Lexmark 2013 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

alone value in that either the customer can resell that item or another vendor sells that item separately. In cases of deliverables with

variable quantities, the Company’s practice is to consider these a separate deliverable in the original arrangement when the customer

does not have the option but to purchase future quantities from the Company. The Company typically does not offer a general right of

return in regards to its multiple deliverable arrangements.

The selling price of each deliverable is determined by establishing vendor specific objective evidence (“VSOE”), third party evidence

(“TPE”) or best estimate of selling price (“BESP”) for each delivered item. If VSOE or TPE is not determinable, the Company utilizes

its BESP in order to allocate consideration for those deliverables.

The Company uses its BESP when allocating the transaction price for most of its non-software deliverables due to variability in

pricing or lack of stand-alone sales as well as the unique and customized nature of certain deliverables. BESP for the Company’s

product deliverables is determined by utilizing a weighted average price approach. BESP for the Company’s service deliverables is

determined by utilizing a cost plus margin approach. These approaches are described further in the paragraphs below.

The Company’s method for determining management’s BESP for products starts with a review of historical stand-alone sales data.

Prior sales are grouped by product and key data points utilized such as the average unit price and the weighted average price in order

to incorporate the frequency of each product sold at any given price. Due to the large number of product offerings, products are then

grouped into common product categories (families) incorporating similarities in function and use and a BESP discount is determined

by common product category. This discount is then applied to product list price to arrive at a product BESP. This method is performed

and applied at a geography level in order to incorporate variances in product pricing across worldwide boundaries.

The Company does not typically sell its services on a stand-alone basis, thus a BESP for services is determined using a cost plus

margin approach. The Company typically uses third party suppliers to provide the services component of its multiple element

arrangements, thus the cost of services is generally that which is invoiced to the Company, but may also include cost estimates based

on parts, labor, overhead and estimates of the number of service actions to be performed. A margin is applied to the cost of services in

order to determine a BESP, and is primarily based on consideration of internal factors such as margin objectives and pricing practices

as well as competitor pricing strategies.

Software:

For software deliverables, relative selling price is determined using VSOE which is based on company specific stand-alone sales data

or renewal rates. For those arrangements, the Company often uses the residual method to allocate arrangement consideration to

delivered software licenses as permitted under the software revenue recognition guidance when VSOE does not exist for all

arrangement deliverables. VSOE for professional services is generally based on hourly rates charged and is determined using a bell

curve approach on stand-alone sales data, while VSOE for maintenance agreements is determined using a renewal rate approach,

which is based on the contractual price for renewal in the original arrangement as substantiated by actual renewal experience.

Maintenance revenue is deferred and recognized ratably over the term of the support period which is generally twelve months.

Software components that function together with the non-software components to provide the equipment’s essential functionality are

accounted for as part of the sale of the equipment. Software components that do not function together with the non-software

components to deliver the equipment’s essential functionality are accounted for under the software revenue recognition guidance.

Research and Development Costs:

Lexmark engages in the design and development of new products and enhancements to its existing products. The Company’s research

and development activity is focused on laser devices and associated supplies, features and related technologies as well as software.

Refer to Software Development Costs earlier in this note for information related to software development costs.

The Company expenses research and development costs when incurred. Equipment acquired for research and development activities

that has alternative future use (in research and development projects or otherwise) may be capitalized and depreciated. Research and

development costs include salary and labor expenses, infrastructure costs, and other costs leading to the establishment of technological

feasibility of the new product or enhancement.

Advertising Costs:

The Company expenses advertising costs when incurred. Advertising expense was approximately $41.7 million, $41.0 million and

$55.3 million in 2013, 2012 and 2011, respectively.

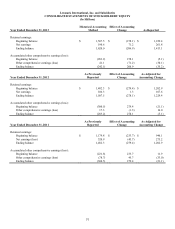

Change in Accounting Policy for Pension and Other Postretirement Plans

During the fourth quarter of 2013, Lexmark changed its accounting methodology for recognizing costs for all of its company-

sponsored U.S. and international pension and postretirement benefit obligations. Previously, the Company recognized the net

actuarial gains and losses as a component of stockholders’ equity within the Consolidated Statements of Financial Position. On an

69