Lexmark 2013 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

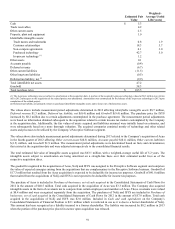

88

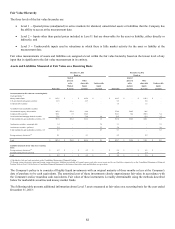

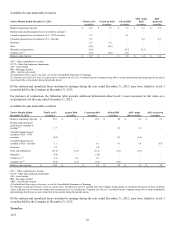

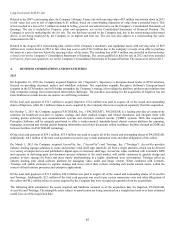

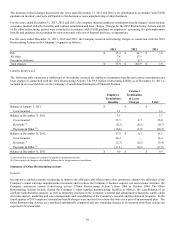

Estimated Fair Value

Weighted-Average Useful Life

(y

ears

)

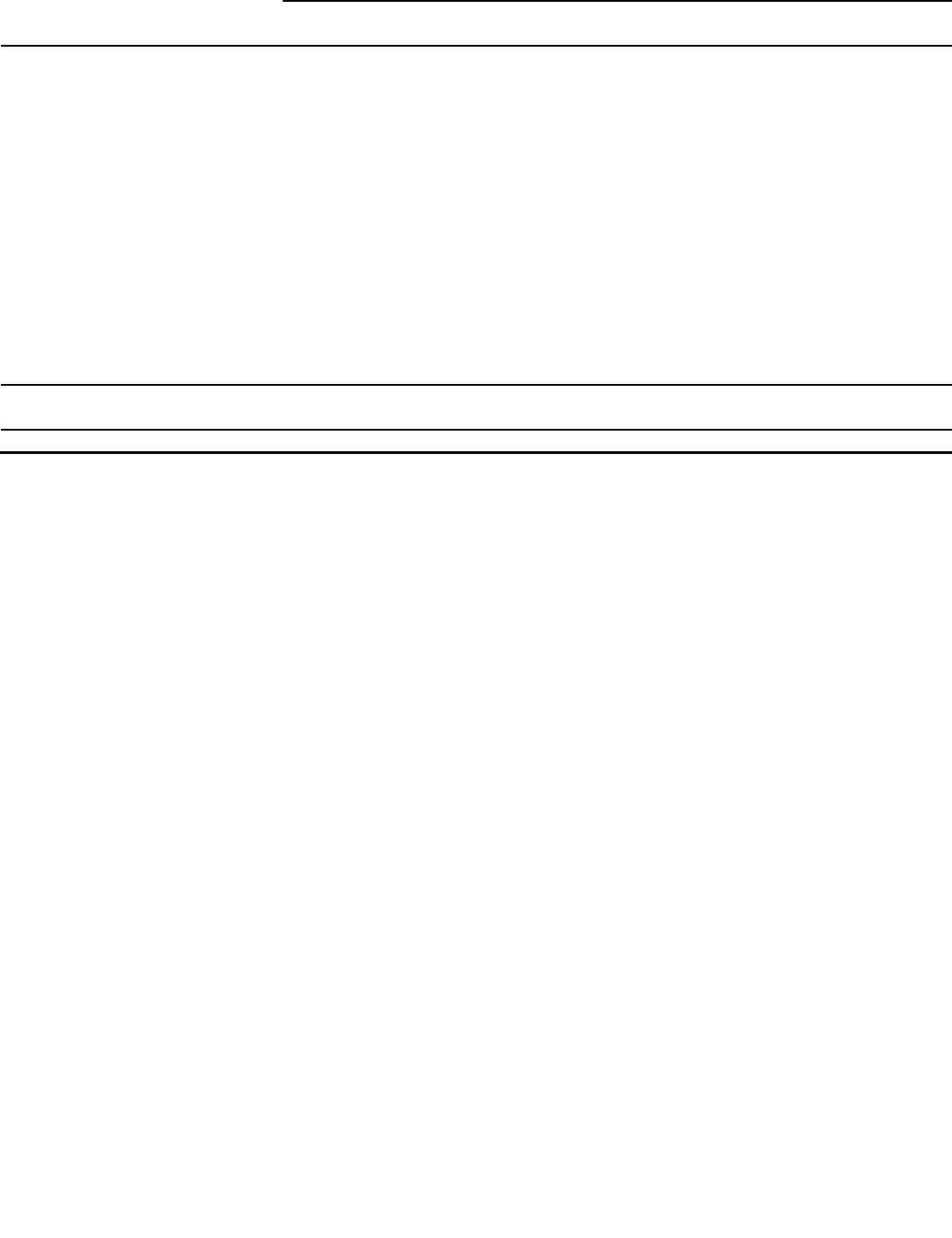

Saperion PACSGEAR

AccessVia and

Twistage

Cash $ 6.5 $ 1.6 $ 0.9

Trade receivables 3.0 2.7 1.3

Inventory 0.2 1.0 –

Other current assets 1.3 1.5 0.3

Property, plant and equipment 0.4 0.2 1.0

Identifiable intangible assets:

Developed technology 15.8 25.8 7.7 7.1

Customer relationships 19.4 2.9 11.1 6.7

Trade names 2.1 0.3 0.1 2.8

In-process technology (1) 0.5 – –

Other long-term assets 0.3 – 0.1

Accounts payable (0.5) – (1.5)

Deferred revenue (3.0) (1.7) (2.6)

Other current liabilities (4.1) (2.4) (2.0)

Deferred tax liability, net (2) (10.2) – (4.2)

Total identifiable net assets 31.7 31.9 12.2

Goodwill 40.5 22.0 16.8

Total purchase price $ 72.2 $ 53.9 $ 29.0

(1) Amortization to begin upon completion of the project.

(2) Deferred tax liability, net primarily relates to purchased identifiable intangible assets and is shown net of deferred tax assets.

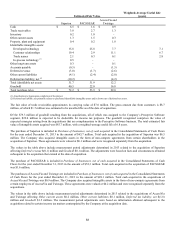

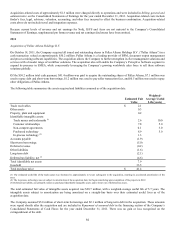

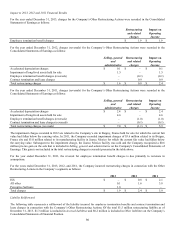

The fair value of trade receivables approximates its carrying value of $7.0 million. The gross amount due from customers is $8.7

million, of which $1.7 million was estimated to be uncollectible as of the date of acquisition.

Of the $79.3 million of goodwill resulting from the acquisitions, all of which was assigned to the Company’s Perceptive Software

segment, $22.0 million is expected to be deductible for income tax purposes. The goodwill recognized comprises the value of

expected synergies arising from the acquisitions that are complementary to the Perceptive Software business. The total estimated fair

value of intangible assets acquired was $85.7 million, with a weighted-average useful life of 6.8 years.

