includes the following: • Base salaries targeted at competitive market levels • Short-term cash incentives paid twice each year based... -

Page 89

... discretionary annual bonus based on the company's total shareholder return compared to key comparators from the high technology and telecommunications industry. Granting of Restricted Shares In recognition of Nokia's executive retention needs, Restricted Shares were granted to Group Executive Board... -

Page 90

...(5) President of Mobile Phones ... (1) Bonus amounts are based on the performance of the Group and the individual for the fiscal year and were paid under Nokia's Short Term Incentive Plan, which is described in the ''Report of the Personnel Committee.'' ''Other Compensation'' in 2004 for Mr... -

Page 91

...lesser of EUR 50,000 or 10% of the executive's total compensation in each year. * Our executives forming the Group Executive Board in 2004 participate in the local retirement programs applicable to all employees in the country where they reside. Executives in Finland participate in the Finnish TEL... -

Page 92

... Board are independent, as defined in the New York Stock Exchange's corporate governance listing standards, as amended in ¨ was determined to be November 2004. In addition to the Chairman, Dr. Bengt Holmstrom non-independent due to a family relationship with an executive officer of a Nokia supplier... -

Page 93

...minimum of three members of the Board, who meet all applicable independence requirements of Finnish law and the rules of the stock exchanges where Nokia shares are listed, including the Helsinki Exchanges and the New York Stock Exchange. Since March 25, 2004, the Personnel Committee has consisted of... -

Page 94

... the delivery of the shares. The NYSE listing standards require that equity compensation plans be approved by a company's shareholders. Nokia's corporate governance practices also comply with the Corporate Governance Recommendation for Listed Companies approved by the Helsinki Exchanges in December... -

Page 95

... and geographical location as follows: 2004 2003 2002 Mobile Phones(1) ...Multimedia(2) ...Enterprise Solutions(2) ...Networks ...Customer and Market Operations(3) Technology Platforms(3) ...Nokia Ventures Organization(4) ...Common Group Functions ...Finland ...Other European countries Americas... -

Page 96

... tables set forth the number of shares and ADSs beneficially held by members of the Board of Directors and the Group Executive Board as of December 31, 2004 (not including the new Group Executive Board members whose service began on or after January 1, 2005). Of the Group Executive Board members... -

Page 97

... pursuant to our Nokia Stock Option Plans 1999, 2001 and 2003. For a description of our stock option plans, please see Note 22 to our consolidated financial statements and ''-Nokia's Equity Based Compensation Program 2004'' and ''-Other Employee Stock Option Plans.'' Number of shares represented by... -

Page 98

... value received in respect of options sold over the Helsinki Exchanges or (b) the difference between the aggregate closing market price (on the Helsinki Exchanges on the exercise day) of the Nokia shares subscribed for, and the exercise price of the options exercised for share subscriptions. 97 -

Page 99

...post split) and the closing market price of Nokia shares on the Helsinki Exchanges as of December 31, 2004 of EUR 11.62. On December 31, 2004, the total outstanding exercisable stock options held by all participants in the Nokia stock option plans, including the Group Executive Board, called for 81... -

Page 100

... period end date (Vesting Date) October 1, 2006. Restriction period end date (Vesting Date) April 1, 2007. The closing market price of Nokia share on the Helsinki Exchanges as of December 31, 2004 was EUR 11.62. Stock Ownership Guidelines for Executive Management The goal of our long-term, equity... -

Page 101

...is in line with the Helsinki Exchanges Guidelines for Insiders and also sets requirements beyond these guidelines. Nokia's Equity Based Compensation Program 2004 In 2004, we introduced performance shares as the main element to our broad-based equity compensation program, as approved by the Board of... -

Page 102

...Group Executive Board members participate, please see Note 22 to our consolidated financial statements included in Item 18 of this Form 20-F. The plans under Note 22 have been approved by the Annual General Meetings in the year of the launch of the plan. Restricted Shares In 2004, we granted a total... -

Page 103

Annual General Meeting 2005 for the approval of a new two-year stock option plan amounting to a maximum of 25 million stock options, permitting these plans. • The maximum number of restricted shares that we intend to grant during 2005 is 3.5 million. Our intent is to grant a similar amount in 2006... -

