Lexmark 2013 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

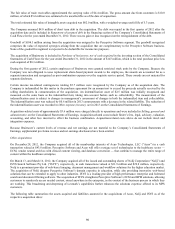

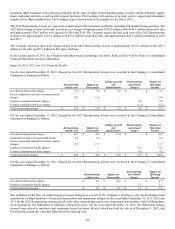

Goodwill of $33.5 million arising from the acquisition was assigned to the Perceptive Software reportable segment and consisted

largely of projected future revenue and profit growth, including benefits from Lexmark’s international structure and sales channels and

entity-specific synergies expected from combining Pallas Athena with Lexmark’s business. None of the goodwill recognized is

expected to be deductible for income tax purposes.

The acquisition of Pallas Athena is included in Purchase of businesses, net of cash acquired in the investing section of the

Consolidated Statements of Cash Flows for the year ended December 31, 2011 in the amount of $41.4 million, which is the total

purchase price.

Acquisition-related costs of approximately $2 million were charged directly to operations and were included in Selling, general and

administrative on the Consolidated Statements of Earnings for the year ended December 31, 2011. Acquisition-related costs include

finder’s fees, legal, advisory, valuation, accounting, and other fees incurred to effect the business combination.

Because Pallas Athena’s current levels of revenue and net earnings are not material to the Company’s Consolidated Statements of

Earnings, supplemental pro forma revenue and net earnings disclosures have been omitted.

Divestiture

In August 2012, the Company announced restructuring actions including exiting the development and manufacturing of its remaining

inkjet hardware. On April 1, 2013, the Company and Funai Electric Co., Ltd. (“Funai”) entered into a Master Inkjet Sale Agreement of

the Company’s inkjet-related technology and assets to Funai for total cash consideration of $100 million, subject to working capital

adjustments. Included in the sale were one of the Company’s subsidiaries, certain intellectual property and other assets of the

Company. The Company must also provide certain transition services to Funai and will continue to sell supplies for its current inkjet

installed base. The sale closed in the second quarter of 2013.

In addition to the $100 million of cash consideration, the Company received a subsequent working capital adjustment of $0.9 million.

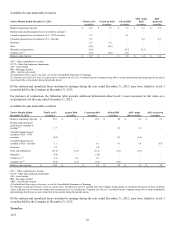

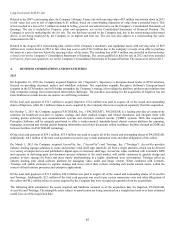

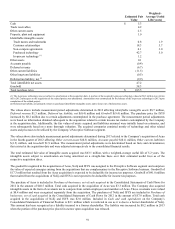

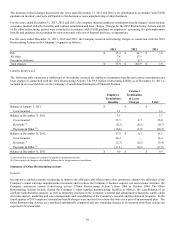

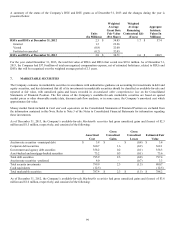

The Company derecognized the following upon the sale:

Cash and cash equivalents $2.3

Inventory 3.0

Prepaid expenses and other current assets 0.2

Property, plant and equipment, net 27.8

Goodwill 1.1

Other assets 2.1

Accounts payable (1.9)

Accrued liabilities (2.4)

Other liabilities (2.6)

Accumulated other comprehensive income (10.3)

Carrying value of disposal group $ 19.3

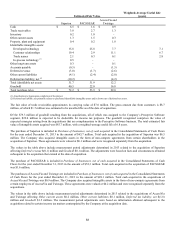

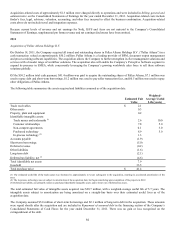

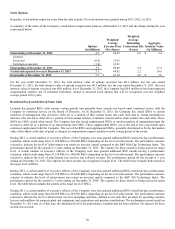

The Company recognized a gain of $73.5 million upon the sale recorded in Gain on sale of inkjet-related technology and assets on the

Consolidated Statements of Earnings for the year ended December 31, 2013. The gain, which was recognized in ISS, consisted of total

consideration of $100.9 offset partially by the carrying value of the disposal group of $19.3 million and $8.1 million of expenses

incurred during the second quarter of 2013 to effect the sale.

Of the $100.9 million of cash proceeds received, or $98.6 million net of the $2.3 million cash balance held by the subsidiary included

in the sale, $97.6 million was presented in investing activities for the sale of the business and $1.0 million was included in operating

activities for transition services on the Consolidated Statements of Cash Flows for the year ended December 31, 2013.

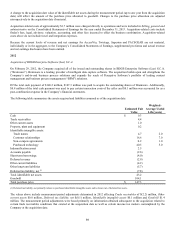

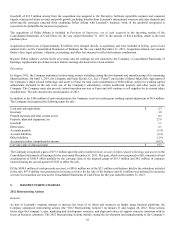

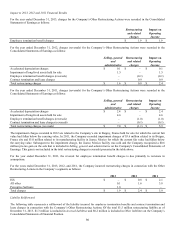

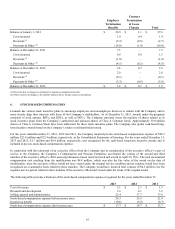

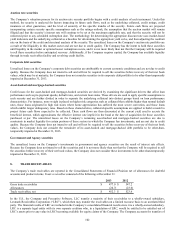

5. RESTRUCTURING CHARGES

2012 Restructuring Actions

General

As part of Lexmark’s ongoing strategy to increase the focus of its talent and resources on higher usage business platforms, the

Company announced restructuring actions (the “2012 Restructuring Actions”) on January 31 and August 28, 2012. These actions

better align the Company’s sales, marketing and development resources, and align and reduce its support structure consistent with its

focus on business customers. The 2012 Restructuring Actions include exiting the development and manufacturing of the Company’s

93