The purchase of Saperion is included in Purchase of businesses, net of cash acquired in the Consolidated Statements of Cash Flows

for the year ended December 31, 2013 in the amount of $65.7 million. Total cash acquired in the acquisition of Saperion was $6.5

million. The Company also acquired intangible assets in the form of non-compete agreements from certain shareholders in the

acquisition of Saperion. These agreements were valued at $0.1 million and were recognized separately from the acquisition.

The values in the table above include measurement period adjustments determined in 2013 related to the acquisition of Saperion

affecting Deferred revenue $(0.1) million and Goodwill $0.1 million. The adjustments were based on facts and circumstances obtained

subsequent to the acquisition that existed at the date of acquisition.

The purchase of PACSGEAR is included in Purchase of businesses, net of cash acquired in the Consolidated Statements of Cash

Flows for the year ended December 31, 2013 in the amount of $52.3 million. Total cash acquired in the acquisition of PACSGEAR

was $1.6 million.

The purchases of AccessVia and Twistage are included in Purchase of businesses, net of cash acquired in the Consolidated Statements

of Cash Flows for the year ended December 31, 2013 in the amount of $28.1 million. Total cash acquired in the acquisitions of

AccessVia and Twistage was $0.9 million. The Company also acquired intangible assets in the form of non-compete agreements from

certain employees of AccessVia and Twistage. These agreements were valued at $0.2 million and were recognized separately from the

acquisitions.

The values in the table above include measurement period adjustments determined in 2013 related to the acquisitions of AccessVia

and Twistage affecting Other current assets $0.2 million, Other current liabilities $0.1 million, Deferred tax liability, net $(1.8)

million and Goodwill $1.5 million. The measurement period adjustments were based on information obtained subsequent to the

acquisition related to certain income tax matters contemplated by the Company at the acquisition date.

88