Page 104

... to Nokia by any director, executive officer or 5% shareholder. There are no material transactions with enterprises controlling, controlled by or under common control with Nokia or associates of Nokia. See Notes 32 and 33 to our consolidated financial statements included in Item 18 of this Form 20... -

Page 105

...financial statements included in Item 18 of this Form 20-F for the amount of our export sales. 8.A.7 Litigation We and several other mobile device manufacturers, distributors and network operators were named as defendants in a series of class action suits filed in various US jurisdictions. The cases... -

Page 106

...and inventory techniques that were allegedly used to improperly manipulate sales figures. While the matters alleged are under review, Nokia does not believe that the Lead Plaintiff's claims have merit and intends to vigorously defend itself. Based upon the information currently available, management... -

Page 107

... the reported high and low quoted prices for our shares on the Helsinki Exchanges and the high and low quoted prices for the shares, in the form of ADSs, on the New York Stock Exchange. In 2000, Nokia effected a four-for-one share split, effective in public trading on April 10, 2000. Price per share... -

Page 108

... the Helsinki Exchanges, in the form of shares. In addition, the shares are listed on the Frankfurt and Stockholm stock exchanges. The shares were also listed on the Paris stock exchange until their de-listing upon the company's application, effective October 13, 2004. 9.D Selling Shareholders Not... -

Page 109

...generally based on the historical weighted average trading price of the shares. A shareholder of this magnitude also is obligated to purchase any subscription rights, stock options, warrants or convertible bonds issued by the company if so requested by the holder. Under the Finnish Securities Market... -

Page 110

... or other payments. 10.E Taxation General The taxation discussion set forth below is intended only as a descriptive summary and does not purport to be a complete analysis or listing of all potential tax effects relevant to ownership of our shares represented by ADSs. The statements of United... -

Page 111

... by the US Holder (in the case of shares), regardless of whether the payment is in fact converted into US dollars. Generally, any gain or loss resulting from currency exchange rate fluctuations during the period between the time such payment is received and the date the dividend payment is converted... -

Page 112

... asset, this gain or loss generally will be long-term capital gain or loss if, at the time of the sale, the ADSs have been held for more than one year. Any capital gain or loss, for foreign tax credit purposes, generally will constitute US source gain or loss. In the case of a US Holder that is an... -

Page 113

... sale or other disposition of shares or ADSs may be subject to information reporting to the Internal Revenue Service and possible US backup withholding at the current rate of 28%. Backup withholding will not apply to a Holder, however, if the Holder furnishes a correct taxpayer identification number... -

Page 114

... management policies covering, for example, treasury and customer finance risks. Financial Risks The key financial targets for Nokia are growth, profitability, operational efficiency and a strong balance sheet. The objective for the Treasury function is twofold: to guarantee cost-efficient funding... -

Page 115

... management of the Group exposures. The VaR figure represents the potential fair value losses for a portfolio resulting from adverse changes in market factors using a specified time period and confidence level based on historical data. To correctly take into account the non-linear price function... -

Page 116

... losses for a portfolio resulting from adverse changes in market factors using a specified time period and confidence level based on historical data. For interest rate risk VaR, Nokia uses variance-covariance methodology. Volatilities and correlations are calculated from a one-year set of daily data... -

Page 117

... in private equity through Nokia Venture Funds. The fair value of these available-for-sale equity investments at December 31, 2004 was USD 142 million (USD 85 million in 2003). Nokia is exposed to equity price risk on social security costs relating to stock compensation plans. Nokia hedges this... -

Page 118

... ''Code of Ethics.'' ITEM 16C. PRINCIPAL ACCOUNTANT FEES AND SERVICES PricewaterhouseCoopers Oy has served as Nokia's independent public auditor for each of the fiscal years in the three-year period ended December 31, 2004, for which audited financial statements appear in this annual report on Form... -

Page 119

...advisory services in connection with the outsourcing of an operational process. Forensic accounting in 2004 mainly related to internal investigations; in 2003 it related entirely to Telsim; for more information, see ''Item 8.A.7 Litigation.'' (2) (3) (4) Audit Committee Pre-approval Policies and... -

