Lexmark 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

remaining inkjet hardware, with reductions primarily in the areas of inkjet-related manufacturing, research and development, supply

chain, marketing and sales as well as other support functions. The Company will continue to provide service, support and aftermarket

supplies for its inkjet installed base. The Company expects these actions to be complete by the end of 2015.

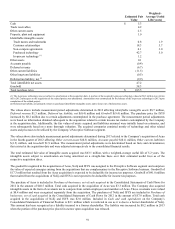

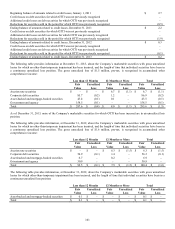

The 2012 Restructuring Actions are expected to impact about 2,063 positions worldwide, including 300 manufacturing positions. The

2012 Restructuring Actions will result in total pre-tax charges of approximately $176.0 million, with $146.4 million incurred to date

and approximately $29.6 million to be incurred in 2014 and 2015. The Company expects the total cash costs of the 2012 Restructuring

Actions to be approximately $101.5 million with $75.9 million incurred to date, and approximately $25.6 million remaining in 2014

and 2015.

The Company expects to incur total charges related to the 2012 Restructuring Actions of approximately $135.2 million in ISS, $35.7

million in All other and $5.1 million in Perceptive Software.

In the second quarter of 2013, the Company sold inkjet-related technology and assets. Refer to Note 4 of the Notes to Consolidated

Financial Statements for more information.

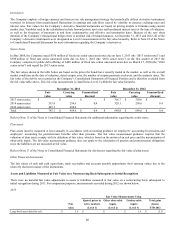

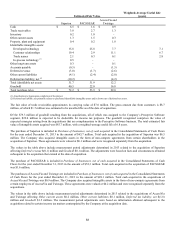

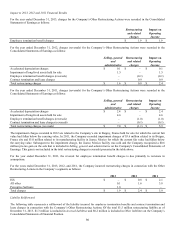

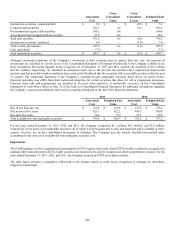

Impact to 2013, 2012 and 2011 Financial Results

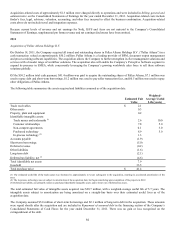

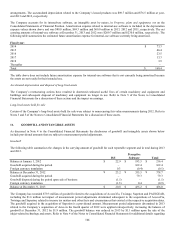

For the year ended December 31, 2013, charges for the 2012 Restructuring Actions were recorded in the Company’s Consolidated

Statements of Earnings as follows:

S

ellin

g

,

g

enera

l

R

estructu

r

in

g

Im

p

act on

R

estructurin

g

-Im

p

act on and and related O

p

eratin

g

related costs Gross

p

ro

f

i

t

administrative char

g

es Income

Accelerated depreciation charges $ 5.6 $ 5.6 $ 5.5 $ – $ 11.1

Excess components and other inventory-related

charges 15.8 15.8 – – 15.8

Employee termination benefit charges – – – 9.2 9.2

Contract termination and lease charges – – – (0.2) (0.2)

Total restructuring charges $ 21.4 $ 21.4 $ 5.5 $ 9.0 $ 35.9

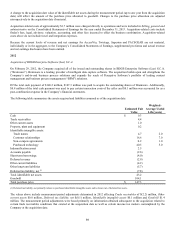

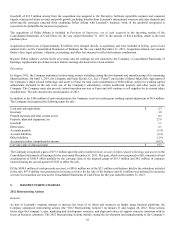

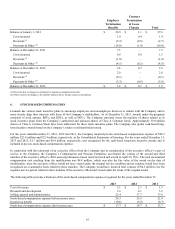

For the year ended December 31, 2012, charges for the 2012 Restructuring Actions were recorded in the Company’s Consolidated

Statements of Earnings as follows:

S

ellin

g

,

g

enera

l

R

estructurin

g

Im

p

act on

R

estructurin

g

-Im

p

act on and and related O

p

eratin

g

related costs Gross

p

ro

f

i

t

administrative char

g

es Income

Accelerated depreciation charges $ 29.5 $ 29.5 $ 19.8 $ – $ 49.3

Impairment of long-lived assets held for sale 0.6 0.6 – – 0.6

Excess components and other inventory-related

charges 17.7 17.7 – – 17.7

Employee termination benefit charges – – – 31.1 31.1

Contract termination and lease charges – – – 4.2 4.2

Total restructuring charges $ 47.8 $ 47.8 $ 19.8 $ 35.3 $ 102.9

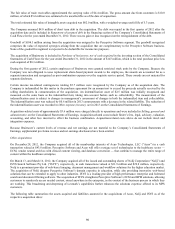

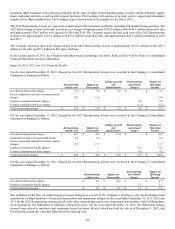

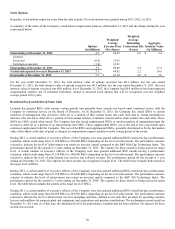

For the year ended December 31, 2011, charges for the 2012 Restructuring Actions were recorded in the Company’s Consolidated

Statements of Earnings as follows:

R

estructurin

g

Im

p

act on

R

estructurin

g

-Im

p

act on and related O

p

eratin

g

related costs Gross

p

ro

f

i

t

char

g

es Income

Accelerated depreciation charges $ 4.5 $ 4.5 $ – $ 4.5

Employee termination benefit charges – – 3.1 3.1

Total restructuring charges $ 4.5 $ 4.5 $ 3.1 $ 7.6

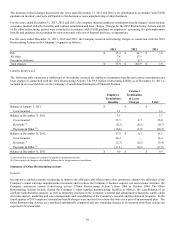

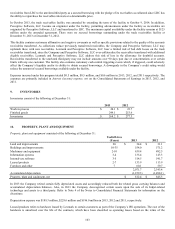

The estimated useful lives of certain long-lived assets changed as a result of the Company’s decision to exit the development and

manufacture of inkjet hardware. Accelerated depreciation and impairment charges for the years ended December 31, 2013, 2012 and

2011 for the 2012 Restructuring Actions and all of the other restructuring actions were determined in accordance with FASB guidance

on accounting for the impairment or disposal of long-lived assets. For the year ended December 31, 2012, the impairment charges

incurred were related to machinery and equipment located in Juarez, Mexico, which was held for sale as of December 31, 2012, and

for which the current fair value had fallen below the carrying value.

94