Lexmark 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 Lexmark annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

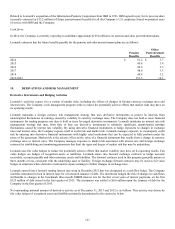

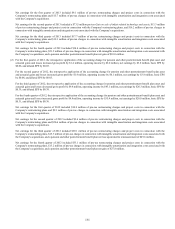

Court. SCC appealed this denial to the Sixth Circuit. SCC’s appeal was denied by the Sixth Circuit on October 21, 2013. SCC has

filed a petition with the Sixth Circuit seeking a rehearing and rehearing en banc. SCC’s petition was denied on February 3, 2014.

The Company has not established an accrual for the SCC litigation, because it has not determined that a loss with respect to such

litigation is probable. Although there is a reasonable possibility of a potential loss with respect to the SCC litigation, with SCC’s

claims being dismissed in the early stages of the litigation and SCC’s request for damages suffered during the period of preliminary

injunction was in place being denied by the District Court and a panel of the Sixth Circuit, the Company does not believe a reasonable

estimate of the range of possible loss is currently possible in view of the uncertainty regarding the amount of damages, if any, that

could be awarded in this matter.

Nuance Communications, Inc. v. ABBYY Software House, et al.

Nuance Communications, Inc. ("Nuance") filed suit against the Company and ABBYY Software House and ABBYY USA Software

House (collectively “ABBYY”) in the U.S. District Court for the Northern District of California ("District Court"). Nuance alleges

that the Company and ABBYY have infringed three U.S. patents related to Optical Character Recognition (“OCR”) and document

management technologies. The Company, and the Company’s supplier of the accused OCR technology, ABBYY, denied

infringement and raised affirmative defenses to the allegations of patent infringement. A two week jury trial was held in August of

2013. At trial, Nuance was seeking approximately $31 million in damages from the Company for the alleged infringement and, in

addition, requested that this amount be trebled for alleged willful infringement. The jury returned a verdict of non-infringement on all

counts. A final judgment was entered in favor of the Company and ABBYY by the District Court on August 26, 2013. Nuance filed

post-judgment motions seeking a judgment as a matter of law, or in the alternative, for a new trial. Nuance’s motion was denied by the

District Court on December 10, 2013. Nuance filed an appeal with the Federal Circuit Court of Appeals on January 10, 2014.

ABBYY USA is indemnifying the Company in this matter.

The Company has not established an accrual for the Nuance litigation because it has not determined that a loss with respect to such

litigation is probable. Although there is a reasonable possibility of a potential loss with respect to the Nuance litigation, given the

finding of non-infringement by the jury, the District Court’s denial of Nuance’s post-trial motion and ABBYY USA’s indemnification

obligations, the Company does not believe a reasonable estimate of the range of possible loss is currently possible in view of the

uncertainty regarding the amount of damages, if any, that could be awarded in this matter.

Molina v. Lexmark

On August 31, 2005 former Company employee Ron Molina filed a class action lawsuit in the California Superior Court for Los

Angeles under a California employment statute which in effect prohibits the forfeiture of vacation time accrued. This statute has been

used to invalidate California employers’ "use or lose" vacation policies. The class is comprised of less than 200 current and former

California employees of the Company. The trial was bifurcated into a liability phase and a damages phase. On May 1, 2009, the trial

court Judge brought the liability phase to a conclusion with a ruling that the Company’s vacation and personal choice day’s policies

from 1991 to the present violated California law. In a Statement of Decision, received by the Company on August 27, 2010, the trial

court Judge awarded the class members approximately $8.3 million in damages which included waiting time penalties and interest.

The class had sought up to $16.7 million in such damages. On November 17, 2010, the trial court Judge partially granted the

Company’s motion for a new trial solely as to the argument that current employees are not entitled to any damages. On March 7, 2011

the trial court Judge reduced the original award to $7.8 million. On October 28, 2011, the trial court Judge awarded the class members

$5.7 million in attorneys’ fees.

The Company filed a notice of appeal with the California Court of Appeals objecting to the trial court Judge’s award of damages and

attorneys’ fees. On September 19, 2013, the California Court of Appeals upheld the rulings of the trial court Judge except for the use

of gross pay rather than base rate of pay in the calculation of damages. The matter was remanded back to the trial court Judge to

recalculate damages using the base rate of pay. The award of $5.7 million in attorneys’ fees was unchanged by the California Court of

Appeals. The Company filed a petition for review with the California Supreme Court on certain issues that were upheld by the

California Court of Appeals. Acceptance of review by the California Supreme Court was discretionary and on December 11, 2013 the

California Supreme Court denied Lexmark’s petition.

In February 2014, the Company and the class reached agreement on a stipulation for damages and attorneys’ fees. Under the terms of

the stipulation, the Company has agreed to pay $5.5 million in damages, which includes forfeited vacation and personal choice days,

waiting time penalties and interest, to former California based employees of the Company. The Company also agreed to pay class

counsel $8.9 million in cost and attorneys’ fees which includes interest. The agreed upon stipulation requires approval by the

California Superior Court.

The Company regularly evaluates the probability of a potential loss of its material litigation to determine whether a liability has been

incurred and whether it is probable that one or more future events will occur confirming the loss. The Company believes an

unfavorable outcome in this matter is probable. If a potential loss is determined by the Company to be probable, and the amount of

the loss can be reasonably estimated, the Company establishes an accrual for the litigation. Based on the developments above, the

125