Page 120

... to the Policy set out the audit, audit-related, tax and other services that have received the general pre-approval of the Audit Committee, which services are subject to annual review by the Audit Committee. All other audit, audit-related, tax and other services, including all internal control... -

Page 121

... Group's obligations in connection with certain employee stock option plans. For more information, see ''Item 6.E Share Ownership-Other Employee Stock Option Plans.'' On March 27, 2003, the Annual General Meeting authorized the Board to repurchase a maximum of 225 million Nokia shares by using funds... -

Page 122

...this Annual Report on Form 20-F: Consolidated Financial Statements Report of Independent Registered Public Accounting Firm . . Consolidated Profit and Loss Accounts ...Consolidated Balance Sheets ...Consolidated Cash Flow Statements ...Consolidated Statements of Changes in Shareholders' Equity Notes... -

Page 123

... GSM technical specifications and reports, including GPRS and EDGE. Access network: A network for the delivery of voice, data, text and images to end users. ADSL (Asymmetric Digital Subscriber Line): A transmission system that supports high bit rates over existing copper twisted pair access networks... -

Page 124

... rate transmission in a CDMA downlink to support multimedia services. HSDPA brings high speed data delivery to 3G terminals, ensuring that users requiring effective multimedia capabilities benefit from data rates previously unavailable because of limitations in the radio access network. IP (Internet... -

Page 125

... as messaging, content download and digital rights management. In addition to these functions, service delivery platforms permit new services to be deployed easier and faster. SSL (Secure Socket Layer): A transport-level protocol that adds authentication and data encryption to TCP connections and as... -

Page 126

...as of December 31, 2004 and 2003, and the related consolidated statements of profit and loss, shareholders' equity and cash flows for each of the three years in the period ended December 31, 2004. These financial statements are the responsibility of the Company's management. Our responsibility is to... -

Page 127

... Corporation and Subsidiaries Consolidated Profit and Loss Accounts Financial year ended December 31 2004 2003 2002 EURm EURm EURm Notes Net sales ...Cost of sales ...Research and development expenses . . Selling, general and administrative expenses ...Customer finance impairment charges, net of... -

Page 128

... 2004 2003 As restated EURm EURm Notes ASSETS Fixed assets and other non-current assets Capitalized development costs ...Goodwill ...Other intangible assets ...Property, plant and equipment ...Investments in associated companies ...Available-for-sale investments ...Deferred tax assets ...Long-term... -

Page 129

...-current available-for-sale investments ...Purchase of shares in associated companies ...Additions to capitalized development costs ...Long-term loans made to customers ...Proceeds from repayment and sale of long-term loans receivable ...Proceeds from (+) / payment of (-) other long-term receivables... -

Page 130

... Flow Statements (Continued) Financial year ended December 31 2004 2003 2002 As restated As restated EURm EURm EURm Notes Cash flow from financing activities Proceeds from stock option exercises ...Purchase of treasury shares ...Capital investment by minority shareholders Proceeds from long-term... -

Page 131

... Statements of Changes in Shareholders' Equity Fair value and other Retained reserves(1) earnings Number of shares (000's) Share capital Share issue Treasury Translation premium shares differences(1) Total Group, EURm Balance at December 31, 2001 ...4,736,302 Stock options exercised ...Stock... -

Page 132

... Financial Statements 1. Accounting principles Basis of presentation The consolidated financial statements of Nokia Corporation (''Nokia'' or ''the Group''), a Finnish limited liability company with domicile in Helsinki, are prepared in accordance with International Financial Reporting Standards... -

Page 133

... of foreign Group companies are translated into euro at the year-end foreign exchange rates with the exception of goodwill arising on the acquisition of a foreign company, which is translated to euro at historical rates. Differences resulting from the translation of profit and loss account items at... -

Page 134

... date. Interest rate and currency swaps are valued by using discounted cash flow analyses. The changes in the fair values of these contracts are reported in the profit and loss account. Fair values of cash-settled equity derivatives are calculated by revaluing the contract at year-end quoted market... -

Page 135

... all times taken directly as adjustments to sales or to cost of sales in the profit and loss account. Accumulated fair value changes from qualifying hedges are released from shareholders' equity into the profit and loss account as adjustments to sales and cost of sales, in the period when the hedged... -

