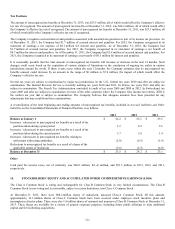

Lexmark 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

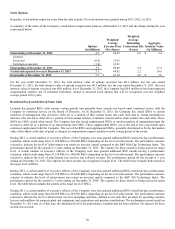

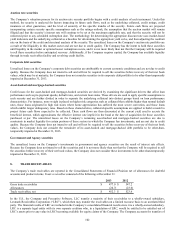

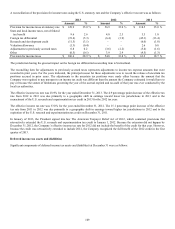

Auction rate securities

The Company’s valuation process for its auction rate security portfolio begins with a credit analysis of each instrument. Under this

method, the security is analyzed for factors impacting its future cash flows, such as the underlying collateral, credit ratings, credit

insurance or other guarantees, and the level of seniority of the specific tranche of the security. Future cash flows are projected

incorporating certain security specific assumptions such as the ratings outlook, the assumption that the auction market will remain

illiquid and that the security’s interest rate will continue to be set at the maximum applicable rate, and that the security will not be

redeemed prior to any scheduled redemption date. The methodology for determining the appropriate discount rate uses market-based

yield indicators and the underlying collateral as a baseline for determining the appropriate yield curve, and then adjusting the resultant

rate on the basis of the credit and structural analysis of the security. The unrealized losses on the Company’s auction rate portfolio are

a result of the illiquidity in this market sector and are not due to credit quality. The Company has the intent to hold these securities

until liquidity in the market or optional issuer redemption occurs, and it is not more likely than not that the Company will be required

to sell these securities before anticipated recovery. Additionally, if the Company requires capital, the Company has available liquidity

through its trade receivables facility and revolving credit facility.

Corporate debt securities

Unrealized losses on the Company’s corporate debt securities are attributable to current economic conditions and are not due to credit

quality. Because the Company does not intend to sell and will not be required to sell the securities before recovery of their net book

values, which may be at maturity, the Company does not consider securities in its corporate debt portfolio to be other-than-temporarily

impaired at December 31, 2013.

Asset-backed and mortgage-backed securities

Credit losses for the asset-backed and mortgage-backed securities are derived by examining the significant drivers that affect loan

performance such as pre-payment speeds, default rates, and current loan status. These drivers are used to apply specific assumptions to

each security and are further divided in order to separate the underlying collateral into distinct groups based on loan performance

characteristics. For instance, more weight is placed on higher risk categories such as collateral that exhibits higher than normal default

rates, those loans originated in high risk states where home appreciation has suffered the most severe correction, and those loans

which exhibit longer delinquency rates. Based on these characteristics, collateral-specific assumptions are applied to build a model to

project future cash flows expected to be collected. These cash flows are then discounted at the current yield used to accrete the

beneficial interest, which approximates the effective interest rate implicit in the bond at the date of acquisition for those securities

purchased at par. The unrealized losses on the Company’s remaining asset-backed and mortgage-backed securities are due to

constraints in market liquidity for certain portions of these sectors in which the Company has investments, and are not due to credit

quality. Because the Company does not intend to sell and will not be required to sell the securities before recovery of their net book

values, the Company does not consider the remainder of its asset-backed and mortgage-backed debt portfolio to be other-than-

temporarily impaired at December 31, 2013.

Government and Agency securities

The unrealized losses on the Company’s investments in government and agency securities are the result of interest rate effects.

Because the Company does not intend to sell the securities and it is not more likely than not that the Company will be required to sell

the securities before recovery of their net book values, the Company does not consider these investments to be other-than-temporarily

impaired at December 31, 2013.

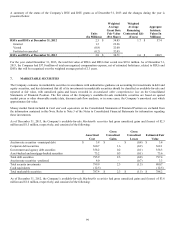

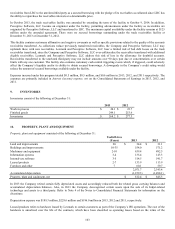

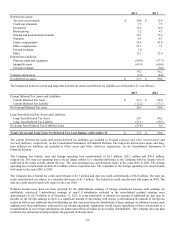

8. TRADE RECEIVABLES

The Company’s trade receivables are reported in the Consolidated Statements of Financial Position net of allowances for doubtful

accounts and product returns. Trade receivables consisted of the following at December 31:

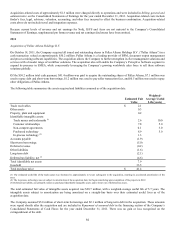

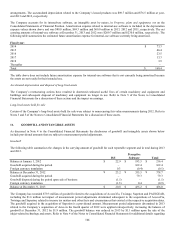

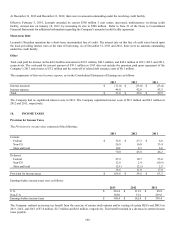

2013 2012

Gross trade receivables $ 477.0 $ 547.2

Allowances (24.7) (23.6)

Trade receivables, net $ 452.3 $ 523.6

In the U.S., the Company and Perceptive Software, LLC transfer a majority of their receivables to a wholly-owned subsidiary,

Lexmark Receivables Corporation (“LRC”), which then may transfer the receivables on a limited recourse basis to an unrelated third

party. The financial results of LRC are included in the Company’s consolidated financial results since it is a wholly-owned subsidiary.

LRC is a separate legal entity with its own separate creditors who, in a liquidation of LRC, would be entitled to be satisfied out of

LRC’s assets prior to any value in LRC becoming available for equity claims of the Company. The Company accounts for transfers of

102