Lexmark 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

32

Multiple Element Arrangements

The Company also enters into multiple element agreements with customers which may involve the provisions of hardware and/or

software, supplies, customized services such as installation, maintenance, and enhanced warranty services, and separately priced

maintenance services. These bundled arrangements typically involve capital or operating leases, or upfront purchases of hardware or

software products with services and supplies provided per contract terms or as needed.

The Company uses its best estimate of selling price (“BESP”) when allocating the transaction price for many of its product and service

deliverables as permitted under the accounting guidance for multiple element arrangements when sufficient vendor specific objective

evidence (“VSOE”) and third party evidence do not exist. BESP for the Company’s product deliverables is determined by utilizing a

weighted average price approach which starts with a review of historical stand-alone sales data. Prior sales are grouped by product and

key data points utilized such as the average unit price and the weighted average price in order to incorporate the frequency of each

product sold at any given price. Due to the large number of product offerings, products are then grouped into common product

categories (families) incorporating similarities in function and use and a BESP discount is determined by common product category.

This discount is then applied to product list price to arrive at a product BESP. Best estimate of selling price for the Company’s service

deliverables is determined by utilizing a cost plus margin approach as the Company does not typically sell its services on a stand-alone

basis. The Company generally uses third party suppliers to provide the services component of its multiple element arrangements, thus

the cost of services is generally that which is invoiced to the Company, but may also include cost estimates based on parts, labor,

overhead and estimates of the number of service actions to be performed. A margin is applied to the cost of services in order to

determine a best estimate of selling price, and is primarily based on consideration of internal factors such as margin objectives and

pricing practices as well as competitor pricing strategies.

For multiple element agreements that include software deliverables accounted for under the industry-specific revenue recognition

guidance, relative selling price must be determined by VSOE, which is based on company specific stand-alone sales data or renewal

rates. For software arrangements, the Company typically uses the residual method to allocate arrangement consideration as permitted

under the industry-specific revenue recognition guidance.

Multiple element arrangements and software and related services represent a smaller, but faster growing portion of the Company’s

overall business. Pricing practices could be modified in the future as the Company’s go-to-market strategies evolve. Such changes

could impact BESP and VSOE, which would change the pattern and timing of revenue recognition for individual elements but would

not change the total revenue recognized for the arrangements.

Refer to Part II, Item 8, Note 2 of the Notes to Consolidated Financial Statements for information regarding the Company’s policy for

revenue recognition.

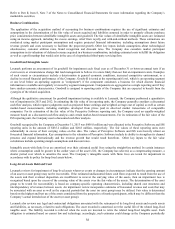

Allowances for Doubtful Accounts

Lexmark maintains allowances for doubtful accounts for estimated losses resulting from the inability of its customers to make required

payments. The Company estimates the allowance for doubtful accounts based on a variety of factors including the length of time

receivables are past due, the financial health of its customers, unusual macroeconomic conditions and historical experience. If the

financial condition of its customers deteriorates or other circumstances occur that result in an impairment of customers’ ability to

make payments, the Company records additional allowances as needed.

In spite of economic uncertainty in Eurozone economies, the Company has not experienced an increase in credit losses in EMEA and

no adjustments have been recognized in the Company’s allowance for doubtful accounts specifically regarding this matter as of

December 31, 2013. Approximately 37% of the Company’s trade receivables balance is related to EMEA customers.

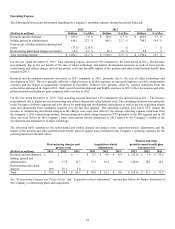

Restructuring

Lexmark records a liability for a cost associated with an exit or disposal activity at its fair value in the period in which the liability is

incurred, except for liabilities for certain employee termination benefit charges that are accrued over time. Employee termination

benefits associated with an exit or disposal activity are accrued when the obligation is probable and estimable as a postemployment

benefit obligation when local statutory requirements stipulate minimum involuntary termination benefits or, in the absence of local

statutory requirements, termination benefits to be provided are similar to benefits provided in prior restructuring activities. Employee

termination benefits accrued as probable and estimable often require judgment by the Company’s management as to the number of

employees being separated and the related salary levels, length of employment with the Company and various other factors related to

the separated employees that could affect the amount of employee termination benefits being accrued. Such estimates could change in

the future as actual data regarding separated employees becomes available.

Specifically for termination benefits under a one-time benefit arrangement, the timing of recognition and related measurement of a

liability depends on whether employees are required to render service until they are terminated in order to receive the termination

benefits and, if so, whether employees will be retained to render service beyond a minimum retention period. For employees who are

32