Page 136

... distribution channels is recognized when the reseller or distributor sells the products to the end users. In addition, sales and cost of sales from contracts involving solutions achieved through modification of complex telecommunications equipment are recognized on the percentage of completion... -

Page 137

... schemes are generally funded through payments to insurance companies or to trustee-administered funds as determined by periodic actuarial calculations. The Group's contributions to defined contribution plans and to multi-employer and insured plans are charged to the profit and loss account in the... -

Page 138

... less. Short-term investments The Group considers all highly liquid marketable securities purchased with maturity at acquisition of more than three months as short-term investments. They are included in current available-for-sale investments, liquid assets, in the balance sheet. Accounts receivable... -

Page 139

... which the unused tax losses can be utilized. Stock compensation No compensation cost is recognized in respect of stock options, restricted shares and performance shares granted to employees. The options are granted with a fixed exercise price set on a date outlined in the plan. When the options... -

Page 140

... the changes in the Nokia share price. The Group recognizes a provision for prior year tax contingencies based upon the estimated future settlement amount at each balance sheet date. Dividends Dividends proposed by the Board of Directors are not recorded in the financial statements until they have... -

Page 141

... 2004, the IASB issued IFRS 2, Share-based Payment. The standard requires the recognition of share-based payment transactions in financial statements, including transactions with employees or other parties to be settled in cash, other assets, or equity instruments of the Company. Currently the Group... -

Page 142

... business segments, which form the main reporting structure: Mobile Phones; Multimedia; Enterprise Solutions; and Networks. Nokia's reportable segments represent the strategic business units that offer different products and services for which monthly financial information is provided to the Board... -

Page 143

... more of Group revenues. Common Total Mobile Multi- Enterprise Group reportable ElimiPhones media Solutions Networks Functions segments nations Group EURm EURm EURm EURm EURm EURm EURm EURm 2004 Profit and Loss Information Net sales to external customers Net sales to other segments ...Depreciation... -

Page 144

... Statements (Continued) 3. Segment information (Continued) Common Total Mobile Multi- Enterprise Group reportable ElimiPhones media Solutions Networks Functions segments nations Group EURm EURm EURm EURm EURm EURm EURm EURm 2003 Profit and Loss Information Net sales to external customers Net sales... -

Page 145

... income and accrued expenses, and deferred tax liabilities amount to EUR 246 million in 2004 (EUR 394 million in 2003). 2004 EURm 2003 EURm 2002 EURm (5) Net sales to external customers by geographic by location of customer Finland ...USA ...China ...Great Britain ...Germany ...Other ... area... -

Page 146

... ...Pension commitments for the management: 25 8 22 5 19 4 The retirement age of the management of the Group companies is between 60-65 years. For the Chief Executive Officer and the President of the Parent Company the retirement age is 60 years. There were also three other Group Executive Board... -

Page 147

Notes to the Consolidated Financial Statements (Continued) 5. Personnel expenses (Continued) Average personnel 2004 2003 2002 Mobile Phones ...Multimedia ...Enterprise Solutions ...Networks ...Common Group Functions ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... ... -

Page 148

... Financial Statements (Continued) 6. Pensions (Continued) The amounts recognized in the profit and loss account are as follows: 2004 EURm 2003 EURm 2002 EURm Current service cost ...Interest cost ...Expected return on plan assets ...Net actuarial losses (gains) recognized in year Past service cost... -

Page 149

...gain of EUR 56 million on the sale of the remaining shares of Nokian Tyres Ltd. In 2003, Nokia Networks recorded a charge of EUR 80 million for personnel expenses and other costs in connection with the restructuring taken in light of general downturn in market conditions, of which EUR 15 million was... -

Page 150

... to the Consolidated Financial Statements (Continued) 8. Impairment 2004 Common Mobile Enterprise Group Phones Multimedia Solutions Networks Functions Group EURm EURm EURm EURm EURm EURm Impairment of available-for-sale investments Impairment of capitalized development costs Total, net ...2003... -

