Lexmark 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

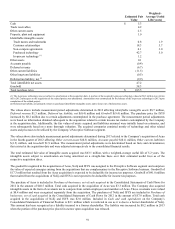

A change to the acquisition date value of the identifiable net assets during the measurement period (up to one year from the acquisition

date) will affect the amount of the purchase price allocated to goodwill. Changes to the purchase price allocation are adjusted

retrospectively to the acquisition date if material.

Acquisition-related costs of approximately $1.7 million were charged directly to operations and were included in Selling, general and

administrative on the Consolidated Statements of Earnings for the year ended December 31, 2013. Acquisition-related costs include

finder's fees, legal, advisory, valuation, accounting, and other fees incurred to effect the business combination. Acquisition-related

costs above do not include travel and integration expenses.

Because the current levels of revenue and net earnings for AccessVia, Twistage, Saperion and PACSGEAR are not material,

individually or in the aggregate, to the Company’s Consolidated Statements of Earnings, supplemental pro forma and actual revenue

and net earnings disclosures have been omitted.

2012

Acquisition of BDGB Enterprise Software (Lux) S.C.A.

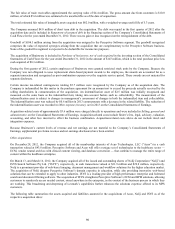

On February 29, 2012, the Company acquired all of the issued and outstanding shares in BDGB Enterprise Software (Lux) S.C.A.

(“Brainware”). Brainware is a leading provider of intelligent data capture software. The acquisition builds upon and strengthens the

Company’s end-to-end business process solutions and expands the reach of Perceptive Software’s portfolio of leading content

management and business process management (“BPM”) solutions.

Of the total cash payment of $148.2 million, $147.3 million was paid to acquire the outstanding shares of Brainware. Additionally,

$0.8 million of the total cash payment was used to pay certain transaction costs of the seller and $0.1 million was accounted for as a

post-combination expense in the Company’s financial statements.

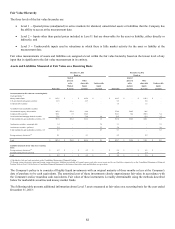

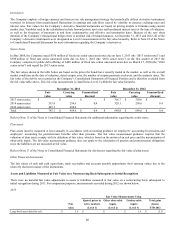

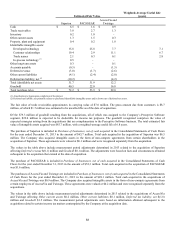

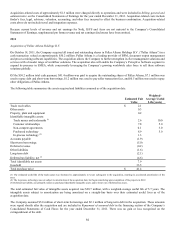

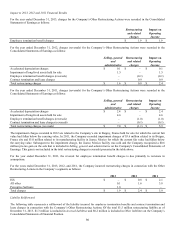

The following table summarizes the assets acquired and liabilities assumed as of the acquisition date:

Estimated Fair

Value

Weighted-

Average Useful

Life (years)

Cash $ 0.3

Trade receivables 4.4

Other current assets 1.0

Property, plant and equipment 0.2

Identifiable intangible assets:

Trade names 4.7 2.0

Customer relationships 16.6 7.0

Non-compete agreements 0.2 1.0

Purchased technology 40.5 5.0

Indemnification assset 2.5

Accounts payable (2.6)

Short-term borrowings (4.0)

Deferred revenue (2.9)

Other current liabilities (4.2)

Other long-term liabilities (5.7)

Deferred tax liability, net (1) (7.8)

Total identifiable net assets 43.2

Goodwill 104.1

Total purchase price $ 147.3

(1) Deferred tax liability, net primarily relates to purchased identifiable intangible assets and is shown net of deferred tax assets.

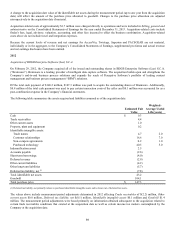

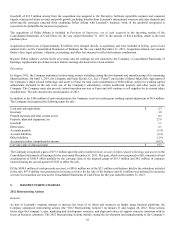

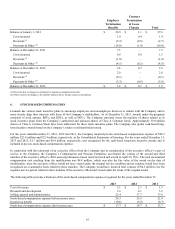

The values above include measurement period adjustments determined in 2012 affecting Trade receivables of $(2.2) million, Other

current assets $0.8 million, Deferred tax liability, net $(0.1) million, Identifiable intangible assets $0.1 million and Goodwill $1.4

million. The measurement period adjustments were based primarily on information obtained subsequent to the acquisition related to

certain trade receivables conditions that existed at the acquisition date as well as certain income tax matters contemplated by the

Company at the acquisition date.

89