Lexmark 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

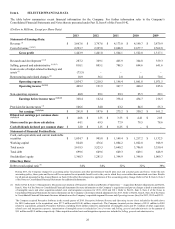

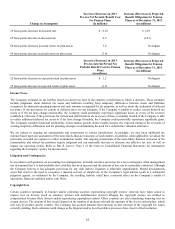

(2) Refer to Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations — Restructuring Charges and Project Costs for

more information on the Company’s restructuring charges and project costs for 2013, 2012 and 2011. Refer to Part II, Item 8, Note 5 of the Notes to Consolidated

Financial Statements for more information on the Company’s restructuring charges for 2013, 2012 and 2011.

Amounts in 2010 include restructuring charges and project costs of $38.6 million. Restructuring charges of $4.1 million and $1.8 million related to accelerated

depreciation on certain fixed assets are included in Cost of revenue and Selling, general and administrative, respectively. Restructuring charges of $2.4 million

relating to employee termination benefits and contract termination charges are included in Restructuring and related charges. Project costs of $13.3 million are

included in Cost of revenue, and $17.0 million are included in Selling, general and administrative.

Amounts in 2009 include restructuring charges and project costs of $141.3 million. Restructuring charges of $41.4 million and $0.1 million related to accelerated

depreciation on certain fixed assets are included in Cost of revenue and Selling, general and administrative, respectively. Restructuring charges of $70.6 million

relating to employee termination benefits and contract termination charges are included in Restructuring and related charges. Project costs of $10.1 million are

included in Cost of revenue, and $19.1 million are included in Selling, general and administrative.

(3) Refer to Part II, Item 8, Note 17 of the Notes to Consolidated Financial Statements for more information on the Company’s asset and actuarial net gain (loss) on

pension and other postretirement benefit plans for 2013, 2012 and 2011.

Amounts in 2010 include asset and actuarial net loss on pension and other postretirement benefit plans of $1.9 million. The net loss is included in Cost of revenue,

Selling, general and administrative and Research and development as a loss of $0.8 million, a gain of $0.2 million and a loss of $1.3 million, respectively.

Amounts in 2009 include asset and actuarial net gain on pension and other postretirement benefit plans of $24.9 million. The net gain is included in Cost of

revenue, Selling, general and administrative and Research and development in the amount of $6.2 million, $3.7 million and $15.0 million, respectively.

(4) Refer to Part II, Item 8, Note 14 of the Notes to Consolidated Financial Statements for more information on the Company’s benefit from discrete tax items for

2013, 2012 and 2011. Amounts in 2010 include a $14.7 million benefit from discrete tax items mainly related to audits concluding, statutes expiring, and true-ups

of prior year tax returns.

(5) The debt to total capital ratio is computed by dividing total debt (which includes both short-term and long-term debt) by the sum of total debt and stockholders’

equity.

26