Page 151

... platform technology, using a discount rate of 15%. At December 31, 2004, there is EUR 0 million of Amber goodwill (EUR 0 million in 2003). The impairment is a result of significant declines in the market outlook for products under development. In 2002, Nokia recognized impairment loss of EUR 36... -

Page 152

... 737 5 1,311 314 473 211 107 206 1,311 ... Total ...Depreciation and amortization by function Cost of sales ...R&D ...Selling, marketing and administration ...Other operating expenses ...Goodwill ... Total ...11. Financial income and expenses 2004 EURm 2003 EURm 2002 EURm Income from available... -

Page 153

... the corporate tax rate in Finland will be reduced from 29% to 26%. The change had no impact on the current tax expense in 2004. The impact of the change on the Profit and loss account through change in deferred taxes in 2004 was EUR 26 million. Certain of the Group companies' income tax returns for... -

Page 154

... to the Consolidated Financial Statements (Continued) 13. Intangible assets 2004 EURm 2003 EURm Capitalized development costs Acquisition cost January 1 ...Additions ...Impairment and write-offs ...Accumulated amortization December 31 Goodwill Acquisition cost January 1 ...Additions ...Impairment... -

Page 155

... Statements (Continued) 14. Property, plant and equipment 2004 EURm 2003 EURm Land and water areas Acquisition cost ...payments and fixed assets Acquisition cost January 1 ...Additions ...Disposals ...Transfers to: Other intangible assets ...Buildings and constructions ...Machinery and equipment... -

Page 156

... Motorola representing 13.2% of all the shares in Symbian, for EUR 57 million (GBP 39.6 million) in cash. Shareholdings in associated companies are comprised of investments in unlisted companies in all periods presented. 16. Available-for-sale investments 2004 EURm 2003 As restated EURm Fair value... -

Page 157

... Long-term loans receivable, consisting of loans made to customers principally to support their financing of network infrastructure and services or working capital, net of allowances and write-offs amounts (Note 8), are repayable as follows: 2004 EURm 2003 EURm Under 1 year ...Between 1 and 2 years... -

Page 158

... Balance at end of year EURm Allowances on assets to which they apply: Deductions EURm (1) 2004 Doubtful accounts receivable ...Excess and obsolete inventory ...2003 Doubtful accounts receivable ...Excess and obsolete inventory ...2002 Doubtful accounts receivable ...Long-term loans receivable... -

Page 159

... that remain highly probable at the balance sheet date, Nokia has adopted a process under which all derivative gains and losses are initially recognized in the profit and loss account. The appropriate reserve balance is calculated at the end of each period and posted to equity. Nokia continuously... -

Page 160

...by the Group companies with an aggregate par value of EUR 10,609,192.62 representing approximately 3.79% of the total number of shares and votes. Authorizations Authorization to increase the share capital The Board of Directors had been authorized by Nokia shareholders at the Annual General Meeting... -

Page 161

... 3% of the total number of votes on December 31, 2004. During 2004 the exercise of 1,260 options resulted in the issuance of 5,040 new shares and the increase of the share capital of Nokia Corporation with EUR 302.40. The plans have been approved by the Annual General Meetings in the year of the... -

Page 162

... equity compensation program, as approved by the Board of Directors. A total number of 3.9 million Performance Share Units were granted to a wide number of selected employees on many levels of the organization in 2004. Performance Share Units represent a commitment by the company to deliver Nokia... -

Page 163

...to the Consolidated Financial Statements (Continued) 22. The shares of the Parent Company (Continued) Outstanding stock option plans, December 31, 2004 Vesting Status (as percentage of Number of total number of Plan (Year participants stock options of launch) Total plan size (approx.) (Sub)category... -

Page 164

Notes to the Consolidated Financial Statements (Continued) 22. The shares of the Parent Company (Continued) Information relating to stock options during 2004, 2003 and 2002 are as follows: Number of shares Weighted average exercise price EUR Shares under option at December 31, 2001 Granted(1) ...... -

Page 165

.... Long-term liabilities Repayment date beyond 5 years EURm Long-term loans are repayable as follows: Outstanding December 31, 2004 EURm Outstanding December 31, 2003 EURm Loans from financial institutions ...Loans from pension insurance companies Other long-term finance loans ...Other long-term... -

