Lexmark 2013 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

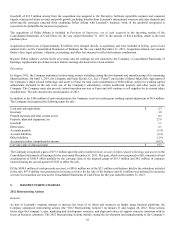

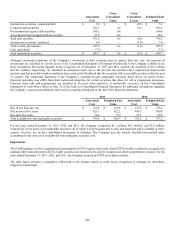

Acquisition-related costs of approximately $1.3 million were charged directly to operations and were included in Selling, general and

administrative on the Consolidated Statements of Earnings for the year ended December 31, 2012. Acquisition-related costs include

finder’s fees, legal, advisory, valuation, accounting, and other fees incurred to effect the business combination. Acquisition-related

costs above do not include travel and integration expenses.

Because current levels of revenue and net earnings for Nolij, ISYS and Acuo are not material to the Company’s Consolidated

Statements of Earnings, supplemental pro forma revenue and net earnings disclosures have been omitted.

2011

Acquisition of Pallas Athena Holdings B.V.

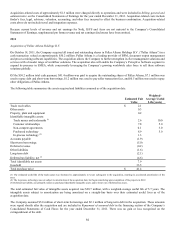

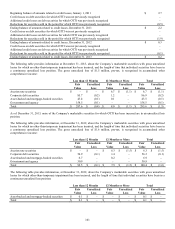

On October 18, 2011, the Company acquired all issued and outstanding shares in Pallas Athena Holdings B.V. (“Pallas Athena”) in a

cash transaction valued at approximately $50.2 million. Pallas Athena is a leading provider of BPM, document output management

and process mining software capabilities. The acquisition allows the Company to further strengthen its fleet management solutions and

services with a broader range of workflow solutions. The acquisition also will enable the Company’s Perceptive Software segment to

expand its presence in EMEA, while concurrently leveraging the Company’s growing worldwide sales force to sell these software

solutions globally.

Of the $50.2 million total cash payment, $41.4 million was paid to acquire the outstanding shares of Pallas Athena, $7.1 million was

used to repay debt and short-term borrowings, $1.2 million was used to pay seller transaction fees, and $0.5 million was used to repay

other obligations of Pallas Athena.

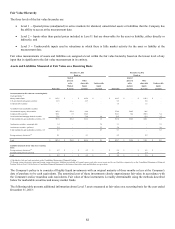

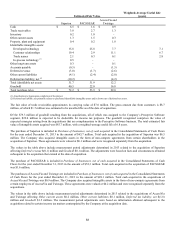

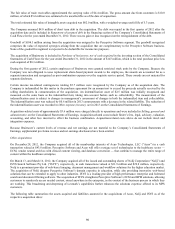

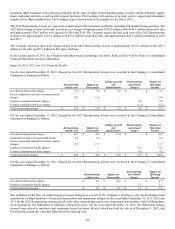

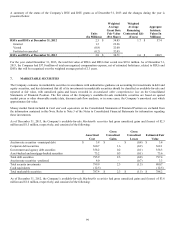

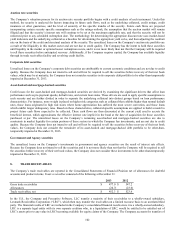

The following table summarizes the assets acquired and liabilities assumed as of the acquisition date.

Estimated Fair

Value

Weighted-

Average Useful

Life (years)

Trade receivables $ 2.1

Other assets 0.3

Property, plant and equipment 0.2

Identifiable intangible assets:

Trade names and trademarks (1) 2.6 10.0

Customer relationships 7.8 5.0

Non-compete agreements 0.1 3.0

Purchased technology 8.9 5.0

In-process technology (2) 1.3

Accounts payable (1.9)

Short-term borrowings (5.0)

Deferred revenue (0.2)

Other liabilities (1.6)

Long-term debt (2.1)

Deferred tax liability, net (3) (4.6)

Total identifiable net assets 7.9

Goodwill 33.5

Total purchase price $ 41.4

(1) The estimated useful life of the trade names was shortened to approximately 2.5 years subsequent to the acquisition, resulting in accelerated amortization of the

asset.

(2) The in-process technology was not subject to amortization at the acquisition date, but began amortizing upon completion of the projects in 2012.

(3) Deferred tax liability, net primarily relates to purchased identifiable intangible assets and is shown net of deferred tax assets.

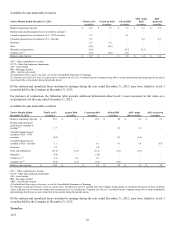

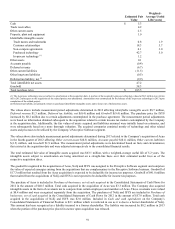

The total estimated fair value of intangible assets acquired was $20.7 million, with a weighted-average useful life of 5.7 years. The

intangible assets subject to amortization are being amortized on a straight-line basis over their estimated useful lives as of the

acquisition date.

The Company assumed $5.0 million of short-term borrowings and $2.1 million of long-term debt in the acquisition. These amounts

were repaid shortly after the acquisition and are included in Repayment of assumed debt in the financing section of the Company’s

Consolidated Statements of Cash Flows for the year ended December 31, 2011. There was no gain or loss recognized on the

extinguishment of the debt.

92