Page 166

... in the tax rate on the profit and loss account through change in deferred taxes in 2004 was EUR 26 million tax expense. During 2004, the Group analyzed the majority of its future foreign investment plans with respect to foreign investments. As a result of this analysis, the Group concluded that... -

Page 167

... EURm 2,422 (6) 1,500 (8) (494) 998 (935) 2,479 2003 EURm Charged to profit and loss account ...Utilized during year ...At December 31, 2004 ... Analysis of total provisions at December 31: Non-current ...Current ... 726 1,753 593 1,829 The IPR provision is based on estimated future settlements... -

Page 168

... of stock options, restricted shares and performance shares outstanding during the period. 30. Commitments and contingencies 2004 EURm 2003 EURm Collateral for our own commitments Property under mortgages ...Assets pledged ...Contingent liabilities on behalf of Group companies Other guarantees... -

Page 169

...to purchases of network infrastructure equipment and services and to fund working capital. The Group has been named as defendant along with certain of its senior executives in a class action complaint in the United States relating to certain public statements about its product portfolio and releated... -

Page 170

... loans granted to top management at December 31, 2004 or 2003. See Note 5, Personnel expenses, for officers and directors remunerations. 33. Associated companies 2004 EURm 2003 EURm 2002 EURm Share of results of associated companies ...Dividend income ...Share of shareholders' equity of associated... -

Page 171

...cash flow statement 2004 EURm 2003 As restated EURm 2002 As restated EURm Adjustments for: Depreciation and amortization (Note 10) ...(Profit)/loss on sale of property, plant and equipment and available-for-sale investments ...Income taxes (Note 12) ...Share of results of associated companies (Note... -

Page 172

... and by managing the balance sheet structure of the Group. Nokia has Treasury Centers in Geneva, Singapore/Beijing and New York/Sao Paolo, and a Corporate Treasury unit in Espoo. This international organization enables Nokia to provide the Group companies with financial services according to... -

Page 173

... management of the Group exposures. The VaR figure represents the potential fair value losses for a portfolio resulting from adverse changes in market factors using a specified time period and confidence level based on historical data. To correctly take into account the non-linear price function... -

Page 174

...Nokia is exposed to equity price risk on social security costs relating to stock compensation plans. Nokia hedges this risk by entering into cash settled equity swap and option contracts. b) Credit risk Customer Finance Credit Risk Network operators in some markets sometimes require their suppliers... -

Page 175

... gives the Company the right to offset in the case that the counterparty would not be able to fulfill the obligations. Direct credit risk represents the risk of loss resulting from counterparty default in relation to on-balance sheet products. The fixed income and money market investment decisions... -

Page 176

... at maintaining flexibility in funding by keeping committed and uncommitted credit lines available. At the end of December 31, 2004, the committed facility totaled USD 2.0 billion. The committed credit facility is intended to be used for U.S. and Euro Commercial Paper Programs back up purposes. The... -

Page 177

... year. The ratings as at December 31, 2004 were: Short-term Long-term Standard & Poor's Moody's Standard & Poor's Moody's A-1 P-1 A A1 Hazard risk Nokia strives to ensure that all financial, reputation and other losses to the Group and our customers are minimized through preventive risk management... -

Page 178

... Nokia Inc...Nokia GmbH ...Nokia UK Limited ...Nokia TMC Limited ...Nokia Capitel Telecommunications Ltd ...Nokia Finance International B.V...´ Nokia Komarom Kft ...Nokia do Brazil Technologia Ltda ...Nokia Italia Spa ...Nokia India Ltd ...Dongguan Nokia Mobile Phones Company Ltd ...Beijing Nokia... -

Page 179

... income and total shareholders' equity as of and for the years ended December 31: 2004 EURm 2003 EURm 2002 EURm Reconciliation of net income: Net income reported under IFRS ...U.S. GAAP adjustments: Pension expense ...Development costs ...Provision for social security cost on stock options ...Stock... -

Page 180

...' equity: Total shareholders' equity reported under IFRS ...U.S. GAAP adjustments: Pension expense ...Additional minimum liability ...Development costs ...Marketable securities and unlisted investments ...Provision for social security cost on stock options ...Deferred compensation ...Share issue... -

Page 181

Notes to the Consolidated Financial Statements (Continued) 37. Differences between International Financial Reporting Standards and U.S. Generally Accepted Accounting Principles (Continued) Earnings per share under U.S. GAAP: Earnings per share amounts are presented below: 2004 EUR 2003 EUR 2002 EUR... -

Page 182

... maintenance and customer support required to satisfy the enterprise's responsibility set forth at the time of sale. The amount of unamortized capitalized computer software costs, under U.S. GAAP, is EUR 210 million in 2004 (EUR 438 million in 2003). Marketable securities and unlisted investments... -

Page 183

.... Under U.S. GAAP, the cumulative translation differences are reported in the profit and loss account only upon the sale or upon complete or substantially complete liquidation of the investment in a foreign entity. Acquisition purchase price Under IFRS, when the consideration paid in a business... -

Page 184

... Statements (Continued) 37. Differences between International Financial Reporting Standards and U.S. Generally Accepted Accounting Principles (Continued) Amortization of goodwill The Group adopted the transition provisions of IFRS 3, Business Combinations, with effect from April 1, 2004. As a result... -

Page 185

... Reporting Standards and U.S. Generally Accepted Accounting Principles (Continued) Below is a roll forward of U.S. GAAP goodwill during 2004 and 2003. The comparative figures are regrouped according to the new organizational structure: Common Mobile Enterprise Group Phones Multimedia Solutions... -

Page 186

... business groups on a symmetrical basis. Under U.S. GAAP, segment assets and liabilities are reported on the basis of the internal reporting structure reflecting management reporting. Assets under U.S. GAAP as at December 31, 2004 for Mobile Phones, Multimedia, Enterprise Solutions and Networks were... -

Page 187

...the Group's net income and earnings per share would have been reduced to the pro forma amounts indicated below: 2004 2003 2002 Net income under U.S. GAAP (EURm) ...Add: Stock-based employee compensation expense included in reported net income under U.S. GAAP, net of tax ...Deduct: Total stock-based... -

Page 188

... by FAS 109, Accounting for Income Taxes, under U.S. GAAP. 2004 EURm 2003 EURm Current assets: Intercompany profit in inventory Warranty provision ...Other provisions ...Tax losses carried forward ...Other ...Non-current assets: Tax losses carried forward . . Warranty provision ...Other provisions... -

Page 189

... Financial Statements (Continued) 37. Differences between International Financial Reporting Standards and U.S. Generally Accepted Accounting Principles (Continued) Pension expense Under IFRS, the determination of pension expense for defined benefit plans differs from the methodology set forth... -

Page 190

...Financial Statements (Continued) 37. Differences between International Financial Reporting Standards and U.S. Generally Accepted Accounting Principles (Continued) The following table sets forth the changes in the benefit obligation and fair value of plan assets during the year and the funded status... -

Page 191

... assumption used in calculation of pension obligations are as follows: 2004 Domestic Foreign % % 2003 Domestic Foreign % % Discount rate for determining present values ...Expected long-term rate of return on plan assets ...Annual rate of increase in future compensation levels Pension increases... -

Page 192

... plans' net periodic benefit cost for years ending December 31, are as follows: 2004 Domestic Foreign % % 2003 Domestic Foreign % % Discount rate for determining present values ...Expected long-term rate of return on plan assets ...Annual rate of increase in future compensation levels Pension... -

Page 193

... 2,090 million. New US Accounting Standards In December 2004, the FASB issued FASB Statement No. 123 (revised 2004), Share-Based Payments (FAS 123R). The statement requires the measurement and recognition of the cost of employee services received in exchange for an award of equity instruments based... -

Page 194

... The registrant hereby certifies that it meets all of the requirements for filing on Form 20-F and that it has duly caused and authorized the undersigned to sign this annual report on its behalf. NOKIA CORPORATION By: /s/ MAIJA TORKKO Name: Maija Torkko Title: Senior Vice President, Corporate... -

Page 195

© Copyright 2005. Nokia Corporation. All rights reserved. Nokia and Nokia Connecting People are registered trademarks of Nokia Corporation.